Region:Europe

Author(s):Shubham

Product Code:KRAA6204

Pages:80

Published On:September 2025

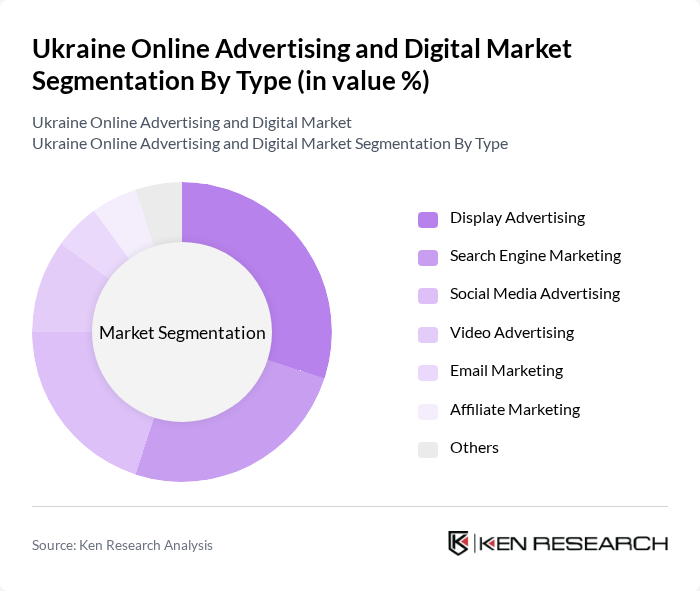

By Type:The online advertising market in Ukraine is diverse, encompassing various types of advertising strategies. Display advertising, search engine marketing, and social media advertising are among the most prominent segments. Display advertising is particularly popular due to its visual appeal and effectiveness in brand awareness campaigns. Search engine marketing continues to grow as businesses seek to improve their visibility on search engines, while social media advertising leverages the vast user base of platforms like Facebook and Instagram to target specific demographics. Video advertising is also gaining traction, driven by the popularity of video content among consumers. Email marketing and affiliate marketing are essential for direct engagement and performance-based advertising, respectively. The "Others" category includes emerging formats and innovative strategies that are being adopted by marketers to stay competitive.

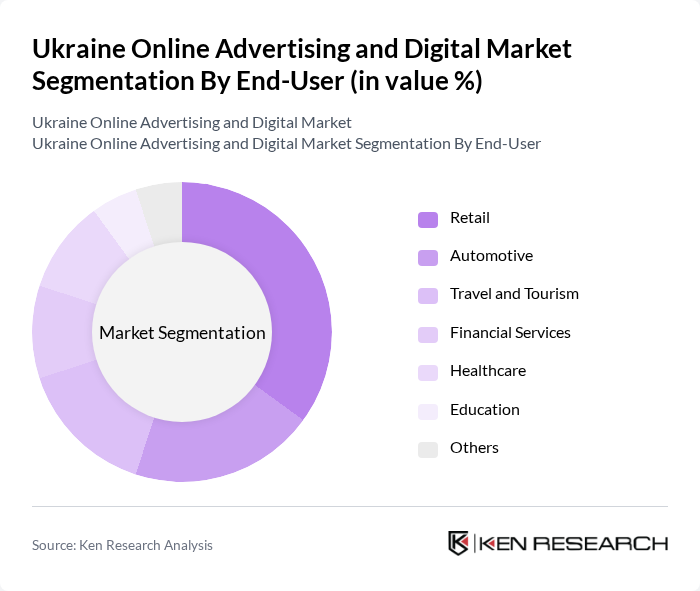

By End-User:The end-user segmentation of the online advertising market in Ukraine reveals a variety of industries leveraging digital marketing strategies. The retail sector is the largest consumer of online advertising, driven by the need to reach consumers directly and promote products effectively. The automotive and travel and tourism sectors also invest heavily in digital marketing to attract customers and enhance brand visibility. Financial services and healthcare are increasingly utilizing online platforms to provide information and services to consumers. Education is another growing sector, with institutions using digital marketing to attract students. The "Others" category includes various industries that are beginning to recognize the value of online advertising.

The Ukraine Online Advertising and Digital Market is characterized by a dynamic mix of regional and international players. Leading participants such as Promodo, Adtelligent, WebPromoExperts, Netpeak, SMM Agency, Digital Agency, Aimbulance, Grape, KMA Business Solutions, Taktik, iProspect Ukraine, Dentsu Ukraine, MRM Ukraine, Ciklum, SoftServe contribute to innovation, geographic expansion, and service delivery in this space.

The future of Ukraine's online advertising market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more businesses are expected to embrace data-driven marketing strategies, enhancing targeting and personalization. Additionally, the integration of artificial intelligence in advertising is likely to streamline campaign management and optimize ad performance. These trends, coupled with the expansion of social media platforms, will create a dynamic environment for advertisers seeking to engage with a diverse audience effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Email Marketing Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Education Others |

| By Industry Vertical | E-commerce Telecommunications Consumer Electronics Food and Beverage Real Estate Entertainment Others |

| By Advertising Format | Native Advertising Sponsored Content Pay-Per-Click (PPC) Programmatic Ads Retargeting Ads Others |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Networks Social Media Platforms Others |

| By Geographic Region | Central Ukraine Eastern Ukraine Western Ukraine Southern Ukraine Northern Ukraine Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Corporations Startups Non-Profit Organizations Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Media Advertising | 150 | Social Media Managers, Digital Marketing Specialists |

| Search Engine Marketing | 100 | SEO Experts, PPC Campaign Managers |

| Display Advertising | 80 | Brand Managers, Advertising Executives |

| Content Marketing Strategies | 70 | Content Creators, Marketing Directors |

| Influencer Marketing | 60 | Influencer Coordinators, PR Managers |

The Ukraine Online Advertising and Digital Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased internet penetration, the rise of social media, and a shift towards digital marketing strategies over traditional advertising methods.