Region:Asia

Author(s):Dev

Product Code:KRAA5643

Pages:86

Published On:September 2025

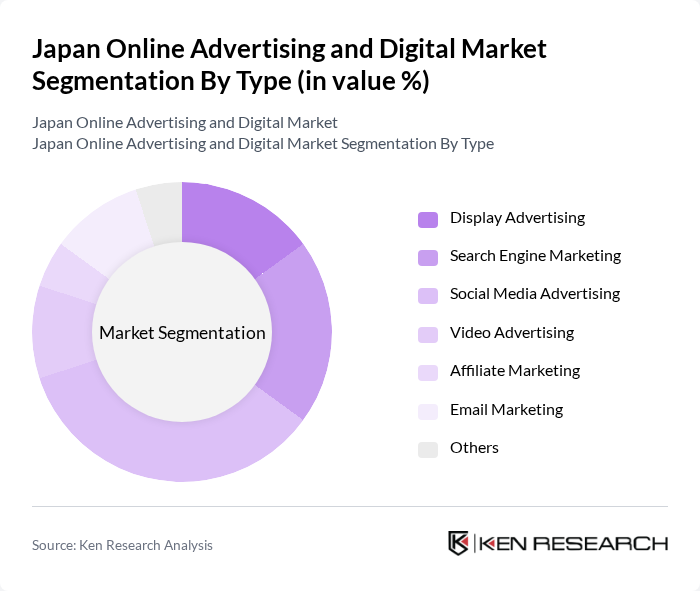

By Type:The segmentation by type includes various forms of online advertising, each catering to different marketing strategies and consumer engagement methods. The subsegments are Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Affiliate Marketing, Email Marketing, and Others. Among these, Social Media Advertising has emerged as a leading segment due to the increasing time spent by users on platforms like Facebook, Instagram, and Twitter, making it a preferred choice for brands aiming to reach a broader audience.

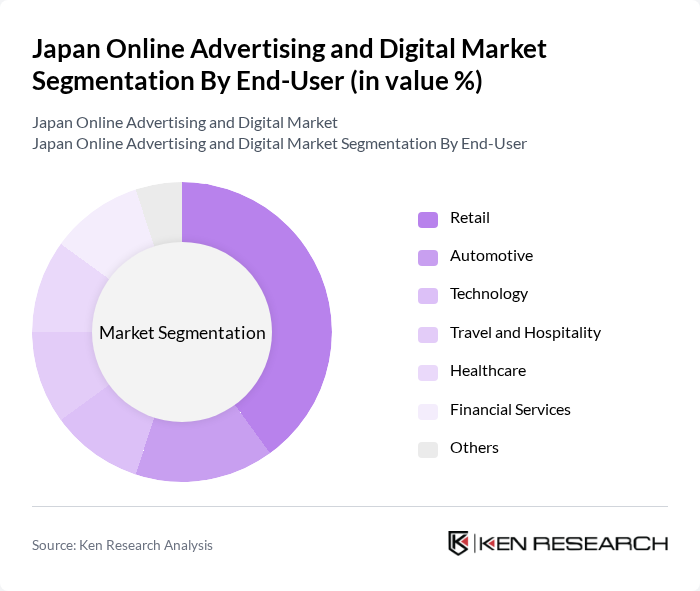

By End-User:The end-user segmentation encompasses various industries that leverage online advertising to reach their target audiences. Key segments include Retail, Automotive, Technology, Travel and Hospitality, Healthcare, Financial Services, and Others. The Retail sector is the most significant contributor, driven by the rapid growth of e-commerce and the need for brands to establish a strong online presence to attract consumers.

The Japan Online Advertising and Digital Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dentsu Inc., Hakuhodo DY Holdings Inc., CyberAgent, Inc., ADK Holdings Inc., Yahoo Japan Corporation, Google Japan G.K., Facebook Japan Inc., LINE Corporation, Amazon Japan G.K., Rakuten, Inc., ZOZO, Inc., NTT Docomo, Inc., Mixi, Inc., Gree, Inc., DeNA Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's online advertising market appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly adopt programmatic advertising, the efficiency of ad placements will improve, leading to better targeting and ROI. Additionally, the integration of AI technologies will enhance data analytics capabilities, allowing for more personalized advertising experiences. Companies that adapt to these trends will likely gain a competitive edge, positioning themselves favorably in a rapidly changing digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Affiliate Marketing Email Marketing Others |

| By End-User | Retail Automotive Technology Travel and Hospitality Healthcare Financial Services Others |

| By Platform | Mobile Platforms Desktop Platforms Social Media Platforms Video Streaming Platforms Others |

| By Advertising Format | Banner Ads Native Ads Sponsored Content Retargeting Ads Others |

| By Campaign Objective | Brand Awareness Lead Generation Customer Engagement Sales Conversion Others |

| By Pricing Model | Cost Per Click (CPC) Cost Per Impression (CPI) Cost Per Acquisition (CPA) Others |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Brand Advertising Strategies | 150 | Marketing Directors, Brand Managers |

| Digital Media Buying Practices | 100 | Media Buyers, Digital Strategists |

| Consumer Engagement Metrics | 80 | Data Analysts, Customer Experience Managers |

| Social Media Advertising Trends | 70 | Social Media Managers, Content Creators |

| E-commerce Advertising Effectiveness | 90 | E-commerce Managers, Digital Marketing Analysts |

The Japan Online Advertising and Digital Market is valued at approximately USD 12 billion, reflecting significant growth driven by increased smartphone penetration and the rising popularity of social media platforms, particularly accelerated by the COVID-19 pandemic.