Region:Asia

Author(s):Dev

Product Code:KRAB5549

Pages:82

Published On:October 2025

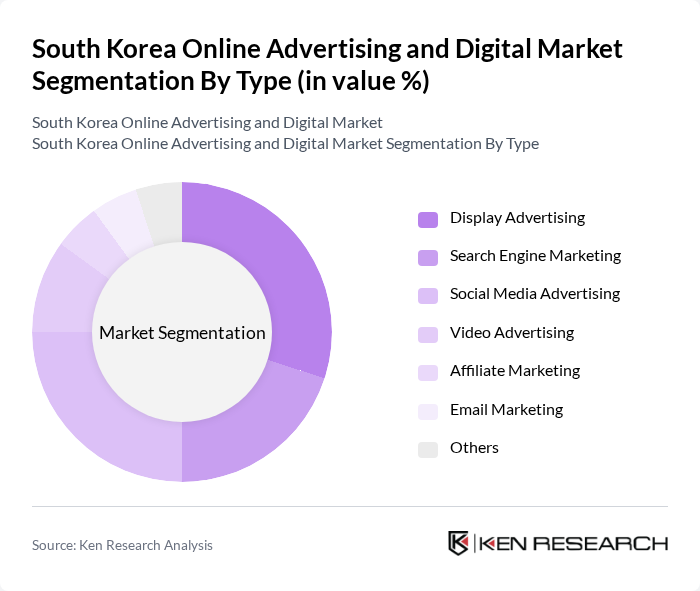

By Type:The online advertising market can be segmented into various types, including Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Affiliate Marketing, Email Marketing, and Others. Among these, Display Advertising and Social Media Advertising are particularly prominent due to their effectiveness in reaching targeted audiences and driving engagement.

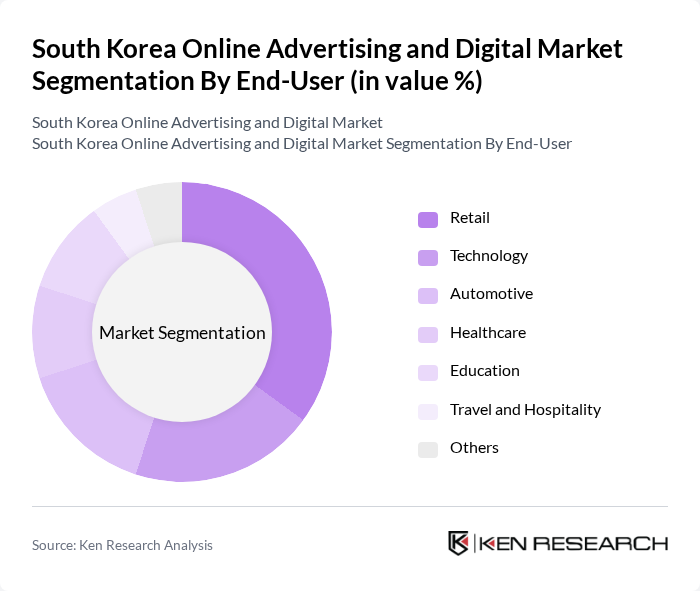

By End-User:The end-user segmentation includes Retail, Technology, Automotive, Healthcare, Education, Travel and Hospitality, and Others. The Retail sector is the most significant contributor, driven by the rapid growth of e-commerce and the need for businesses to enhance their online presence.

The South Korea Online Advertising and Digital Market is characterized by a dynamic mix of regional and international players. Leading participants such as Naver Corporation, Kakao Corp, Google Korea, Facebook Korea, Coupang, SK Telecom, Daum Communications, Samsung Ads, LG Uplus, CJ ENM, TMON, Interpark, YG Entertainment, LINE Corporation, Woowa Brothers contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean online advertising market is poised for transformative growth, driven by technological advancements and evolving consumer behaviors. As advertisers increasingly adopt programmatic buying and personalized marketing strategies, the demand for data analytics will intensify. Furthermore, the integration of augmented reality in advertising campaigns is expected to enhance user engagement. With a focus on sustainability, brands will likely prioritize eco-friendly practices, aligning their marketing efforts with consumer values and preferences, thereby fostering long-term loyalty.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Affiliate Marketing Email Marketing Others |

| By End-User | Retail Technology Automotive Healthcare Education Travel and Hospitality Others |

| By Platform | Mobile Platforms Desktop Platforms Social Media Platforms Video Streaming Platforms Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Conversion Campaigns Retargeting Campaigns Others |

| By Advertising Format | Text Ads Image Ads Video Ads Interactive Ads Others |

| By Budget Size | Small Budget Medium Budget Large Budget Others |

| By Geographic Focus | Urban Areas Rural Areas National Campaigns Regional Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Media Advertising | 150 | Marketing Managers, Social Media Strategists |

| Search Engine Marketing | 100 | PPC Specialists, Digital Marketing Analysts |

| Content Marketing Strategies | 80 | Content Creators, Brand Managers |

| Email Marketing Campaigns | 70 | Email Marketing Coordinators, CRM Managers |

| Influencer Marketing Initiatives | 60 | Influencer Relations Managers, PR Specialists |

The South Korea Online Advertising and Digital Market is valued at approximately USD 6.5 billion, reflecting significant growth driven by smartphone penetration, social media usage, and the rise of e-commerce, which encourages businesses to invest in digital marketing strategies.