Region:Middle East

Author(s):Geetanshi

Product Code:KRAE7305

Pages:87

Published On:December 2025

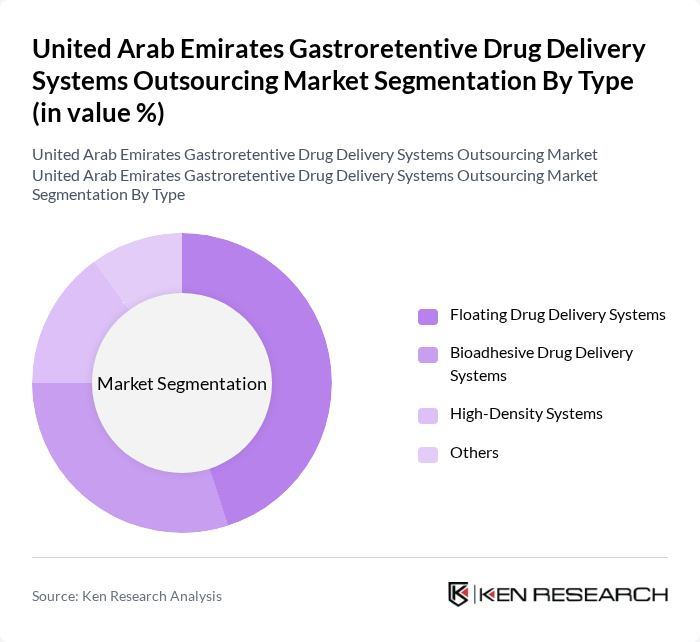

By Type:The market is segmented into various types of gastroretentive drug delivery systems, including Floating Drug Delivery Systems, Bioadhesive Drug Delivery Systems, High-Density Systems, Swelling and Expandable Systems, and Other Gastroretentive Systems. Among these, Floating Drug Delivery Systems are gaining traction due to their ability to remain buoyant in the gastric environment, thus enhancing drug absorption and therapeutic efficacy. Bioadhesive Drug Delivery Systems are also popular for their prolonged retention time in the gastrointestinal tract, making them suitable for chronic conditions where localized gastric delivery and reduced dosing frequency improve adherence.

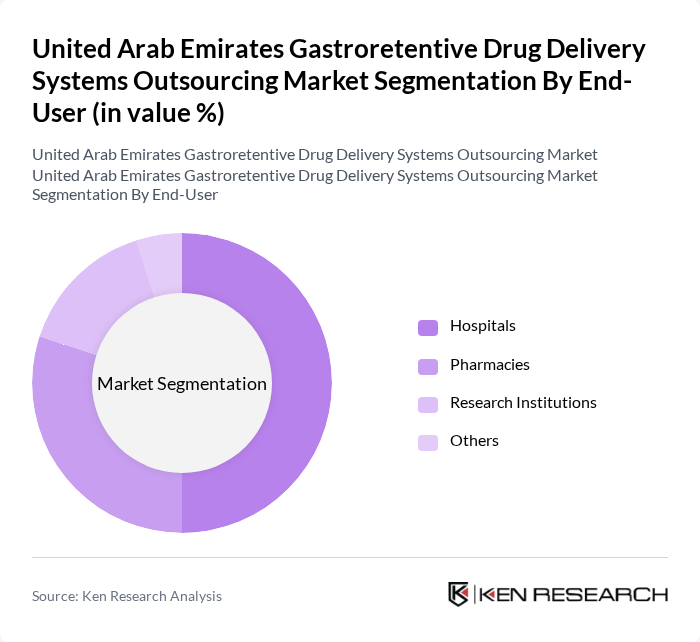

By End-User:The end-user segmentation includes Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Specialty Clinics, and Others. Hospital Pharmacies are the leading end-users due to their need for advanced drug delivery systems to manage complex patient cases effectively. Retail Pharmacies also play a significant role, as they are the primary point of access for patients seeking medications, including gastroretentive formulations.

The United Arab Emirates Gastroretentive Drug Delivery Systems Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Pharmaceutical Company, Dubai Healthcare City, Gulf Pharmaceutical Industries, Julphar, Neopharma, Hikma Pharmaceuticals, Aster DM Healthcare, Al Ain Pharmaceuticals, United Pharmacies, Emirates Pharmaceuticals, Pharma International, Medpharma, Biopharma, Al Haramain Pharmaceuticals, Sharjah Pharmaceutical Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gastroretentive drug delivery systems outsourcing market in the UAE appears promising, driven by ongoing advancements in technology and a growing emphasis on patient-centric solutions. As healthcare providers increasingly adopt digital health technologies, the integration of these innovations into drug delivery systems is expected to enhance patient compliance and treatment outcomes. Furthermore, the expansion of healthcare infrastructure will facilitate the adoption of these systems, creating a conducive environment for market growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Immediate Release Systems Sustained Release Systems Controlled Release Systems Others |

| By End-User | Hospitals Pharmacies Research Institutions Others |

| By Therapeutic Area | Gastrointestinal Disorders Cardiovascular Diseases Diabetes Management Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Formulation Type | Tablets Capsules Liquids Others |

| By Packaging Type | Blister Packs Bottles Sachets Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | R&D Managers, Product Development Leads |

| Healthcare Providers | 80 | Gastroenterologists, Clinical Pharmacists |

| Regulatory Bodies | 8 | Regulatory Affairs Specialists, Compliance Officers |

| Market Research Analysts | 70 | Market Analysts, Business Development Managers |

| Patients and Caregivers | 60 | Chronic Disease Patients, Caregivers |

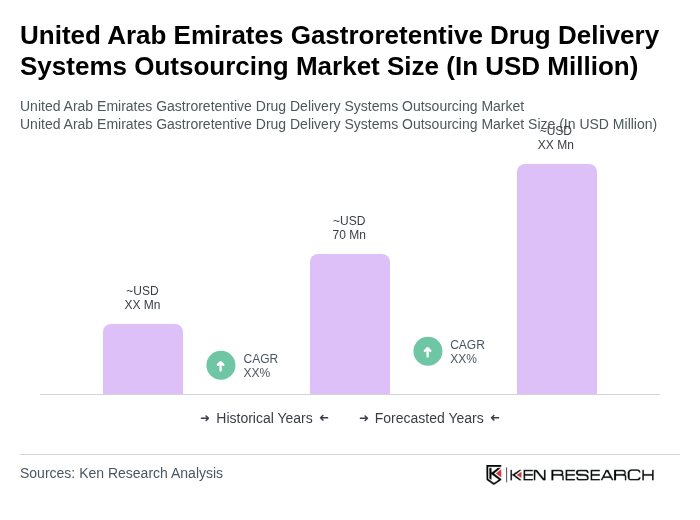

The United Arab Emirates Gastroretentive Drug Delivery Systems Outsourcing Market is valued at approximately USD 70 million, reflecting a significant growth driven by the increasing prevalence of gastrointestinal disorders and the demand for advanced drug delivery systems.