Region:Middle East

Author(s):Geetanshi

Product Code:KRAE7302

Pages:116

Published On:December 2025

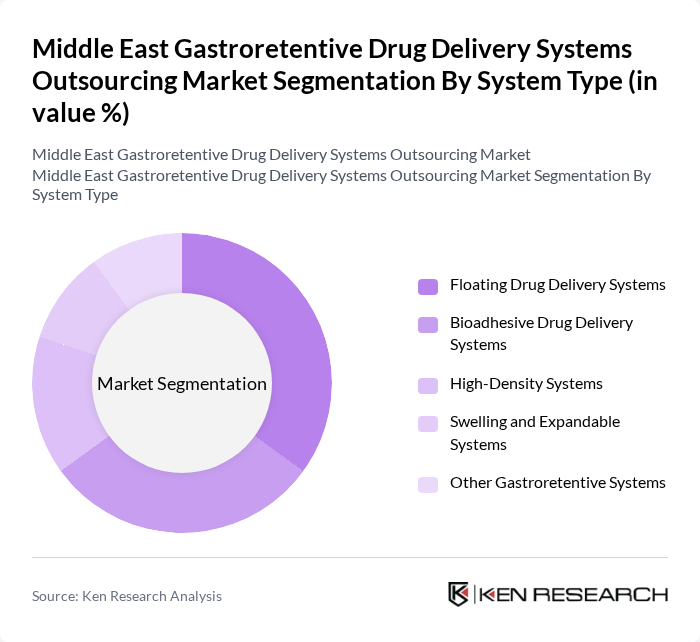

By System Type:The market is segmented into various system types, including Floating Drug Delivery Systems, Bioadhesive Drug Delivery Systems, High-Density Systems, Swelling and Expandable Systems, and Other Gastroretentive Systems. Among these, Floating Drug Delivery Systems are gaining traction due to their ability to prolong gastric retention time, thereby enhancing drug bioavailability. Bioadhesive systems are also popular for their targeted delivery capabilities, particularly for local gastrointestinal treatments.

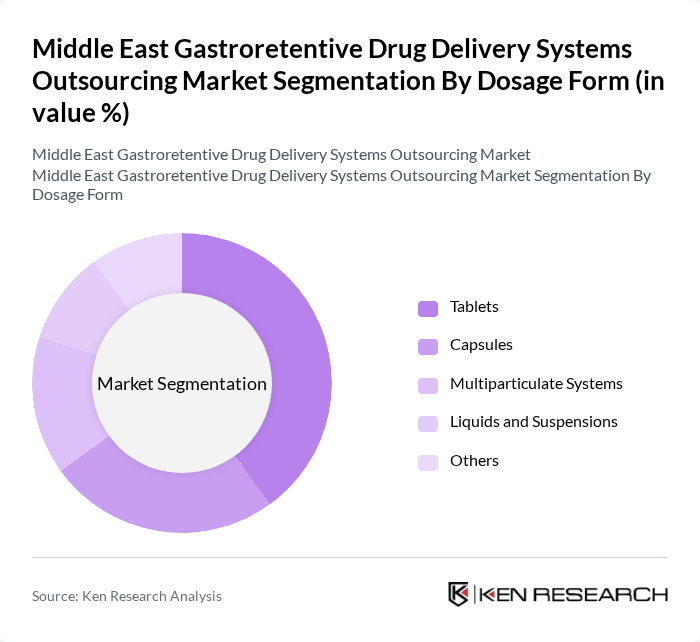

By Dosage Form:The market is also categorized by dosage forms, including Tablets, Capsules, Multiparticulate Systems, Liquids and Suspensions, and Others. Tablets are the most widely used dosage form due to their convenience and ease of administration. Capsules are gaining popularity for their ability to mask unpleasant tastes and provide a controlled release of medication. Multiparticulate systems are increasingly favored for their flexibility in dosing and improved patient compliance.

The Middle East Gastroretentive Drug Delivery Systems Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novartis AG, Pfizer Inc., Teva Pharmaceutical Industries Ltd., Sanofi S.A., Merck & Co., Inc., AstraZeneca PLC, GSK plc, Roche Holding AG, AbbVie Inc., Amgen Inc., Bayer AG, Johnson & Johnson, Eli Lilly and Company, Boehringer Ingelheim, Julphar (Gulf Pharmaceutical Industries) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East gastroretentive drug delivery systems outsourcing market appears promising, driven by increasing healthcare investments and a focus on patient-centric solutions. As the region's healthcare infrastructure expands, the demand for innovative drug delivery systems is expected to rise. Furthermore, collaborations between pharmaceutical companies and technology firms are likely to enhance R&D efforts, leading to the development of more effective gastroretentive systems that cater to diverse patient needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By System Type | Floating Drug Delivery Systems Bioadhesive Drug Delivery Systems High-Density Systems Swelling and Expandable Systems Other Gastroretentive Systems |

| By Dosage Form | Tablets Capsules Multiparticulate Systems Liquids and Suspensions Others |

| By Application | Gastrointestinal Disorders Diabetes and Metabolic Disorders Cardiovascular Diseases Infectious Diseases Other Chronic Indications |

| By End-User | Hospital Pharmacies Retail Pharmacies Online Pharmacies Specialty Clinics Others |

| By Country | UAE Saudi Arabia Qatar Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 45 | R&D Directors, Product Managers |

| Healthcare Professionals | 60 | Pharmacists, Physicians |

| Regulatory Bodies | 25 | Regulatory Affairs Specialists, Compliance Officers |

| Patients Using Gastroretentive Systems | 50 | Chronic Disease Patients, Caregivers |

| Market Analysts and Consultants | 40 | Healthcare Analysts, Market Research Consultants |

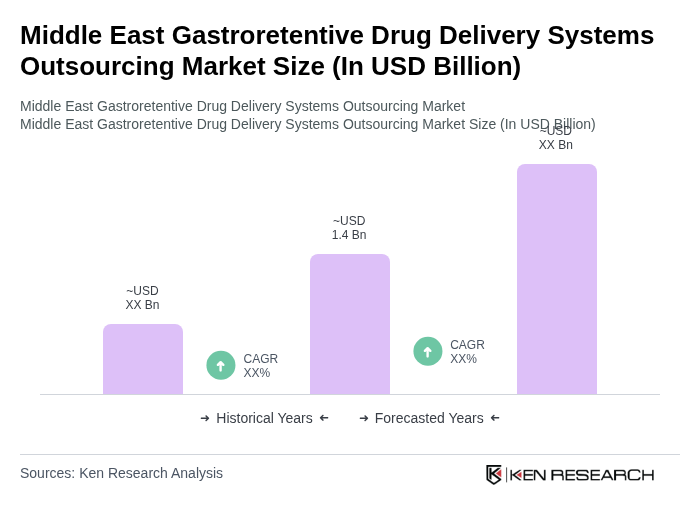

The Middle East Gastroretentive Drug Delivery Systems Outsourcing Market is valued at approximately USD 1.4 billion, driven by the rising prevalence of chronic diseases and advancements in drug delivery technologies.