Region:Middle East

Author(s):Geetanshi

Product Code:KRAE7303

Pages:87

Published On:December 2025

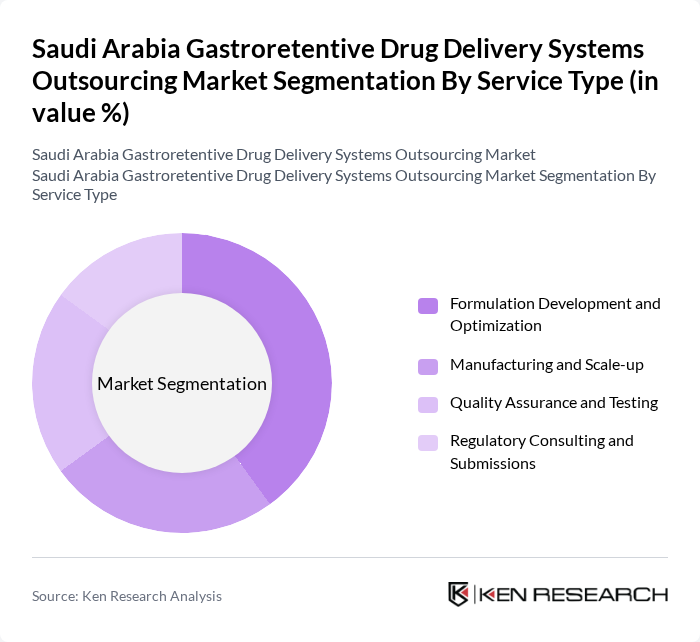

By Service Type:The service type segmentation includes various essential services that support the development and delivery of gastroretentive drug systems. The dominant sub-segment is Formulation Development and Optimization, which is crucial for creating effective drug formulations tailored to specific therapeutic needs. This sub-segment is driven by the increasing complexity of drug formulations and the need for customized solutions to enhance bioavailability and patient adherence.

By Therapeutic Application:The therapeutic application segmentation encompasses various medical fields where gastroretentive drug delivery systems are utilized. Gastroenterology is the leading sub-segment, driven by the high prevalence of gastrointestinal diseases such as ulcers and gastroesophageal reflux disease (GERD). The demand for effective treatment options in this area has led to increased investment in gastroretentive technologies, making it a focal point for pharmaceutical companies.

The Saudi Arabia Gastroretentive Drug Delivery Systems Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), Al-Dawaa Pharmacies, Jamjoom Pharma, United Pharmacies, Al Nahdi Medical Company, Gulf Pharmaceutical Industries (Julphar), Riyadh Pharma, Tabuk Pharmaceuticals, AJA Pharma, Al-Muhaidib Group, Dar Al Dawa Development and Investment Company, Al-Hokair Group, Al-Faisaliah Group, Saudi International Trading Company (SITC), Al-Muhaidib Pharmaceuticals contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gastroretentive drug delivery systems outsourcing market in Saudi Arabia appears promising, driven by technological advancements and increasing healthcare investments. The integration of digital health technologies and artificial intelligence in drug development processes is expected to enhance efficiency and patient outcomes. Furthermore, the focus on personalized medicine and chronic disease management will likely create new avenues for growth, positioning the market for significant expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Formulation Development and Optimization Manufacturing and Scale-up Quality Assurance and Testing Regulatory Consulting and Submissions |

| By Therapeutic Application | Gastroenterology Oncology Cardiovascular Others |

| By Drug Delivery Technology | Floating Systems Bioadhesive Systems Swelling Systems Hybrid Systems |

| By Product Formulation | Tablets Capsules Suspensions Others |

| By End-User | Pharmaceutical Companies Contract Research Organizations (CROs) Hospitals and Healthcare Facilities Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Regulatory Compliance Framework | SFDA Compliance Services GMP Certification Support Clinical Trial Support Post-Approval Vigilance Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 45 | R&D Directors, Product Managers |

| Healthcare Providers | 40 | Gastroenterologists, Pharmacists |

| Regulatory Bodies | 30 | Regulatory Affairs Specialists, Compliance Officers |

| Market Research Analysts | 35 | Market Analysts, Business Development Managers |

| Academic Institutions | 40 | Researchers, Professors in Pharmaceutical Sciences |

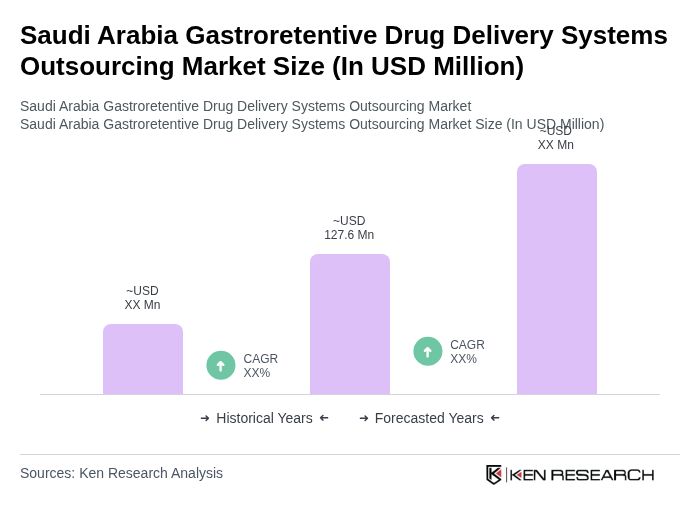

The Saudi Arabia Gastroretentive Drug Delivery Systems Outsourcing Market is valued at approximately USD 127.6 million, driven by the increasing prevalence of gastrointestinal disorders and the demand for advanced drug delivery systems that enhance therapeutic efficacy and patient compliance.