Region:Asia

Author(s):Geetanshi

Product Code:KRAE7306

Pages:112

Published On:December 2025

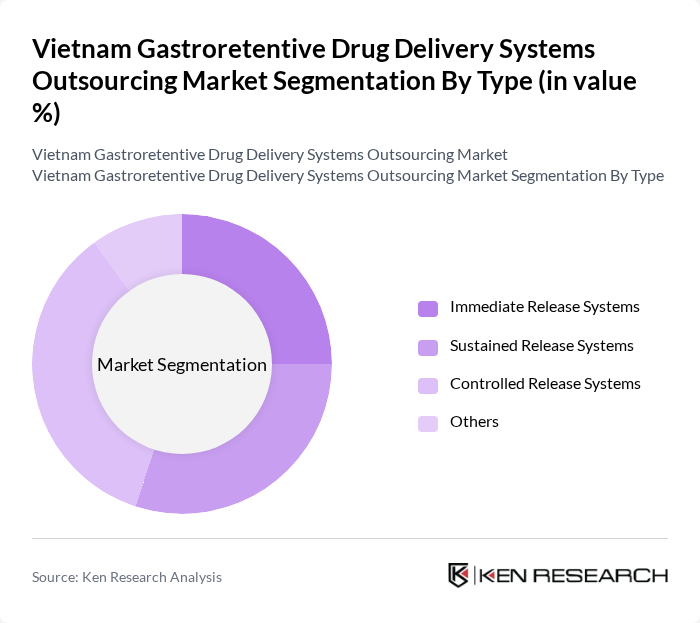

By Type:The market is segmented into various types of drug delivery systems, including Immediate Release Systems, Sustained Release Systems, Controlled Release Systems, and Others. Among these, the Controlled Release Systems are gaining traction due to their ability to provide a steady release of medication over an extended period, improving patient adherence and therapeutic outcomes.

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare, and Others. Hospitals are the leading end-users due to their extensive patient base and the need for advanced drug delivery systems to manage complex medical conditions effectively.

The Vietnam Gastroretentive Drug Delivery Systems Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vietnam Pharmaceutical Corporation, Hau Giang Pharmaceutical JSC, Traphaco JSC, Domesco Medical Import-Export JSC, Bidiphar Pharmaceutical JSC, SPM Pharmaceutical JSC, Vimedimex Medi-Pharma JSC, Central Pharmaceutical JSC No. 1, An Phat Holdings, FPT Corporation, Vingroup, Vinamilk, Nutifood, TH Group, Imexpharm Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gastroretentive drug delivery systems market in Vietnam appears promising, driven by technological advancements and increasing healthcare investments. As the demand for personalized medicine grows, companies are likely to focus on developing tailored drug delivery solutions. Additionally, the integration of digital health technologies and artificial intelligence in drug development processes will enhance efficiency and patient outcomes, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Immediate Release Systems Sustained Release Systems Controlled Release Systems Others |

| By End-User | Hospitals Clinics Home Healthcare Others |

| By Therapeutic Area | Gastroenterology Oncology Cardiology Others |

| By Distribution Channel | Direct Sales Online Pharmacies Retail Pharmacies Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam |

| By Product Formulation | Tablets Capsules Liquid Formulations Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | R&D Directors, Product Managers |

| Healthcare Providers | 80 | Pharmacists, Physicians |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Market Research Analysts | 60 | Market Analysts, Industry Consultants |

| Patients and End-users | 70 | Chronic Disease Patients, Healthcare Advocates |

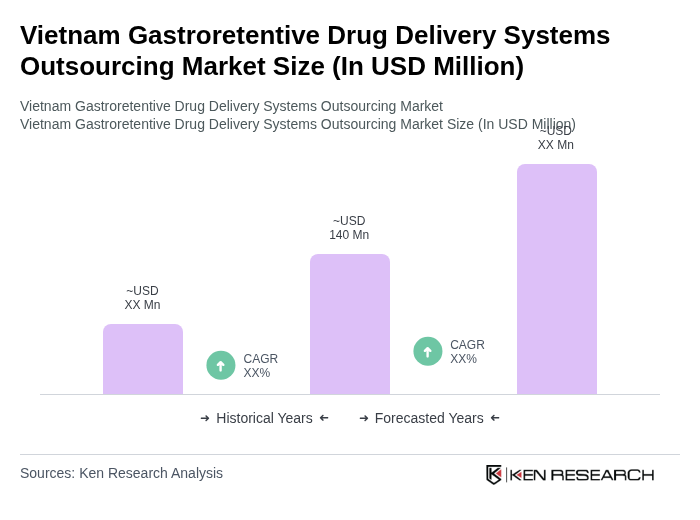

The Vietnam Gastroretentive Drug Delivery Systems Outsourcing Market is valued at approximately USD 140 million, reflecting a significant growth driven by the rising prevalence of gastrointestinal disorders and the demand for advanced drug delivery systems.