Region:Middle East

Author(s):Shubham

Product Code:KRAA6427

Pages:91

Published On:January 2026

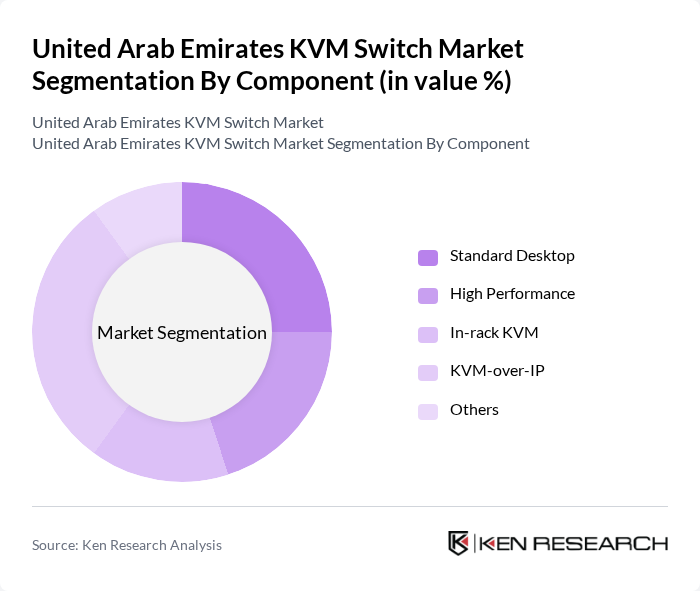

By Component:

The KVM switch market is segmented by component into Standard Desktop, High Performance, In-rack KVM, KVM-over-IP, and Others. Among these, the KVM-over-IP segment is currently leading the market due to its ability to provide remote access and management capabilities, which are increasingly essential in today's digital landscape. The growing trend of remote work and the need for centralized control of IT resources have made KVM-over-IP solutions particularly attractive to enterprises. Standard Desktop and High Performance KVM switches also hold significant market shares, catering to specific user needs in various sectors.

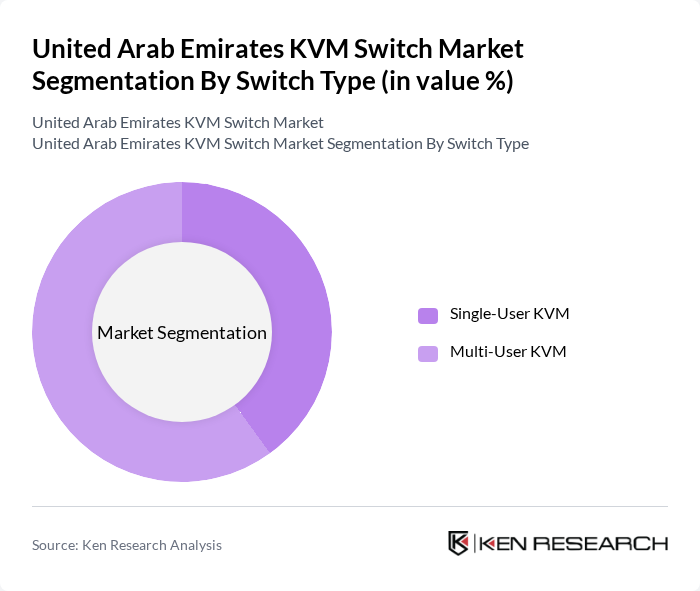

By Switch Type:

The market is also segmented by switch type into Single-User KVM and Multi-User KVM. The Multi-User KVM segment is dominating the market as it allows multiple users to access and control several computers from a single console, which is particularly beneficial for large enterprises and data centers. This capability enhances operational efficiency and reduces costs associated with hardware management. Single-User KVM switches, while still relevant, cater to a more niche market focused on individual users or small setups.

The United Arab Emirates KVM Switch Market is characterized by a dynamic mix of regional and international players. Leading participants such as Raritan, ATEN International, Belkin International, Tripp Lite, Black Box Corporation, IOGEAR, StarTech.com, APC by Schneider Electric, Avocent (Emerson Network Power), Dataprobe, Rose Electronics, Aten Technology, D-Link, Netgear, Cisco Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the KVM switch market in the UAE appears promising, driven by ongoing digital transformation initiatives and the increasing complexity of IT environments. As organizations continue to embrace remote management solutions and cloud computing, the demand for advanced KVM technologies is expected to rise. Additionally, the integration of AI and machine learning into KVM solutions will likely enhance operational efficiency, positioning the UAE as a leader in innovative IT management solutions in the region.

| Segment | Sub-Segments |

|---|---|

| By Component | Standard Desktop High Performance In-rack KVM KVM-over-IP Others |

| By Switch Type | Single-User KVM Multi-User KVM |

| By Enterprise Size | Large Enterprises SMEs |

| By End-User | IT & Telecom BFSI Industrial Government & Public Sector Healthcare Media & Content Provider Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise IT Infrastructure | 120 | IT Managers, Network Administrators |

| Data Center Operations | 100 | Data Center Managers, Systems Engineers |

| Educational Institutions | 80 | IT Coordinators, Technical Support Staff |

| Healthcare Facilities | 70 | IT Directors, Biomedical Engineers |

| Government Agencies | 60 | IT Procurement Officers, Network Security Analysts |

The United Arab Emirates KVM switch market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient data management solutions across various sectors, including IT, telecommunications, and healthcare.