Region:Asia

Author(s):Shubham

Product Code:KRAA6591

Pages:93

Published On:January 2026

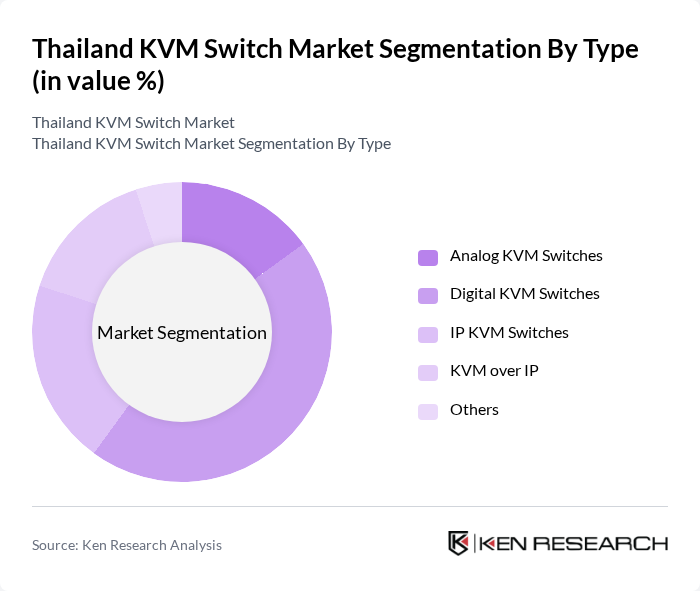

By Type:The KVM switch market can be segmented into various types, including Analog KVM Switches, Digital KVM Switches, IP KVM Switches, KVM over IP, and Others. Among these, Digital KVM Switches are currently leading the market due to their advanced features, such as high-resolution video support and enhanced security protocols. The growing trend of virtualization in data centers and the increasing need for remote access solutions are driving the adoption of digital KVM switches. As organizations seek to optimize their IT infrastructure, the demand for these switches is expected to remain strong. Additionally, KVM over IP solutions are gaining traction as enterprises increasingly adopt cloud-based infrastructure and require remote management capabilities across geographically dispersed data centers.

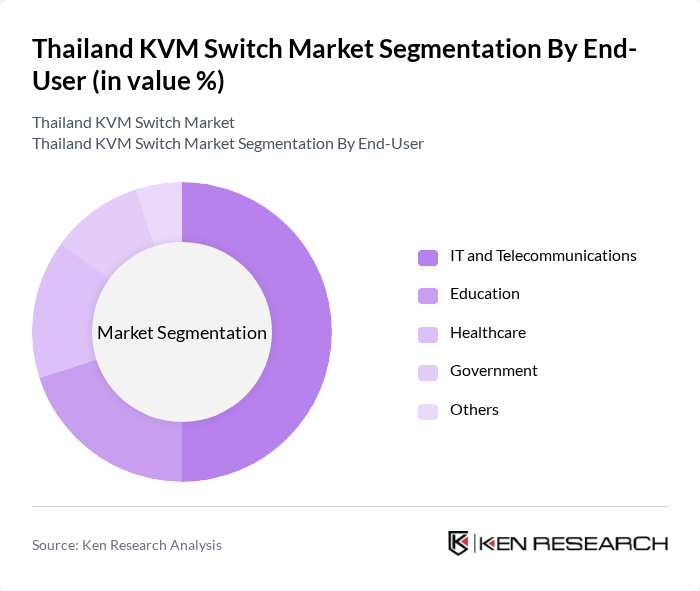

By End-User:The end-user segmentation includes IT and Telecommunications, Education, Healthcare, Government, and Others. The IT and Telecommunications sector is the dominant end-user of KVM switches, driven by the need for efficient data management and control in data centers. The increasing reliance on cloud computing and virtualization technologies has further propelled the demand for KVM solutions in this sector. Additionally, educational institutions are increasingly adopting KVM switches to facilitate remote learning and manage multiple devices effectively. Healthcare organizations are also expanding their adoption of KVM solutions to support telemedicine infrastructure and remote monitoring systems, contributing to market growth across this critical sector.

The Thailand KVM Switch Market is characterized by a dynamic mix of regional and international players. Leading participants such as ATEN International Co., Ltd., Raritan, Inc., Belkin International, Inc., Tripp Lite, StarTech.com, IOGEAR, Inc., Black Box Corporation, APC by Schneider Electric, D-Link Corporation, Lenovo Group Limited, Cisco Systems, Inc., HP Inc., Dell Technologies Inc., Fujitsu Limited, and Netgear, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand KVM switch market is poised for significant growth, driven by the increasing integration of advanced technologies and the rising demand for efficient data management solutions. As businesses continue to embrace remote work and virtualization, the need for reliable KVM switches will intensify. Additionally, government initiatives aimed at enhancing IT infrastructure will further support market expansion. Companies that adapt to these trends and invest in innovative KVM solutions will likely gain a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Analog KVM Switches Digital KVM Switches IP KVM Switches KVM over IP Others |

| By End-User | IT and Telecommunications Education Healthcare Government Others |

| By Application | Data Center Management Remote Management Video Broadcasting Industrial Automation Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| By Region | Central Thailand Northern Thailand Northeastern Thailand Southern Thailand |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Technology Integration | Standalone KVM Switches Integrated KVM Solutions Cloud-Based KVM Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate IT Departments | 100 | IT Managers, Network Administrators |

| Data Center Operations | 80 | Data Center Managers, Systems Engineers |

| Educational Institutions | 60 | IT Coordinators, Technical Support Staff |

| Healthcare Facilities | 50 | IT Directors, Biomedical Engineers |

| Government Agencies | 40 | Procurement Officers, IT Policy Makers |

The Thailand KVM Switch Market is valued at approximately USD 165 million, reflecting a robust demand for efficient data management solutions across various sectors, including IT, education, and healthcare.