Region:North America

Author(s):Geetanshi

Product Code:KRAA4754

Pages:95

Published On:September 2025

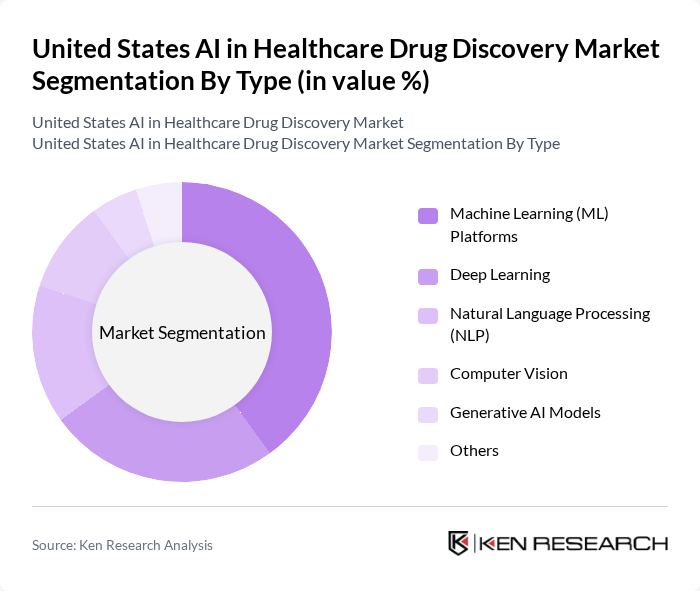

By Type:The market is segmented into various types, including Machine Learning (ML) Platforms, Deep Learning, Natural Language Processing (NLP), Computer Vision, Generative AI Models, and Others. Among these, Machine Learning (ML) Platforms are leading the market due to their ability to analyze vast datasets and identify patterns that can significantly enhance drug discovery processes. The increasing reliance on data-driven decision-making in pharmaceutical research is propelling the growth of this segment. Deep learning and generative AI models are also gaining traction, particularly for de novo drug design and molecular optimization .

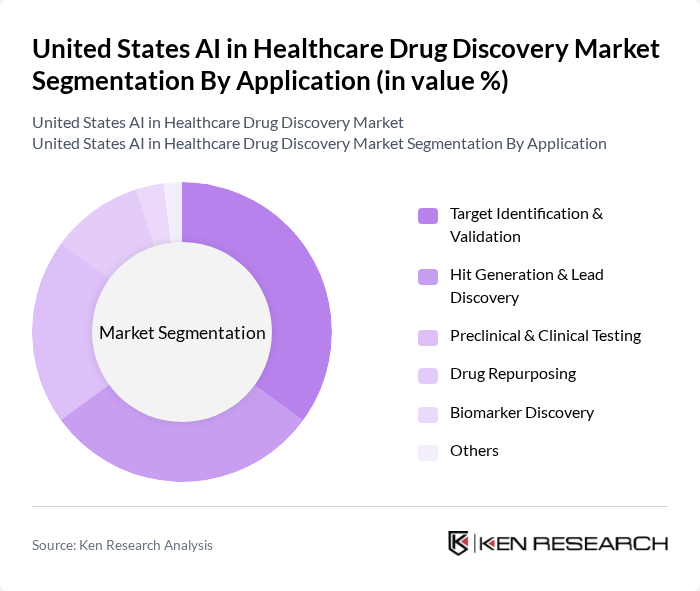

By Application:The applications of AI in healthcare drug discovery include Target Identification & Validation, Hit Generation & Lead Discovery, Preclinical & Clinical Testing, Drug Repurposing, Biomarker Discovery, and Others. The Target Identification & Validation segment is currently dominating the market, as it is crucial for determining the most promising drug candidates early in the development process. AI’s ability to analyze biological data and predict interactions is driving significant interest and investment in this area. Preclinical and clinical testing is also a major segment, supported by increased collaborations between pharmaceutical companies and AI solution providers to streamline trial design and data analysis .

The United States AI in Healthcare Drug Discovery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Insilico Medicine, Exscientia, Atomwise, BenevolentAI, Recursion Pharmaceuticals, Tempus Labs, Valo Health, XtalPi, BioSymetrics, GNS Healthcare, Deep Genomics, Cyclica (Recursion), Absci, Healx, Biorelate contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in healthcare drug discovery appears promising, with ongoing advancements in technology and increasing collaboration between tech firms and pharmaceutical companies. As regulatory frameworks evolve, the integration of AI into clinical trials and drug development processes is expected to accelerate. Furthermore, the focus on rare diseases and personalized medicine will drive innovation, leading to more efficient drug discovery methods and improved patient outcomes in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Machine Learning (ML) Platforms Deep Learning Natural Language Processing (NLP) Computer Vision Generative AI Models Others |

| By Application | Target Identification & Validation Hit Generation & Lead Discovery Preclinical & Clinical Testing Drug Repurposing Biomarker Discovery Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic & Research Institutions Contract Research Organizations (CROs) Others |

| By Region | Northeast Midwest South West Others |

| By Funding Source | Venture Capital Government Grants Private Equity Corporate Investments Others |

| By Technology Maturity | Emerging Technologies Established Technologies Disruptive Innovations Others |

| By Market Segment | Early-Stage Startups Mid-Stage Companies Established Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical R&D Departments | 100 | R&D Directors, Lead Scientists |

| AI Technology Providers | 60 | Product Managers, Technical Leads |

| Healthcare Professionals | 50 | Clinical Researchers, Pharmacists |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Investors in Healthcare Startups | 40 | Venture Capitalists, Angel Investors |

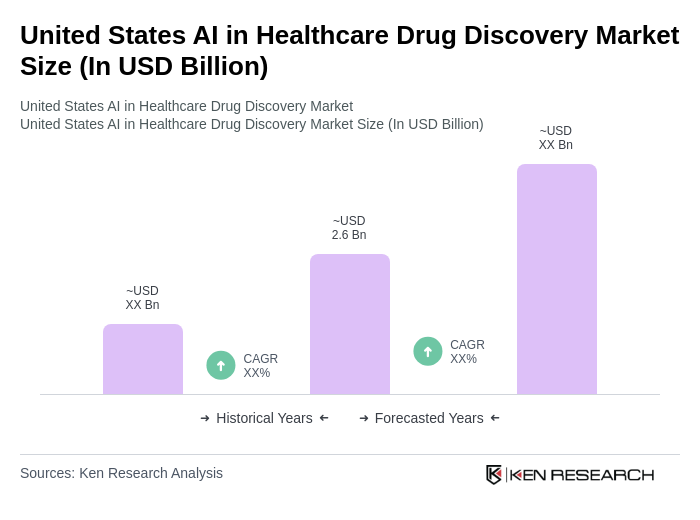

The United States AI in Healthcare Drug Discovery Market is valued at approximately USD 2.6 billion, reflecting significant growth driven by the adoption of AI technologies in drug discovery processes, personalized medicine, and the need for cost-effective drug development solutions.