Region:North America

Author(s):Rebecca

Product Code:KRAA4576

Pages:88

Published On:September 2025

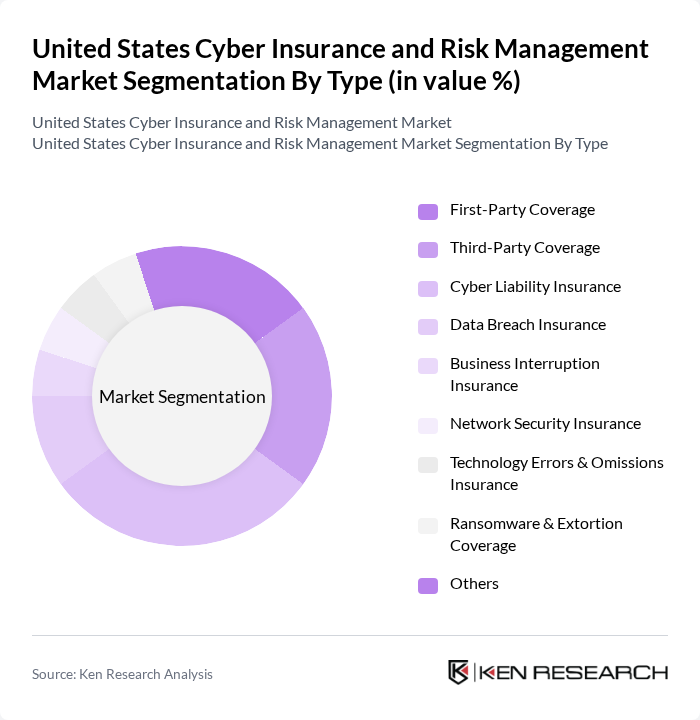

By Type:

The segmentation by type includes First-Party Coverage, Third-Party Coverage, Cyber Liability Insurance, Data Breach Insurance, Business Interruption Insurance, Network Security Insurance, Technology Errors & Omissions Insurance, Ransomware & Extortion Coverage, and Others. Among these,Cyber Liability Insuranceremains the leading subsegment, driven by the rising number of data breaches and the need for organizations to protect themselves against legal liabilities and regulatory penalties arising from cyber incidents. The growing adoption of digital transformation, cloud computing, and remote work has further fueled demand for comprehensive cyber insurance solutions that address both direct and indirect risks .

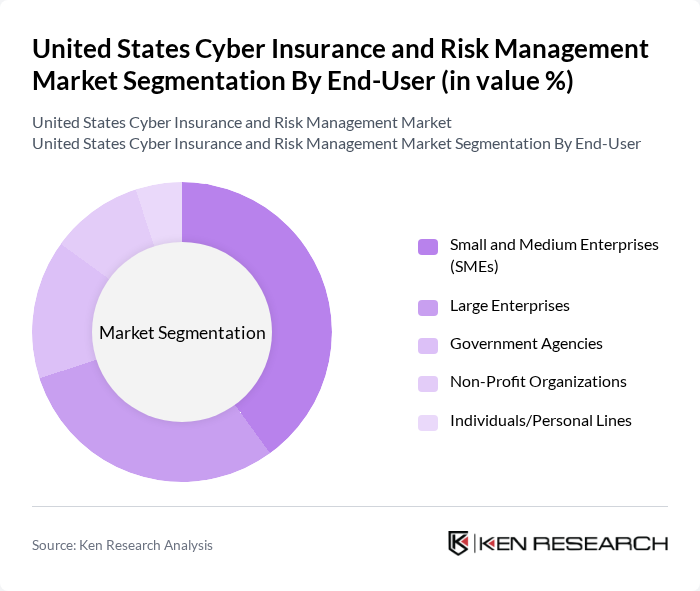

By End-User:

This segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, Non-Profit Organizations, and Individuals/Personal Lines. TheSmall and Medium Enterprises (SMEs)segment is currently the most dominant, as these businesses increasingly recognize the importance of cyber insurance in safeguarding their operations against escalating cyber threats. The surge in targeted attacks on smaller organizations, coupled with limited in-house cybersecurity resources, has led to heightened awareness and demand for tailored insurance solutions that address their unique risk profiles .

The United States Cyber Insurance and Risk Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as American International Group (AIG), Chubb Limited, Allianz Global Corporate & Specialty (AGCS), Beazley Group, Hiscox Ltd, The Travelers Companies, Inc., Zurich Insurance Group, CNA Financial Corporation, AXA XL, Berkshire Hathaway Specialty Insurance, Lockton Companies, Marsh & McLennan Companies (Marsh), Tokio Marine HCC, Liberty Mutual Insurance, Munich Re contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States cyber insurance market appears promising, driven by technological advancements and increasing digitalization. As businesses continue to adopt remote work policies, the demand for tailored cyber insurance solutions will likely rise. Additionally, the integration of artificial intelligence in risk assessment and underwriting processes is expected to enhance the efficiency and accuracy of cyber insurance offerings, making them more accessible and appealing to a broader range of organizations.

| Segment | Sub-Segments |

|---|---|

| By Type | First-Party Coverage Third-Party Coverage Cyber Liability Insurance Data Breach Insurance Business Interruption Insurance Network Security Insurance Technology Errors & Omissions Insurance Ransomware & Extortion Coverage Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Profit Organizations Individuals/Personal Lines |

| By Industry | Financial Services & Banking Healthcare & Life Sciences Retail & E-commerce Technology & IT Services Manufacturing Education Energy & Utilities Government & Public Sector Others |

| By Coverage Type | Comprehensive Coverage Limited Coverage Customized Coverage |

| By Distribution Channel | Direct Sales Insurance Brokers Online Platforms Agents Bancassurance |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Premium Range | Low Premium Medium Premium High Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Cyber Insurance | 100 | Risk Managers, IT Security Officers |

| Financial Services Cyber Risk Management | 110 | Compliance Officers, Underwriters |

| Retail Sector Cyber Insurance | 75 | Operations Managers, Cybersecurity Analysts |

| Manufacturing Cyber Risk Assessment | 60 | IT Managers, Risk Assessment Specialists |

| Technology Sector Cyber Insurance | 85 | Product Managers, Security Consultants |

The United States Cyber Insurance and Risk Management Market is valued at approximately USD 15 billion, reflecting a significant increase driven by the rising frequency of cyberattacks and the growing need for businesses to protect their digital assets.