Region:North America

Author(s):Dev

Product Code:KRAD5116

Pages:80

Published On:December 2025

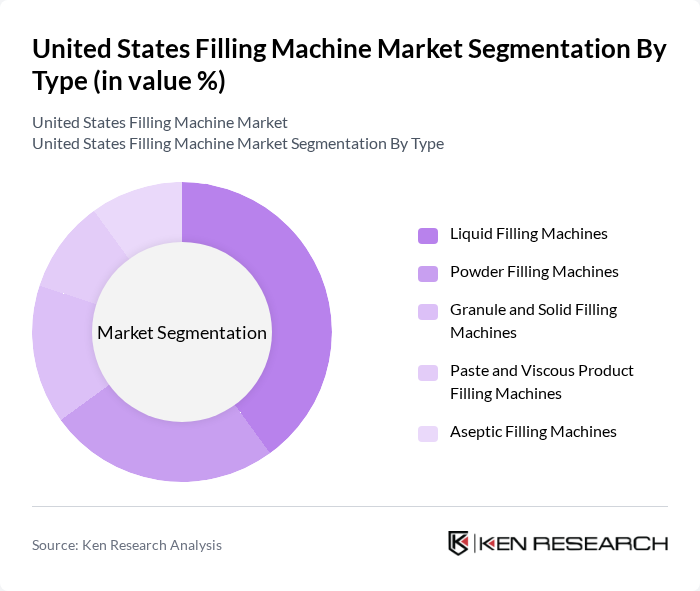

By Type:The filling machine market can be segmented into various types, including liquid filling machines, powder filling machines, granule and solid filling machines, paste and viscous product filling machines, and aseptic filling machines. This structure aligns with broader global filling machinery classifications that distinguish liquid, powder, granular, and aseptic systems for different product characteristics and hygiene requirements. Among these, liquid filling machines are the most widely used due to their versatility and high demand in the food and beverage sector, as well as in pharmaceuticals and personal care where liquid and semi-liquid formulations dominate packaging lines.

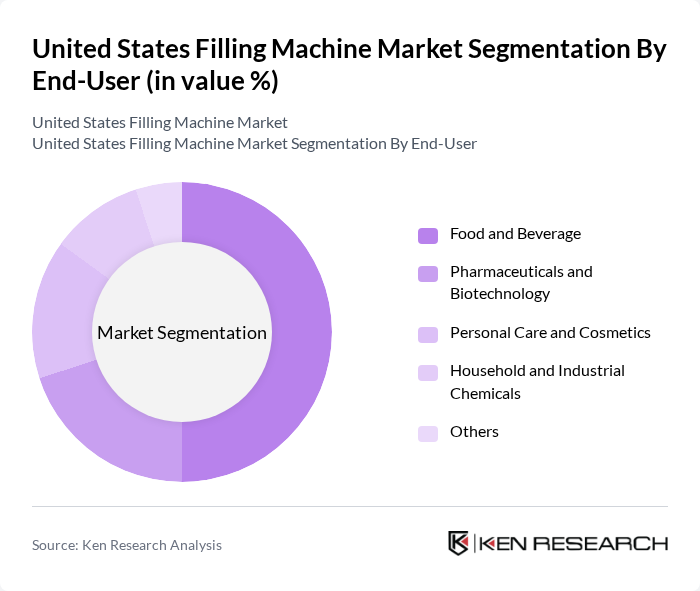

By End-User:The end-user segmentation includes food and beverage, pharmaceuticals and biotechnology, personal care and cosmetics, household and industrial chemicals, and others. This reflects the core application areas identified in global and U.S. filling machinery analyses, where these sectors account for the majority of installed filling lines. The food and beverage sector is the leading end-user, driven by the increasing demand for packaged and ready-to-consume products, growth in beverages and dairy, and the need for efficient, hygienic, and flexible filling solutions that support frequent product changeovers and high-volume production.

The United States Filling Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syntegon Technology GmbH (formerly Bosch Packaging Technology), Krones AG, Tetra Pak Group, Accutek Packaging Equipment Companies, Inc., Inline Filling Systems, LLC, Scholle IPN (a SIG company), Cozzoli Machine Company, Aesus Packaging Systems Inc., Serac Group, Sidel Group, Federal Mfg., LLC (a ProMach Product Brand), R.A Jones & Co. (a Coesia company), ProMach, Inc., Paxiom Group, Orics Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States filling machine market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt Industry 4.0 technologies, the integration of IoT and automation will enhance operational efficiency. Additionally, the expansion of e-commerce is likely to create new demand for innovative filling solutions, enabling companies to adapt to changing consumer preferences and market dynamics effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Filling Machines Powder Filling Machines Granule and Solid Filling Machines Paste and Viscous Product Filling Machines Aseptic Filling Machines |

| By End-User | Food and Beverage Pharmaceuticals and Biotechnology Personal Care and Cosmetics Household and Industrial Chemicals Others |

| By Application | Bottling (Rigid Containers) Canning Pouch and Sachet Filling Cup, Tray, and Carton Filling Bag-in-Box and Other Formats |

| By Automation Level | Manual Filling Machines Semi-Automatic Filling Machines Fully Automatic Filling Machines Robotic and Integrated Line Solutions |

| By Region | Northeast Midwest South West |

| By Material Type | Plastic Glass Metal Paperboard and Composite Materials |

| By Technology | Volumetric Filling Technology Net Weight Filling Technology Gravity and Pressure Filling Technology Aseptic and Cleanroom Filling Technology |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Industry | 120 | Production Managers, Quality Assurance Leads |

| Pharmaceutical Sector | 90 | Regulatory Affairs Managers, Operations Directors |

| Cosmetics and Personal Care | 70 | Product Development Managers, Supply Chain Coordinators |

| Industrial Chemicals | 60 | Procurement Managers, Plant Engineers |

| Contract Packaging Services | 80 | Business Development Managers, Operations Supervisors |

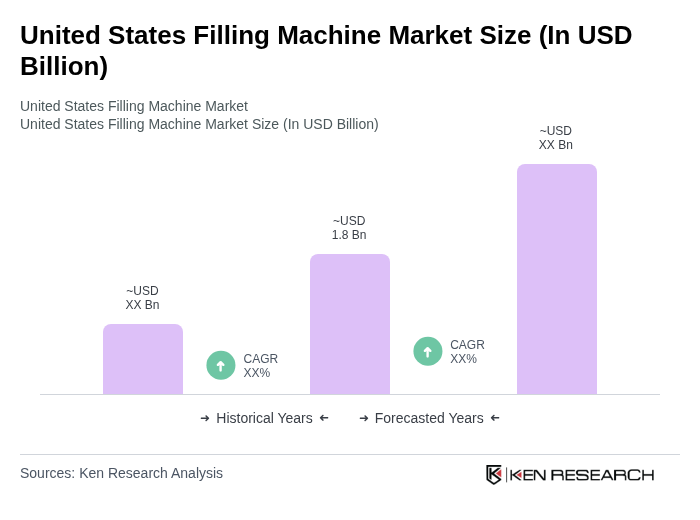

The United States Filling Machine Market is valued at approximately USD 1.8 billion, driven by increasing automation in manufacturing, rising consumer goods production, and the demand for efficient packaging solutions across various industries, including food and beverage, pharmaceuticals, and personal care.