Region:North America

Author(s):Geetanshi

Product Code:KRAA0143

Pages:86

Published On:August 2025

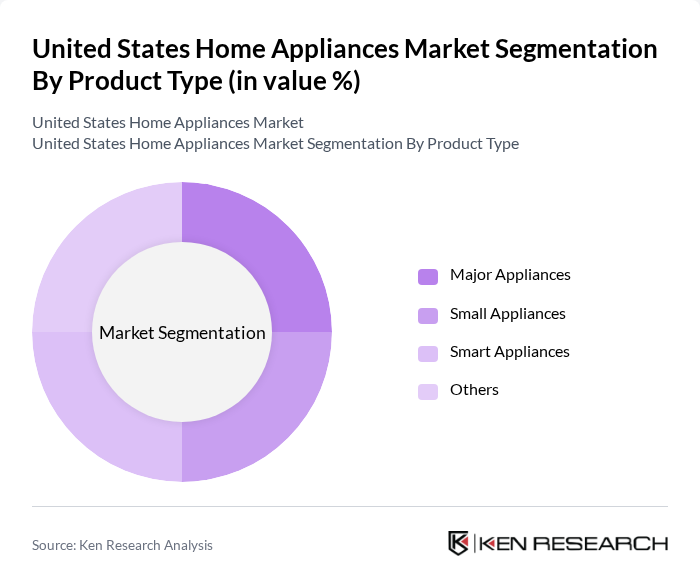

By Product Type:The product type segmentation includes major appliances, small appliances, smart appliances, and others. Major appliances—such as refrigerators, washing machines, and ovens—dominate the market due to their essential role in daily household activities and their long replacement cycles. Small appliances, including microwaves and coffee makers, are significant contributors, driven by consumer demand for convenience and ongoing innovation in design. Smart appliances are rapidly gaining traction as technology advances, appealing to tech-savvy consumers seeking integrated and automated home solutions. The integration of IoT and AI features is a key trend within the smart appliances segment .

By End-User:The end-user segmentation covers residential, commercial, industrial, government & utilities, and others. The residential segment is the largest, driven by a growing number of households, home renovation trends, and increased adoption of smart home technologies. Commercial users—including hospitality, healthcare, and retail—also represent a significant share, requiring reliable and efficient appliances for daily operations. The industrial segment, while smaller, is expanding due to the need for specialized appliances in manufacturing and processing environments. Government and utility end-users focus on energy-efficient and sustainable solutions .

The United States Home Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, LG Electronics USA, Samsung Electronics America, Electrolux North America, GE Appliances (a Haier company), Bosch Home Appliances (BSH Home Appliances Corporation), Panasonic Corporation of North America, Frigidaire (Electrolux), KitchenAid (Whirlpool Corporation), Maytag (Whirlpool Corporation), Miele USA, Haier America, Sharp Electronics Corporation, Smeg USA, and Hisense USA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. home appliances market appears promising, driven by technological advancements and evolving consumer preferences. As smart home integration becomes more prevalent, manufacturers are expected to focus on developing connected appliances that enhance user experience. Additionally, the increasing emphasis on sustainability will likely lead to innovations in eco-friendly products, aligning with consumer demand for energy-efficient solutions. These trends indicate a dynamic market landscape poised for growth and transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Major Appliances (Refrigerators, Freezers, Washing Machines, Dishwashers, Ovens, Ranges, Dryers) Small Appliances (Microwaves, Coffee Makers, Blenders, Toasters, Air Fryers, Food Processors, Vacuum Cleaners) Smart Appliances (Wi-Fi Enabled, Voice-Controlled, IoT-Integrated) Others |

| By End-User | Residential Commercial (Hospitality, Offices, Retail, Healthcare) Industrial Government & Utilities Others |

| By Distribution Channel | Online Retail (E-commerce Platforms, Brand Websites) Offline Retail (Electronic Stores, Department Stores, Specialty Stores, Home Improvement Stores) Direct Sales Wholesale Others |

| By Price Range | Budget Appliances Mid-Range Appliances Premium Appliances Luxury Appliances Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers Others |

| By Energy Efficiency Rating | ENERGY STAR Rated Non-ENERGY STAR Rated Others |

| By Product Features | Smart Features Energy Efficiency Design and Aesthetics Warranty and Service Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Purchases | 120 | Homeowners, Renters |

| Retail Appliance Sales Insights | 90 | Store Managers, Sales Associates |

| Energy Efficiency Preferences | 60 | Environmentally Conscious Consumers |

| Smart Appliance Adoption | 50 | Tech-Savvy Homeowners, Early Adopters |

| Post-Purchase Satisfaction | 70 | Recent Appliance Buyers, Customer Service Representatives |

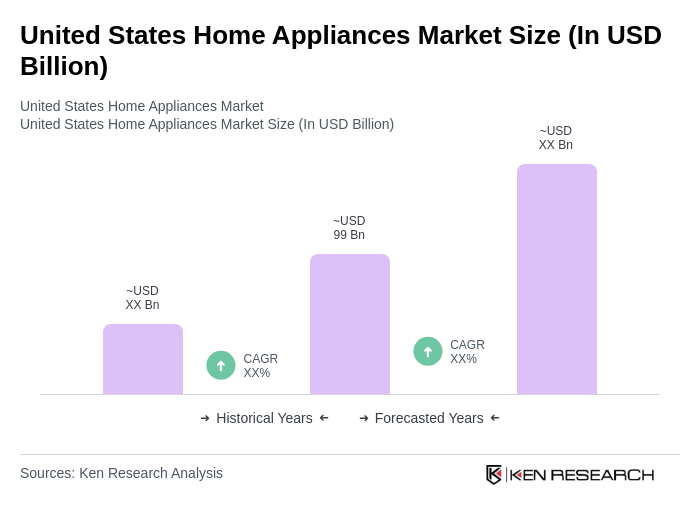

The United States Home Appliances Market is valued at approximately USD 99 billion, reflecting a significant growth trend driven by consumer demand for energy-efficient and smart appliances, rising disposable income, and urbanization.