Region:North America

Author(s):Rebecca

Product Code:KRAD0217

Pages:90

Published On:August 2025

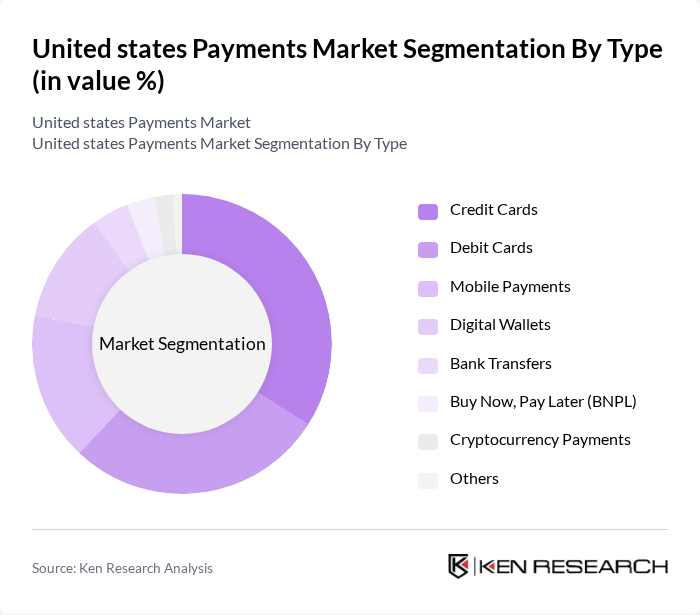

By Type:The segmentation by type includes a wide array of payment methods reflecting evolving consumer preferences and technological advancements. The primary subsegments are Credit Cards, Debit Cards, Mobile Payments, Digital Wallets, Bank Transfers, Buy Now, Pay Later (BNPL), Cryptocurrency Payments, and Others. Each subsegment plays a distinct role in shaping market dynamics, with credit and debit cards remaining dominant, while mobile and digital wallet adoption accelerates, and BNPL and cryptocurrency payments gain traction among younger demographics .

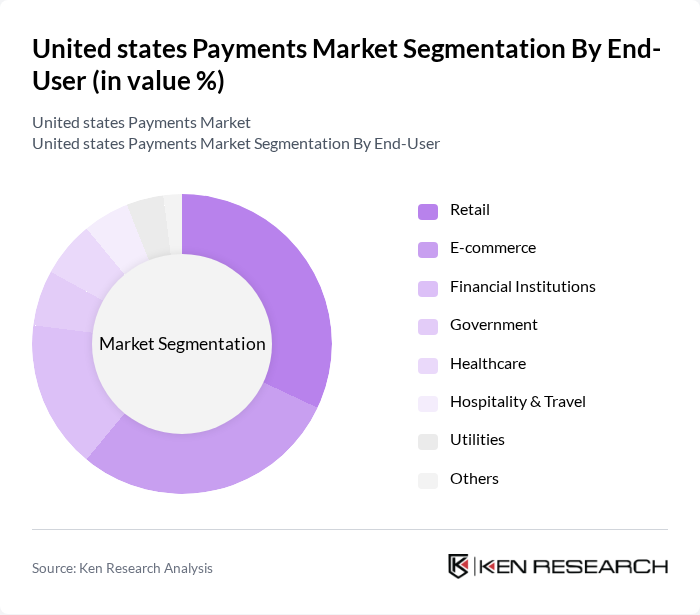

By End-User:The segmentation by end-user covers a diverse range of sectors utilizing payment solutions, including Retail, E-commerce, Financial Institutions, Government, Healthcare, Hospitality & Travel, Utilities, and Others. Each sector has unique transaction requirements and adoption patterns, with retail and e-commerce leading in digital and contactless payment adoption, while sectors like healthcare and government are increasingly integrating electronic payment systems for efficiency and compliance .

The United States Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc., Block, Inc. (formerly Square, Inc.), Stripe, Inc., Visa Inc., Mastercard Incorporated, American Express Company, Discover Financial Services, Fiserv, Inc., Adyen N.V., Worldpay, Inc. (FIS), Global Payments Inc., Payoneer Inc., Affirm, Inc., Early Warning Services, LLC (Zelle), Venmo (a PayPal service), JPMorgan Chase & Co., Bank of America Corporation, Wells Fargo & Company, Capital One Financial Corporation, and PNC Financial Services Group, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States payments market is poised for transformative growth, driven by technological innovations and evolving consumer preferences. As digital payment adoption continues to rise, the integration of advanced technologies such as AI and blockchain will enhance transaction security and efficiency. Additionally, the shift towards cashless transactions is expected to accelerate, with more consumers embracing mobile wallets and contactless payment methods. This dynamic landscape presents both challenges and opportunities for payment providers as they adapt to changing regulatory environments and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Credit Cards Debit Cards Mobile Payments Digital Wallets Bank Transfers Buy Now, Pay Later (BNPL) Cryptocurrency Payments Others |

| By End-User | Retail E-commerce Financial Institutions Government Healthcare Hospitality & Travel Utilities Others |

| By Payment Method | Online Payments In-Store Payments Recurring Payments Peer-to-Peer Payments Contactless Payments Others |

| By Industry Vertical | Retail and E-commerce Travel and Hospitality Healthcare Education Utilities Entertainment and Digital Content Others |

| By Transaction Size | Micro Transactions (<$10) Small Transactions ($10-$100) Medium Transactions ($100-$1,000) Large Transactions (>$1,000) Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Government Entities Others |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Payment Preferences | 100 | General Consumers, Millennials, Gen Z |

| SME Payment Processing Insights | 60 | Business Owners, Financial Managers |

| Corporate Payment Solutions | 40 | CFOs, Treasury Managers |

| Digital Wallet Adoption Trends | 80 | Tech-Savvy Consumers, Early Adopters |

| Impact of Regulatory Changes | 50 | Compliance Officers, Legal Advisors |

The United States Payments Market is valued at approximately USD 8.5 trillion, driven by the increasing adoption of digital payment solutions, e-commerce growth, and consumer preferences for contactless and mobile transactions.