United States Plant-Based Meat & Alternative Proteins Market Overview

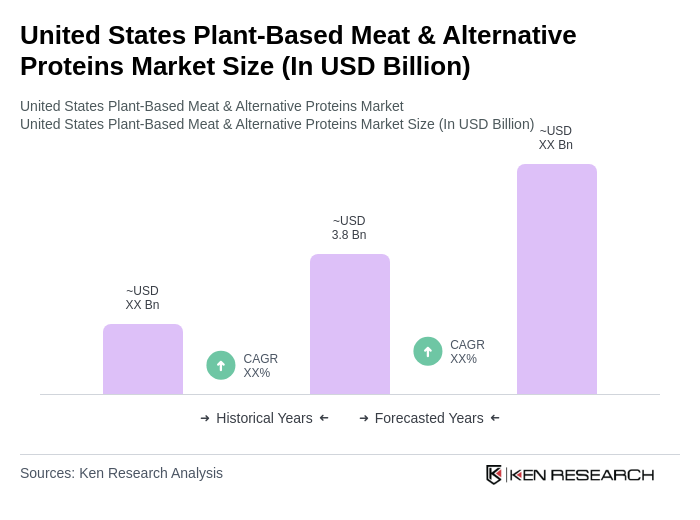

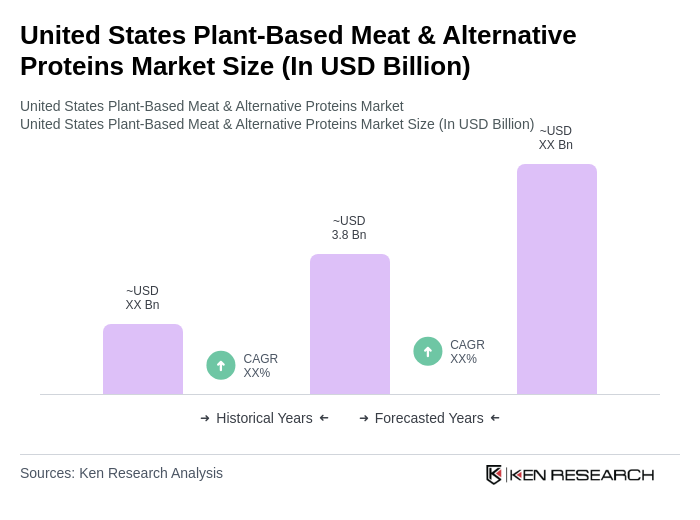

- The United States Plant-Based Meat & Alternative Proteins Market is valued at USD 3.8 billion, based on a five-year historical analysis. This market size reflects the latest available data for the U.S. market, which is driven by increasing consumer demand for healthier and sustainable food options, heightened awareness of the environmental impact of traditional meat production, and ongoing innovation in food technology. Growth is further supported by the popularity of clean-label, protein-rich foods and the expansion of e-commerce and direct-to-consumer channels .

- Key states driving market volume includeCalifornia, New York, and Texas, which benefit from large populations, progressive food trends, and robust retail infrastructures. These states have seen a surge in plant-based product offerings, supported by both local startups and established food companies investing in alternative protein technologies .

- The regulatory framework for plant-based foods is governed by theFood Labeling: Plant-Based Milk and Alternatives Act, 2023issued by the U.S. Congress. This act sets labeling standards for plant-based products, mandates clear ingredient disclosure, and supports research and development in alternative proteins through federal funding for sustainable agricultural practices. These measures enhance market transparency and foster innovation in the sector .

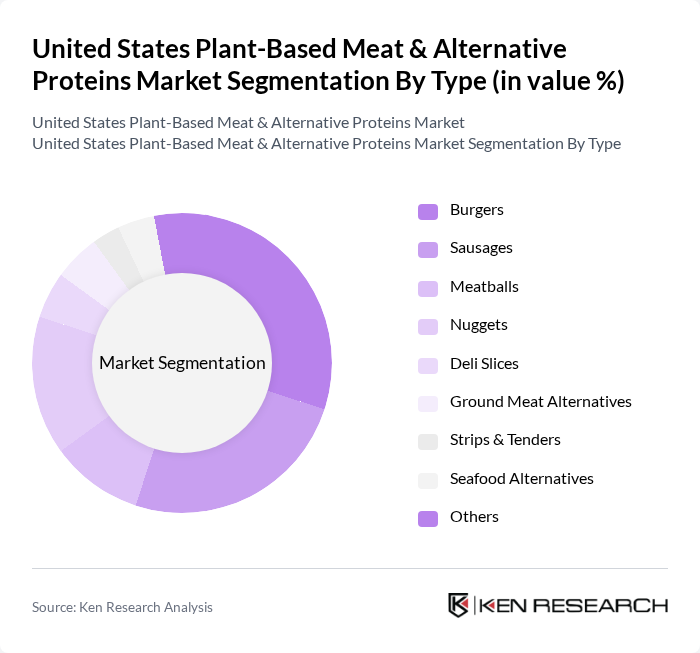

United States Plant-Based Meat & Alternative Proteins Market Segmentation

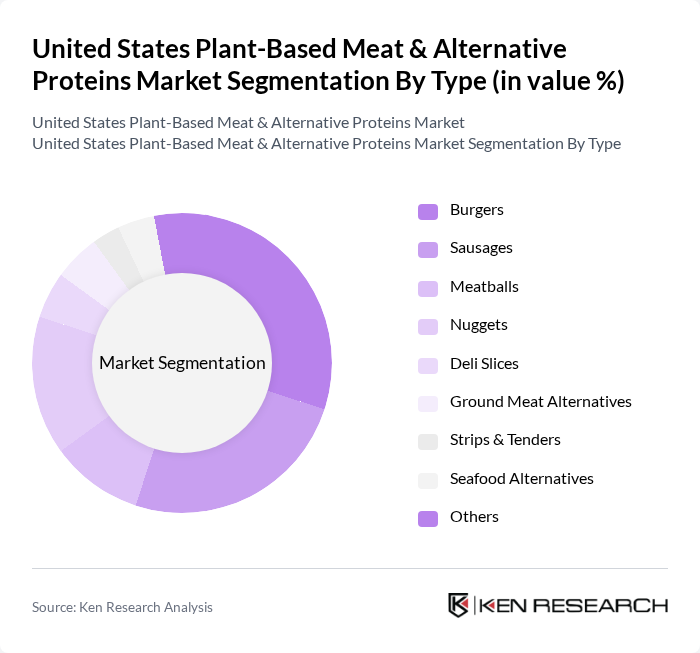

By Type:The market is segmented into various types of plant-based meat alternatives, including burgers, sausages, meatballs, nuggets, deli slices, ground meat alternatives, strips & tenders, seafood alternatives, and others.Burgers and sausagesremain the most popular subsegments due to their versatility, familiarity, and widespread availability in both retail and foodservice channels. Nuggets and meatballs also show strong consumer acceptance, while seafood alternatives are gaining traction as innovation expands in this category .

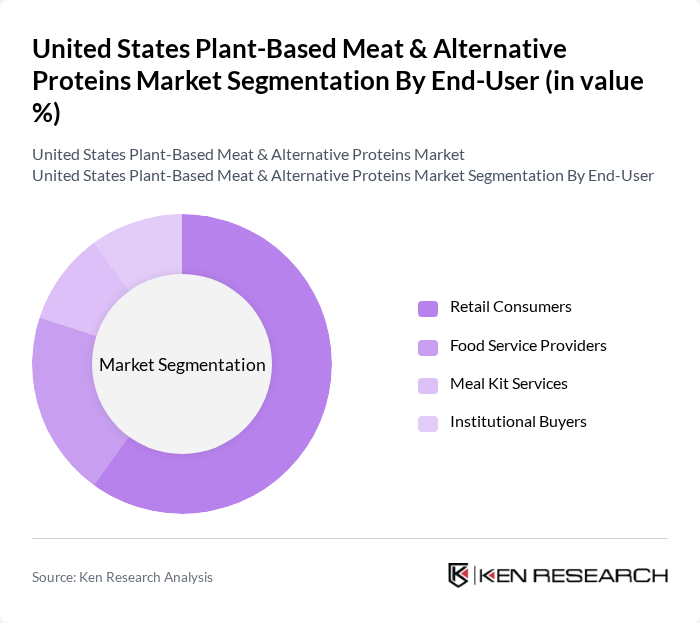

By End-User:The market is segmented by end-users, including retail consumers, food service providers, meal kit services, and institutional buyers.Retail consumersaccount for the largest share, driven by demand for convenient, healthy, and sustainable meal options in grocery stores and supermarkets. Food service providers are expanding their plant-based offerings, while meal kit services and institutional buyers contribute to category growth through targeted product innovation and menu diversification .

United States Plant-Based Meat & Alternative Proteins Market Competitive Landscape

The United States Plant-Based Meat & Alternative Proteins Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beyond Meat, Impossible Foods, MorningStar Farms, Tofurky, Gardein, Field Roast, Lightlife, Quorn, Amy's Kitchen, Oumph!, Daring Foods, Good Catch, Plant Power Fast Food, The Very Good Food Company, Eat Just, Maple Leaf Foods, No Evil Foods, Alpha Foods, Sweet Earth Foods, Yves Veggie Cuisine contribute to innovation, geographic expansion, and service delivery in this space.

United States Plant-Based Meat & Alternative Proteins Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Sustainable Protein Sources:The U.S. plant-based meat market is experiencing a surge in demand, with sales reaching approximatelyUSD 1.4 billionin future. This growth is driven by a significant shift in consumer preferences towards sustainable protein sources, as60%of consumers express a desire to reduce their meat consumption. The World Bank projects that in future, the demand for plant-based proteins will continue to rise, supported by environmental concerns and climate change awareness.

- Rising Health Consciousness Among Consumers:Health trends are increasingly influencing consumer choices, with70%of Americans actively seeking healthier food options. The plant-based meat segment has benefited from this trend, as products are often perceived as lower in saturated fats and higher in fiber. According to the USDA, the health food market is expected to grow byUSD 100 billionin future, further propelling the demand for plant-based alternatives as consumers prioritize wellness and nutrition.

- Innovations in Product Development and Technology:The plant-based meat industry is witnessing rapid innovations, withover 200new products launched in future alone. Companies are investing heavily in R&D, with expenditures exceedingUSD 1 billion, focusing on improving taste, texture, and nutritional profiles. The Food and Drug Administration (FDA) supports these advancements, which are expected to enhance consumer acceptance and expand market reach, particularly among younger demographics who prioritize innovative food experiences.

Market Challenges

- Price Competitiveness with Traditional Meat Products:One of the significant challenges facing the plant-based meat market is its price competitiveness. In future, the average price of plant-based burgers was approximatelyUSD 5.50per pound, compared toUSD 4.00per pound for traditional beef. This price gap poses a barrier to widespread adoption, particularly among price-sensitive consumers. As inflation continues to impact food prices, maintaining competitive pricing will be crucial for market growth.

- Consumer Perception and Acceptance Issues:Despite growing interest, consumer perception remains a challenge, with40%of consumers still skeptical about the taste and quality of plant-based meats. This skepticism is compounded by misinformation regarding nutritional benefits. Industry reports indicate that overcoming these perception barriers is essential for market expansion, as consumer education and effective marketing strategies will play a pivotal role in enhancing acceptance and driving sales.

United States Plant-Based Meat & Alternative Proteins Market Future Outlook

The future of the U.S. plant-based meat and alternative proteins market appears promising, driven by evolving consumer preferences and increasing health awareness. As more individuals adopt flexitarian diets, the demand for innovative, sustainable protein sources is expected to rise. Additionally, advancements in technology and product development will likely enhance the appeal of plant-based options, making them more accessible and acceptable to a broader audience. The market is poised for significant growth as these trends continue to evolve.

Market Opportunities

- Growth in E-commerce and Online Sales Channels:The rise of e-commerce presents a significant opportunity for plant-based meat brands, with online grocery sales projected to reachUSD 100 billionin future. This shift allows companies to reach a wider audience, particularly younger consumers who prefer online shopping. Enhanced digital marketing strategies can further capitalize on this trend, driving sales and brand loyalty in the competitive landscape.

- Development of New Product Lines:There is a growing opportunity for companies to diversify their product offerings, with plant-based seafood and dairy alternatives gaining traction. The market for plant-based dairy is expected to exceedUSD 30 billionin future, indicating a strong demand for innovative alternatives. By expanding product lines, companies can cater to diverse consumer preferences and tap into new market segments, enhancing overall growth potential.