Region:North America

Author(s):Dev

Product Code:KRAC0368

Pages:80

Published On:August 2025

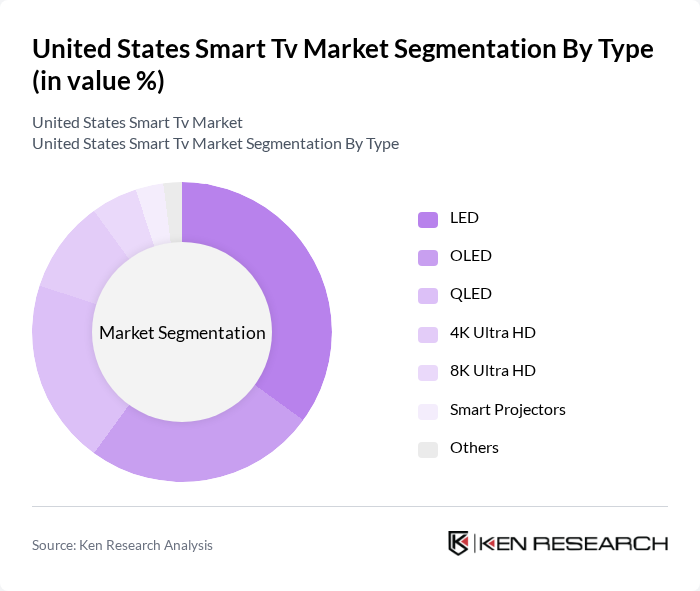

By Type:The market is segmented into various types of smart TVs, including LED, OLED, QLED, 4K Ultra HD, 8K Ultra HD, smart projectors, and others. Each type caters to different consumer preferences and technological advancements, influencing market dynamics.

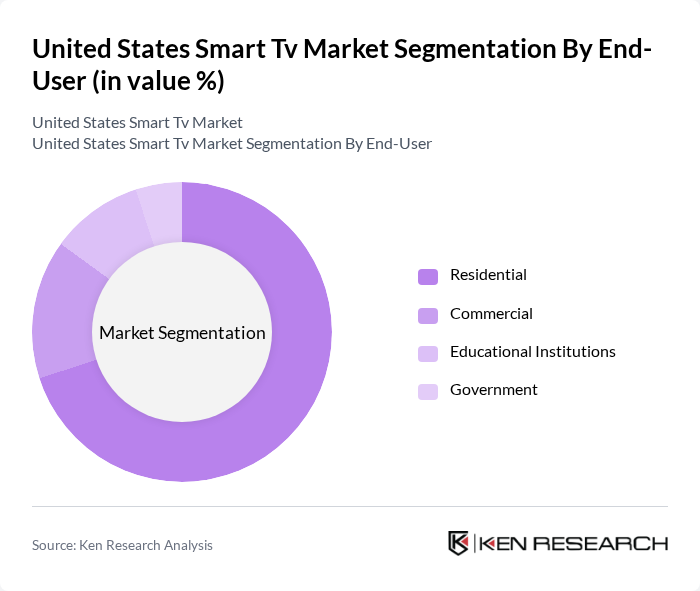

By End-User:The smart TV market is segmented by end-user categories, including residential, commercial, educational institutions, and government. Each segment has unique requirements and purchasing behaviors that influence market trends.

The United States Smart TV market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics, LG Electronics, Sony Corporation, TCL Technology, Vizio Inc., Hisense USA, Panasonic Corporation, Sharp Electronics, Philips Electronics, Insignia (Best Buy Co., Inc.), Amazon (Fire TV Edition), Roku Inc., Apple Inc. (Apple TV Integration), Google LLC (Android TV/Google TV), Skyworth Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart TV market in the United States appears promising, driven by technological advancements and evolving consumer preferences. As 5G technology expands, it will enhance streaming capabilities and enable higher-quality content delivery. Additionally, the integration of artificial intelligence in smart TVs is expected to improve user experience through personalized recommendations and voice control. These trends indicate a shift towards more interactive and user-friendly devices, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | LED OLED QLED K Ultra HD K Ultra HD Smart Projectors Others |

| By End-User | Residential Commercial Educational Institutions Government |

| By Sales Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Samsung LG Sony TCL Vizio Hisense Insignia Philips Sharp Panasonic Others |

| By Features | Smart Home Integration Voice Control Gaming Features (e.g., HDMI 2.1, VRR, ALLM) Streaming Capabilities (Built-in Apps, App Store) Multi-User Profiles Parental Controls |

| By Distribution Mode | Direct-to-Consumer Retail Partnerships E-commerce Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Purchase Behavior | 140 | Smart TV Owners, Recent Buyers |

| Retail Insights | 90 | Store Managers, Electronics Retail Staff |

| Technological Adoption Trends | 80 | Tech Enthusiasts, Early Adopters |

| Market Trends Analysis | 70 | Industry Analysts, Market Researchers |

| Consumer Preferences Survey | 120 | General Consumers, Focus Group Participants |

The United States Smart TV market is valued at approximately USD 55 billion, driven by the increasing adoption of streaming services, smart-home integration, and advancements in display technology and operating systems.