Region:Middle East

Author(s):Rebecca

Product Code:KRAE0957

Pages:93

Published On:December 2025

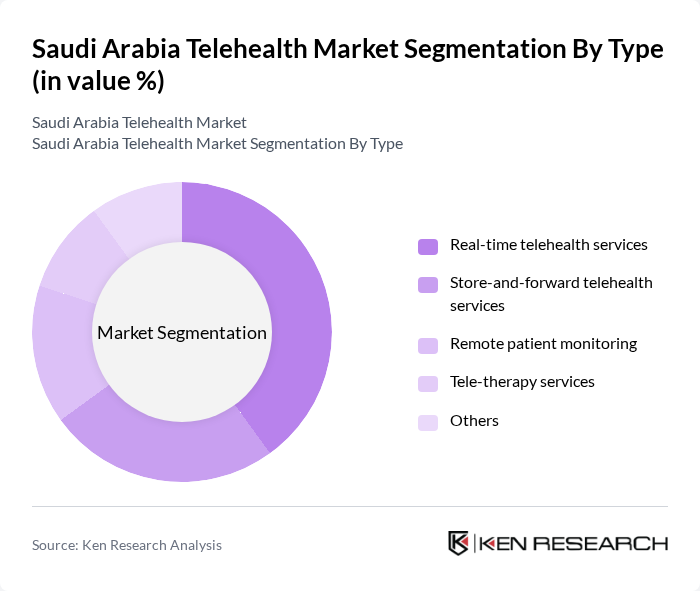

By Type:The telehealth market is segmented into various types, including real-time telehealth services, store-and-forward telehealth services, remote patient monitoring, tele-therapy services, and others. Real-time telehealth services are currently leading the market due to their convenience and immediate access to healthcare professionals, which is increasingly preferred by patients seeking timely medical advice.

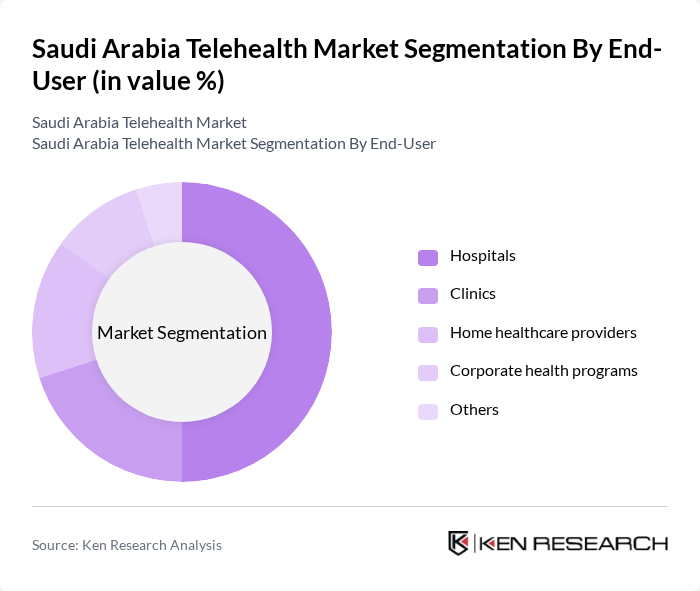

By End-User:The end-user segmentation includes hospitals, clinics, home healthcare providers, corporate health programs, and others. Hospitals are the dominant end-user segment, leveraging telehealth solutions to enhance patient care, streamline operations, and reduce wait times, thus improving overall healthcare delivery.

The Saudi Arabia Telehealth Market is characterized by a dynamic mix of regional and international players. Leading participants such as DabaDoc, Healthigo, Altibbi, Vezeeta, Okadoc, Mawid, Meddy, Careem Health, Seha, Tibbiyah, Telemedico, Doctor Anywhere, Medcare, Aster DM Healthcare, and Al Nahdi Medical Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the telehealth market in Saudi Arabia appears promising, driven by technological advancements and increasing consumer acceptance. In future, the integration of artificial intelligence and machine learning into telehealth platforms is expected to enhance diagnostic accuracy and patient engagement. Additionally, the shift towards patient-centered care models will likely encourage healthcare providers to adopt telehealth solutions, ensuring that services are tailored to individual needs and preferences, ultimately improving health outcomes across the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Real-time telehealth services Store-and-forward telehealth services Remote patient monitoring Tele-therapy services Others |

| By End-User | Hospitals Clinics Home healthcare providers Corporate health programs Others |

| By Service Type | Primary care services Specialty care services Mental health services Emergency services Others |

| By Technology | Video conferencing tools Mobile health applications Wearable health devices Cloud-based telehealth platforms Others |

| By Patient Demographics | Pediatric patients Adult patients Geriatric patients Patients with chronic conditions Others |

| By Payment Model | Fee-for-service Subscription-based Pay-per-visit Insurance reimbursement Others |

| By Geographic Coverage | Urban areas Rural areas Semi-urban areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Provider Telehealth Adoption | 150 | Doctors, Clinic Managers, Hospital Administrators |

| Patient Experience with Telehealth Services | 200 | Patients using telehealth for consultations, follow-ups |

| Telehealth Technology Providers | 100 | Product Managers, Technical Leads, Business Development Executives |

| Mental Health Teletherapy Services | 80 | Psychologists, Counselors, Teletherapy Platform Managers |

| Remote Patient Monitoring Solutions | 70 | Healthcare IT Specialists, Remote Monitoring Coordinators |

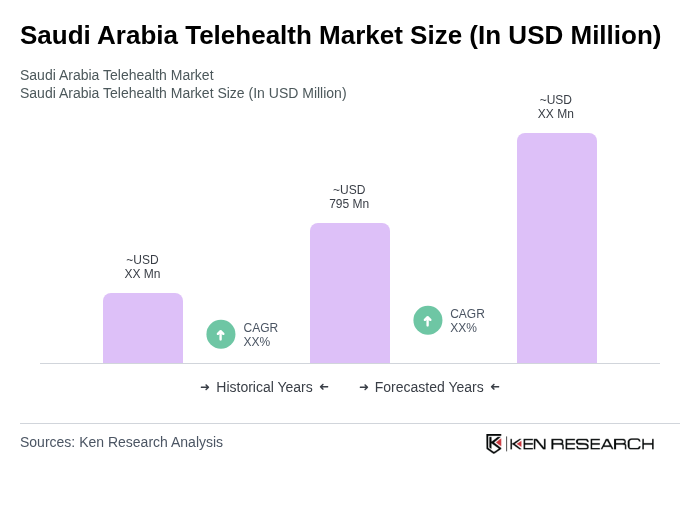

The Saudi Arabia Telehealth Market is valued at approximately USD 795 million, reflecting significant growth driven by digital health initiatives, increasing chronic disease prevalence, and rising demand for remote consultations and AI-enabled diagnostics.