Region:Asia

Author(s):Rebecca

Product Code:KRAE0950

Pages:87

Published On:December 2025

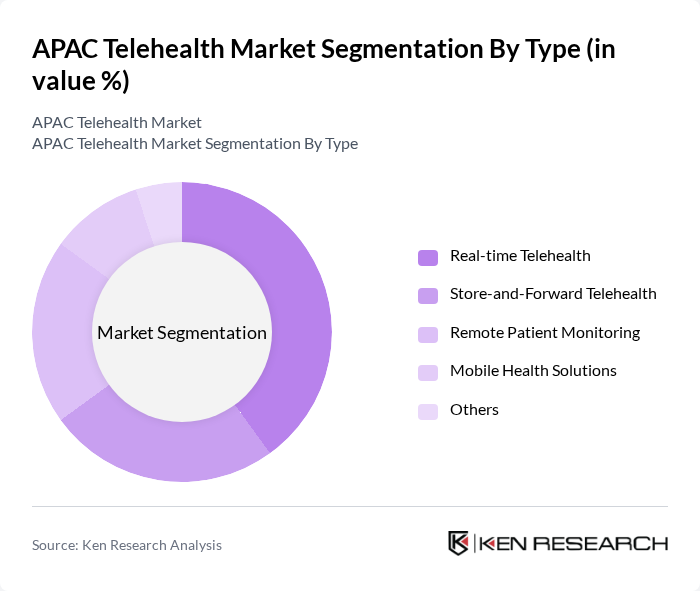

By Type:The telehealth market is segmented into various types, including Real-time Telehealth, Store-and-Forward Telehealth, Remote Patient Monitoring, Mobile Health Solutions, and Others. Among these, Real-time Telehealth is currently dominating the market due to its ability to provide immediate access to healthcare professionals, which is crucial for urgent medical situations. The convenience of video consultations and instant messaging has led to increased consumer adoption, particularly during the pandemic, where remote consultations became a necessity.

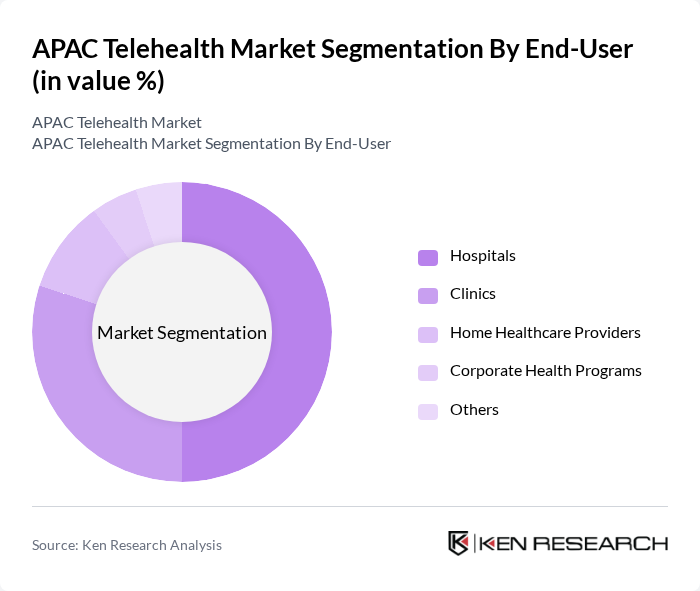

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare Providers, Corporate Health Programs, and Others. Hospitals are the leading end-users in the telehealth market, primarily due to their extensive patient base and the need for efficient healthcare delivery systems. The integration of telehealth services in hospitals allows for better patient management, reduced wait times, and improved access to specialists, which is increasingly important in urban areas with high patient volumes.

The APAC Telehealth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teladoc Health, Amwell, Doctor on Demand, MDLive, Doxy.me, HealthTap, PlushCare, Zocdoc, Babylon Health, Kry, Livi, Push Health, SimplePractice, Talkspace, and MyTelemedicine contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC telehealth market appears promising, driven by technological advancements and increasing consumer acceptance. As telehealth becomes more integrated into healthcare systems, the focus will shift towards enhancing user experience and accessibility. Innovations in artificial intelligence and machine learning will further personalize healthcare delivery, while partnerships with insurance providers will facilitate broader coverage. Additionally, the rise of mental health services through telehealth platforms will cater to the growing demand for mental health support, ensuring comprehensive care for patients across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Real-time Telehealth Store-and-Forward Telehealth Remote Patient Monitoring Mobile Health Solutions Others |

| By End-User | Hospitals Clinics Home Healthcare Providers Corporate Health Programs Others |

| By Region | North India South India East India West India |

| By Technology | Video Conferencing Mobile Applications Cloud-based Platforms Wearable Devices Others |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Follow-up Care Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Others |

| By Policy Support | Subsidies for Telehealth Services Tax Incentives for Providers Grants for Technology Development Regulatory Support for Implementation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 150 | Doctors, Clinic Managers, Telehealth Coordinators |

| Patients Utilizing Telehealth | 200 | Telehealth Users, Patients with Chronic Conditions |

| Telehealth Technology Vendors | 100 | Product Managers, Sales Directors, Technical Support Leads |

| Regulatory Bodies | 50 | Policy Makers, Health Administrators, Compliance Officers |

| Insurance Providers | 80 | Underwriters, Claims Adjusters, Healthcare Analysts |

The APAC Telehealth Market is valued at approximately USD 40 billion, driven by factors such as increased smartphone penetration, improved internet connectivity, and the rising prevalence of chronic diseases, which necessitate remote patient monitoring and teleconsultations.