Region:North America

Author(s):Geetanshi

Product Code:KRAE0711

Pages:93

Published On:December 2025

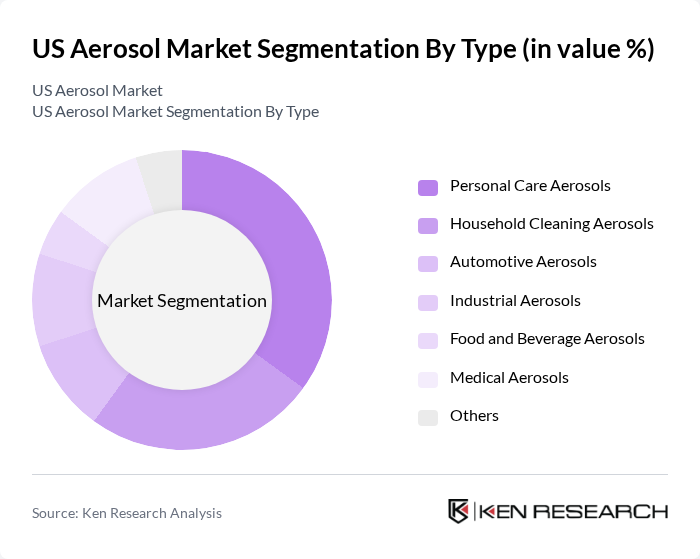

By Type:The aerosol market is segmented into various types, including personal care aerosols, household cleaning aerosols, automotive aerosols, industrial aerosols, food and beverage aerosols, medical aerosols, and others. Among these, personal care aerosols dominate the market due to the rising consumer preference for convenience and hygiene in personal grooming products. The increasing awareness of personal hygiene and grooming, especially post-pandemic, has led to a surge in demand for deodorants, hair sprays, and other personal care aerosols.

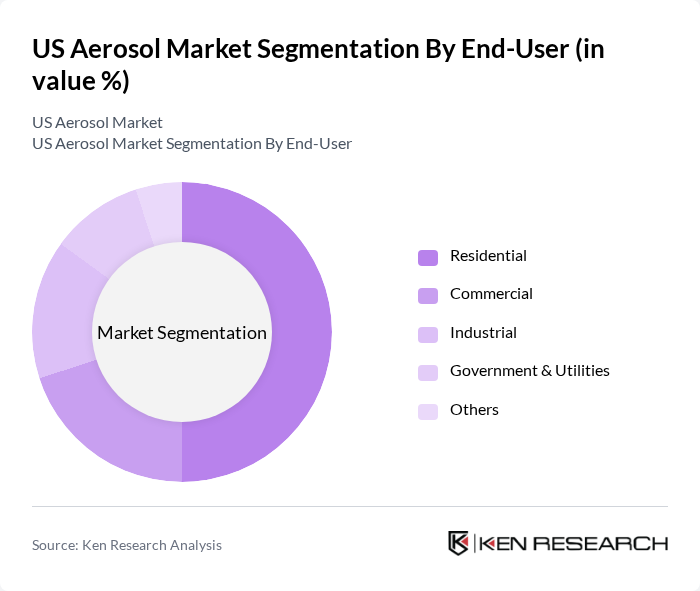

By End-User:The end-user segmentation includes residential, commercial, industrial, government & utilities, and others. The residential segment is the largest consumer of aerosol products, driven by the increasing demand for household cleaning and personal care products. The trend towards home cleanliness and personal hygiene has significantly boosted the residential segment, making it a key driver of market growth.

The US Aerosol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble, Unilever, SC Johnson, Reckitt Benckiser, Henkel, Clorox, Colgate-Palmolive, L'Oréal, Kimberly-Clark, 3M, Cargill, BASF, Dow Chemical, and Eastman Chemical Company contribute to innovation, geographic expansion, and service delivery in this space.

The US aerosol market is poised for transformative growth, driven by increasing consumer demand for sustainable and innovative products. As manufacturers adapt to regulatory pressures and evolving consumer preferences, the focus will shift towards eco-friendly formulations and advanced delivery systems. Additionally, the expansion of online sales channels will facilitate greater market access, enabling brands to reach a broader audience. This dynamic environment presents opportunities for companies to innovate and differentiate their offerings, ensuring long-term competitiveness in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Care Aerosols Household Cleaning Aerosols Automotive Aerosols Industrial Aerosols Food and Beverage Aerosols Medical Aerosols Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | Household Use Automotive Use Industrial Use Medical Use Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Convenience Stores Others |

| By Region | Northeast Midwest South West |

| By Packaging Type | Metal Cans Plastic Containers Glass Containers Others |

| By Product Formulation | Water-Based Aerosols Solvent-Based Aerosols Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Care Products | 100 | Brand Managers, Product Development Leads |

| Automotive Aerosols | 80 | Procurement Managers, Technical Directors |

| Industrial Applications | 70 | Operations Managers, Safety Compliance Officers |

| Household Cleaning Products | 90 | Marketing Managers, R&D Specialists |

| Food and Beverage Aerosols | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

The US Aerosol Market is valued at approximately USD 25 billion, driven by increasing demand for personal care and household products, as well as a shift towards eco-friendly propellants and sustainable packaging innovations.