Region:North America

Author(s):Geetanshi

Product Code:KRAD1273

Pages:91

Published On:November 2025

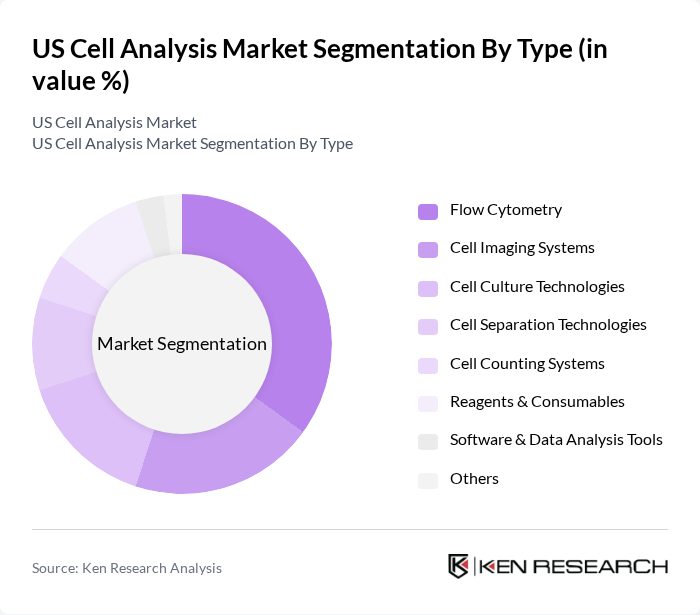

By Type:The market is segmented into various types, including Flow Cytometry, Cell Imaging Systems, Cell Culture Technologies, Cell Separation Technologies, Cell Counting Systems, Reagents & Consumables, Software & Data Analysis Tools, and Others. Among these, Flow Cytometry is the leading sub-segment due to its widespread application in clinical diagnostics and research, particularly in immunology, oncology, and hematology. The demand for precise and rapid cell analysis techniques, as well as the integration of automated and high-throughput systems, has driven the adoption of flow cytometry across research and clinical laboratories .

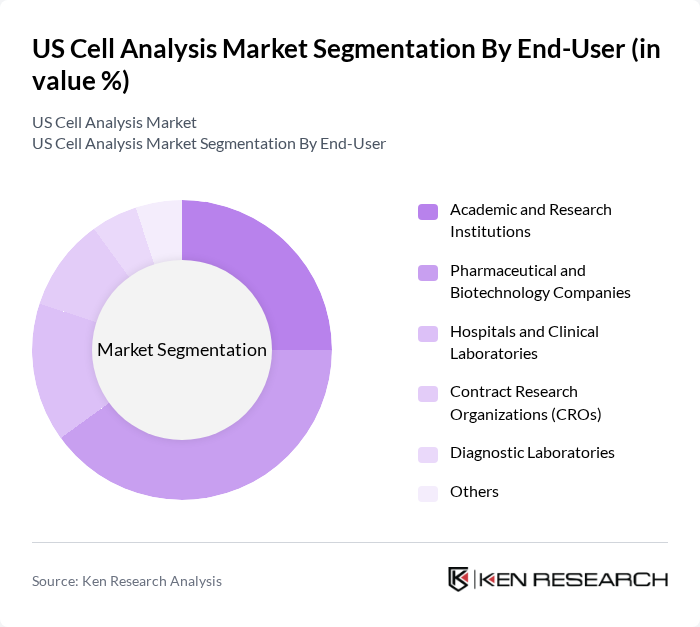

By End-User:The end-user segmentation includes Academic and Research Institutions, Pharmaceutical and Biotechnology Companies, Hospitals and Clinical Laboratories, Contract Research Organizations (CROs), Diagnostic Laboratories, and Others. The Pharmaceutical and Biotechnology Companies segment is the dominant player, driven by the increasing investment in drug discovery, biologics development, and precision medicine initiatives. These companies rely heavily on cell analysis technologies to enhance research productivity, accelerate therapeutic pipelines, and support regulatory submissions .

The US Cell Analysis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific, BD (Becton, Dickinson and Company), Merck KGaA, Agilent Technologies, Bio-Rad Laboratories, PerkinElmer (now Revvity, Inc.), Sartorius AG, Luminex Corporation (a DiaSorin company), Miltenyi Biotec, 10x Genomics, Illumina, Inc., F. Hoffmann-La Roche AG, Charles River Laboratories, Eppendorf AG, QIAGEN N.V., Standard BioTools Inc. (formerly Fluidigm), Bio-Techne Corporation, Cell Microsystems, BGI Group, Novogene Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The US cell analysis market is poised for significant transformation, driven by technological advancements and increasing healthcare demands. The integration of artificial intelligence and machine learning is expected to enhance data analysis capabilities, leading to more accurate diagnostics. Additionally, the shift towards automation in laboratory processes will streamline workflows, improving efficiency. As regulatory frameworks evolve, they will likely facilitate faster approvals for innovative technologies, further propelling market growth and enhancing patient care outcomes in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Flow Cytometry Cell Imaging Systems Cell Culture Technologies Cell Separation Technologies Cell Counting Systems Reagents & Consumables Software & Data Analysis Tools Others |

| By End-User | Academic and Research Institutions Pharmaceutical and Biotechnology Companies Hospitals and Clinical Laboratories Contract Research Organizations (CROs) Diagnostic Laboratories Others |

| By Application | Cancer Research Stem Cell Research Drug Discovery and Development Genetic Research Immunology Infectious Disease Research Others |

| By Technology | Microscopy Spectroscopy Mass Cytometry Next-Generation Sequencing PCR & qPCR High-Content Screening Others |

| By Region | Northeast Midwest South West |

| By Research Type | Basic Research Applied Research Clinical Research Translational Research Others |

| By Funding Source | Government Grants Private Investments Corporate Funding Non-Profit & Foundation Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Diagnostics Applications | 100 | Clinical Lab Directors, Pathologists |

| Research and Development in Biotechnology | 80 | Biotech Researchers, Lab Managers |

| Pharmaceutical Development Processes | 60 | Pharmaceutical Scientists, Regulatory Affairs Specialists |

| Academic Research Institutions | 50 | University Professors, Research Fellows |

| Cell Analysis Equipment Manufacturers | 40 | Product Development Managers, Sales Executives |

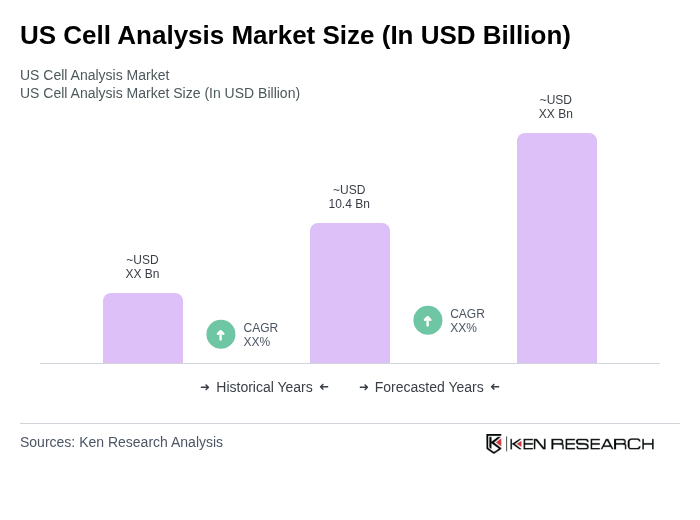

The US Cell Analysis Market is valued at approximately USD 10.4 billion, driven by advancements in cell-based research, the increasing prevalence of chronic diseases, and the demand for personalized medicine.