Region:North America

Author(s):Geetanshi

Product Code:KRAD1227

Pages:90

Published On:November 2025

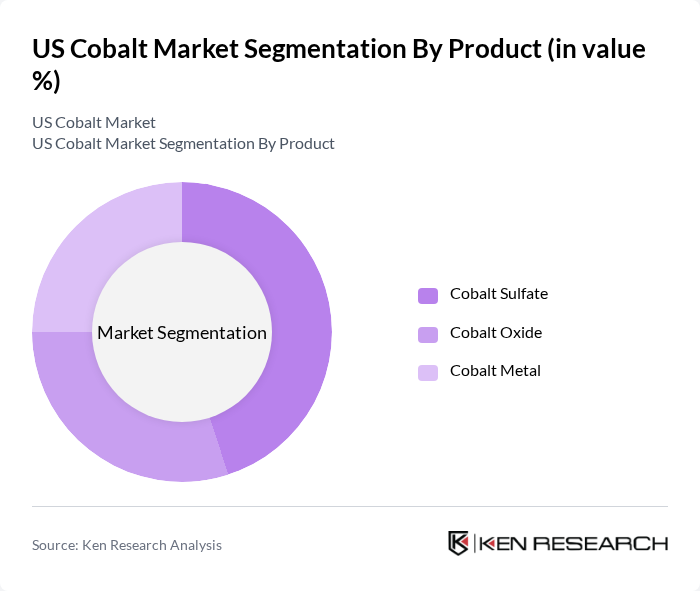

By Product:The product segmentation of the cobalt market includes Cobalt Sulfate, Cobalt Oxide, and Cobalt Metal. Cobalt Sulfate is increasingly favored in battery applications due to its high purity and efficiency in lithium-ion batteries, which dominate the EV sector. Cobalt Oxide is primarily used in ceramics, pigments, and as a catalyst in various chemical processes. Cobalt Metal, valued for its strength and resistance to corrosion, is widely utilized in superalloys, aerospace, and hard metals.

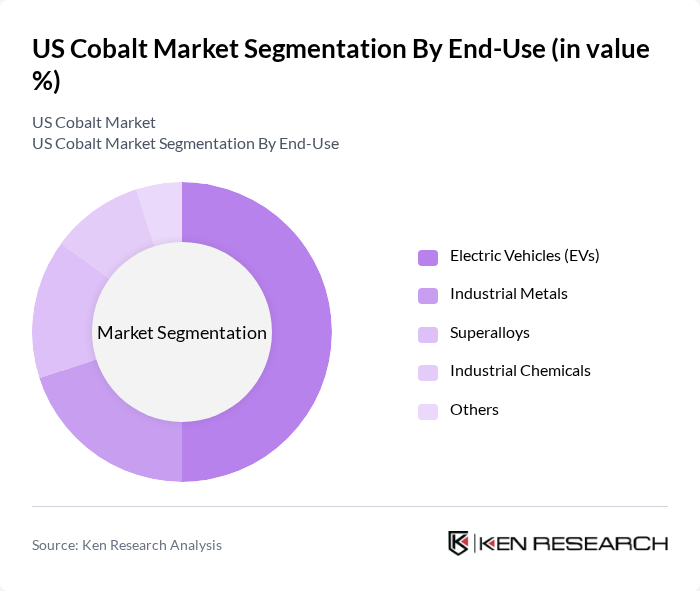

By End-Use:The end-use segmentation encompasses Electric Vehicles (EVs), Industrial Metals, Superalloys, Industrial Chemicals, and Others. The EV segment is the largest consumer of cobalt, driven by the rapid adoption of electric vehicles and the demand for high-performance batteries using cobalt-containing chemistries. Industrial Metals and Superalloys also represent significant markets, as cobalt is essential for producing durable materials used in aerospace, defense, and industrial applications. Industrial Chemicals utilize cobalt for catalysts and pigments, while other segments include medical and electronics applications.

The US Cobalt Market is characterized by a dynamic mix of regional and international players. Leading participants such as Glencore plc, China Molybdenum Co., Ltd. (CMOC Group Limited), Umicore SA, Freeport-McMoRan Inc., Eurasian Resources Group (ERG), Jinchuan Group International Resources Co. Ltd., Electra Battery Materials Corporation, American Battery Technology Company, Li-Cycle Holdings Corp., Battery Mineral Resources Corp., First Cobalt Corp. (now Electra Battery Materials), Sumitomo Metal Mining Co., Ltd., Cobalt Blue Holdings Limited, Cobalt 27 Capital Corp., Cobalt Power Group Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The US cobalt market is poised for significant transformation as demand from electric vehicles and renewable energy technologies continues to rise. In future, the market is expected to adapt to challenges such as supply chain disruptions and environmental regulations. Companies are likely to invest in sustainable mining practices and recycling technologies, which will enhance supply security. Additionally, strategic partnerships with battery manufacturers will be crucial in navigating the evolving landscape, ensuring a stable supply of cobalt to meet growing industrial needs.

| Segment | Sub-Segments |

|---|---|

| By Product | Cobalt Sulfate Cobalt Oxide Cobalt Metal |

| By End-Use | Electric Vehicles (EVs) Industrial Metals Superalloys Industrial Chemicals Others |

| By Application | Lithium-ion Batteries Aerospace Alloys Catalysts Hard Metals Others |

| By Source | Primary Mining Secondary Recycling Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | West Coast East Coast Midwest South Others |

| By Policy Support | Federal Incentives State-Level Support Tax Credits Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cobalt Mining Operations | 100 | Mining Executives, Operations Managers |

| Battery Manufacturing Sector | 60 | Production Managers, R&D Directors |

| Electric Vehicle Manufacturers | 50 | Supply Chain Managers, Product Development Leads |

| Renewable Energy Applications | 40 | Project Managers, Sustainability Officers |

| Regulatory and Policy Makers | 40 | Government Officials, Industry Regulators |

The US Cobalt Market is valued at approximately USD 260 million, driven by increasing demand for electric vehicles and advancements in battery technology, which require cobalt as a critical component.