Region:North America

Author(s):Rebecca

Product Code:KRAC7989

Pages:96

Published On:November 2025

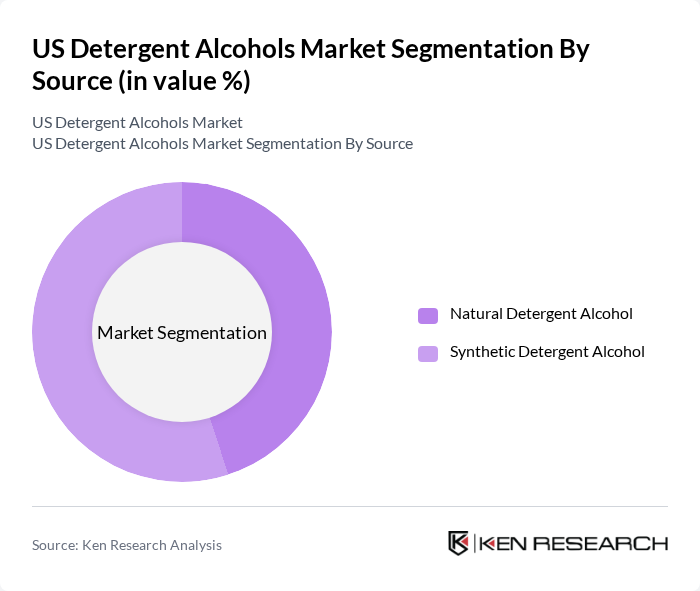

By Source:The market is segmented into Natural Detergent Alcohol and Synthetic Detergent Alcohol. Natural Detergent Alcohol is derived from renewable resources, appealing to environmentally conscious consumers. Synthetic Detergent Alcohol, on the other hand, is produced through chemical processes and is often favored for its cost-effectiveness and consistent quality. The demand for both sources is influenced by consumer preferences and regulatory standards. In 2024, the natural detergent alcohol segment held a significant share due to growing consumer demand for eco-friendly products and regulatory support for sustainable ingredients .

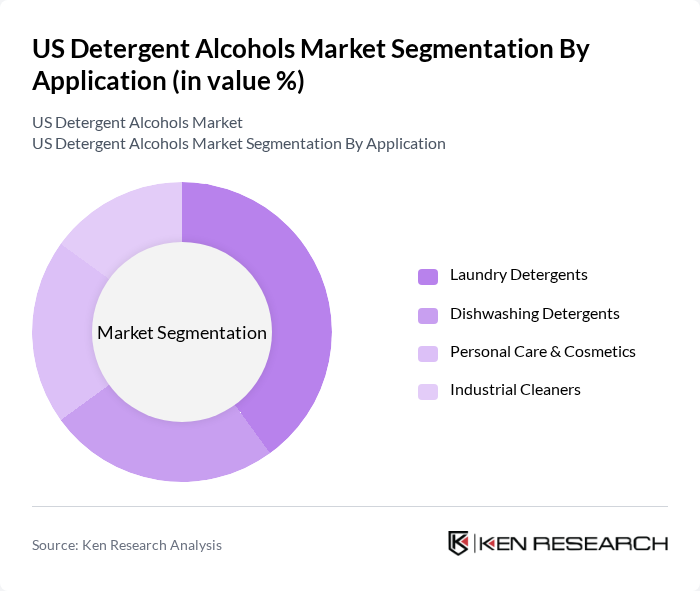

By Application:The applications of detergent alcohols include Laundry Detergents, Dishwashing Detergents, Personal Care & Cosmetics, and Industrial Cleaners. Laundry Detergents dominate the market due to the high volume of household laundry and the increasing trend towards premium cleaning products. The Personal Care & Cosmetics segment is also growing rapidly, driven by the demand for natural and organic ingredients in beauty products. The rise in hygiene awareness and the adoption of concentrated formulations are further accelerating growth across all segments .

The US Detergent Alcohols Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stepan Company, Kraton Corporation, Procter & Gamble, Vantage Specialty Chemicals, Inc., Colonial Chemical, Pilot Chemical Company, Oleon NV, Essential Labs, and Rita Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The US detergent alcohols market is poised for significant transformation as sustainability becomes a core focus for consumers and manufacturers alike. Innovations in biodegradable formulations and the rise of e-commerce platforms are expected to reshape distribution channels. Additionally, the increasing integration of technology in product development will enhance efficiency and sustainability. As companies invest in research and development, the market is likely to witness a surge in eco-friendly product offerings, aligning with consumer preferences for sustainable solutions.

| Segment | Sub-Segments |

|---|---|

| By Source | Natural Detergent Alcohol Synthetic Detergent Alcohol |

| By Application | Laundry Detergents Dishwashing Detergents Personal Care & Cosmetics Industrial Cleaners |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Others |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Cleaning Products | 120 | Product Development Managers, Marketing Directors |

| Personal Care Applications | 90 | R&D Scientists, Brand Managers |

| Industrial Cleaning Solutions | 70 | Operations Managers, Procurement Specialists |

| Regulatory Compliance Insights | 50 | Compliance Officers, Quality Assurance Managers |

| Market Trends and Innovations | 60 | Industry Analysts, Business Development Executives |

The US Detergent Alcohols Market is valued at approximately USD 1.15 billion, driven by increasing demand for eco-friendly cleaning products and the expansion of the personal care and cosmetics industry.