Region:Asia

Author(s):Rebecca

Product Code:KRAD2379

Pages:83

Published On:January 2026

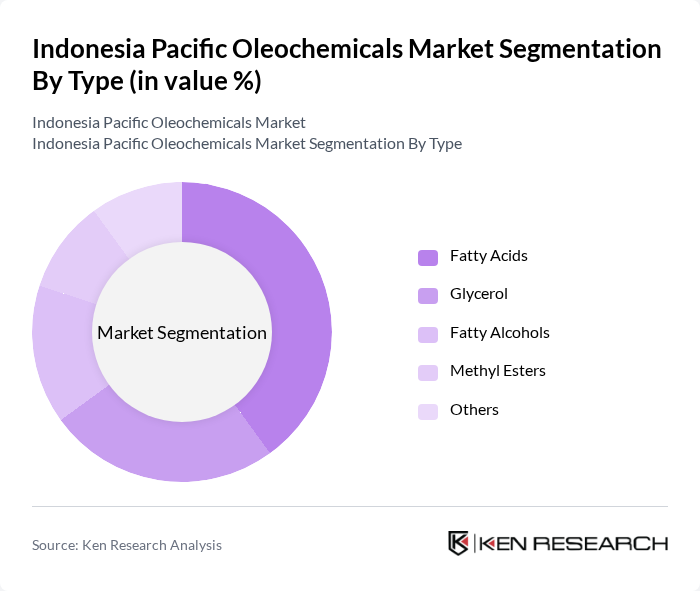

By Type:The market is segmented into various types, including Fatty Acids, Glycerol, Fatty Alcohols, Methyl Esters, and Others. Among these, Fatty Acids are the leading subsegment due to their extensive use in personal care products, detergents, and industrial applications. The increasing consumer preference for natural and organic ingredients in personal care products has further propelled the demand for Fatty Acids, making them a dominant force in the market.

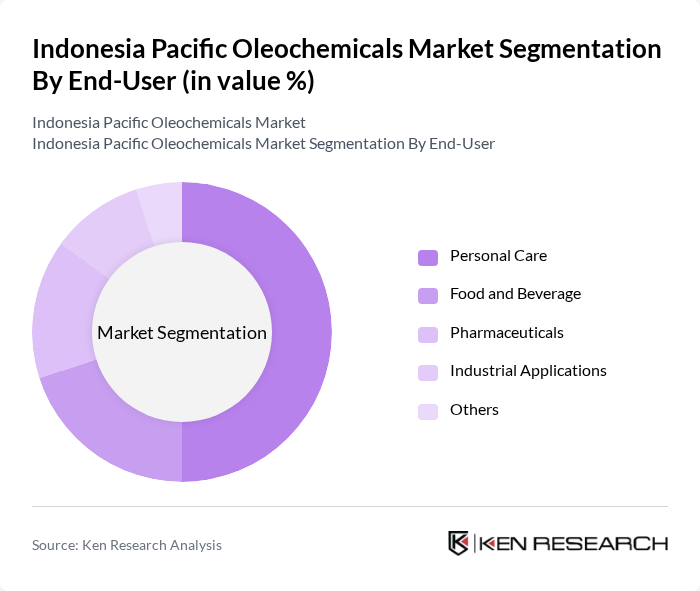

By End-User:The end-user segmentation includes Personal Care, Food and Beverage, Pharmaceuticals, Industrial Applications, and Others. The Personal Care segment is the most significant contributor to the market, driven by the rising demand for natural and organic personal care products. Consumers are increasingly seeking products that are free from harmful chemicals, leading to a surge in the use of oleochemicals in cosmetics and skincare formulations.

The Indonesia Pacific Oleochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Musim Mas, PT. Wilmar International, PT. Sinar Mas Agro Resources and Technology, PT. Cargill Indonesia, PT. Golden Agri-Resources, PT. Astra Agro Lestari, PT. Bumitama Agri, PT. Asian Agri, PT. Tunas Baru Lampung, PT. Inti Karya Persada Tehnik, PT. Djarum, PT. Pupuk Kaltim, PT. Indocement Tunggal Prakarsa, PT. Semen Indonesia, PT. Pupuk Sriwidjaja Palembang contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia Pacific oleochemicals market is poised for significant transformation, driven by increasing consumer demand for sustainable products and government initiatives promoting eco-friendly practices. In future, technological advancements in production processes are expected to enhance efficiency and reduce costs. Additionally, the growing trend towards natural ingredients in personal care and food applications will further stimulate market growth. As companies invest in research and development, the sector is likely to witness innovative product offerings that align with consumer preferences for sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Fatty Acids Glycerol Fatty Alcohols Methyl Esters Others |

| By End-User | Personal Care Food and Beverage Pharmaceuticals Industrial Applications Others |

| By Application | Surfactants Emulsifiers Lubricants Coatings Others |

| By Source | Palm Oil Coconut Oil Soybean Oil Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Java Sumatra Kalimantan Sulawesi Others |

| By Product Form | Liquid Solid Powder Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fatty Acids Production | 120 | Production Managers, Quality Control Supervisors |

| Glycerol Market Insights | 100 | Sales Directors, Product Managers |

| Surfactants Application in Industries | 90 | R&D Managers, Application Engineers |

| Bio-based Oleochemicals Trends | 80 | Sustainability Officers, Market Analysts |

| Export Market Dynamics | 110 | Export Managers, Trade Compliance Officers |

The Indonesia Pacific Oleochemicals Market is valued at approximately USD 2.5 billion, driven by the increasing demand for sustainable and biodegradable products, as well as the rising consumption of palm oil derivatives across various industries.