Region:North America

Author(s):Rebecca

Product Code:KRAA9333

Pages:89

Published On:November 2025

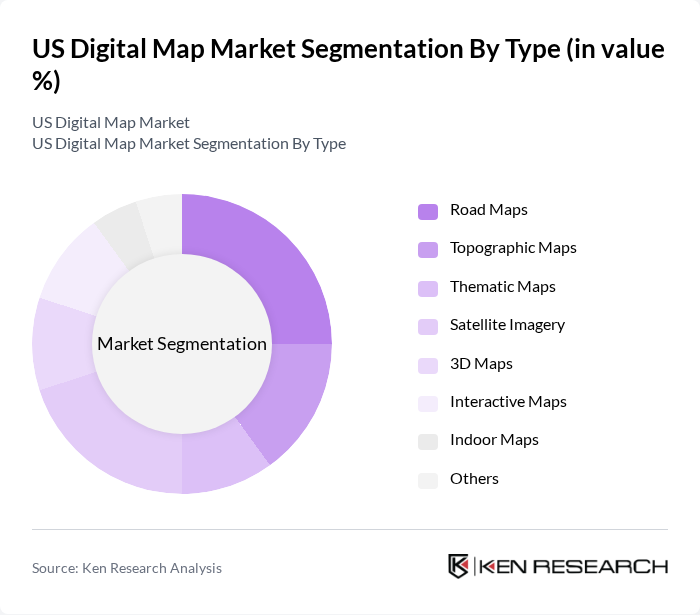

By Type:The digital map market is segmented into Road Maps, Topographic Maps, Thematic Maps, Satellite Imagery, 3D Maps, Interactive Maps, Indoor Maps, and Others. Each sub-segment serves distinct purposes: Road Maps support navigation and logistics; Topographic Maps are used for land use and environmental planning; Thematic Maps visualize demographic and economic data; Satellite Imagery enables remote sensing and monitoring; 3D Maps provide immersive visualization for urban planning and gaming; Interactive Maps facilitate user engagement in web and mobile applications; Indoor Maps are essential for navigation within large facilities; and Others include specialized mapping solutions for niche applications.

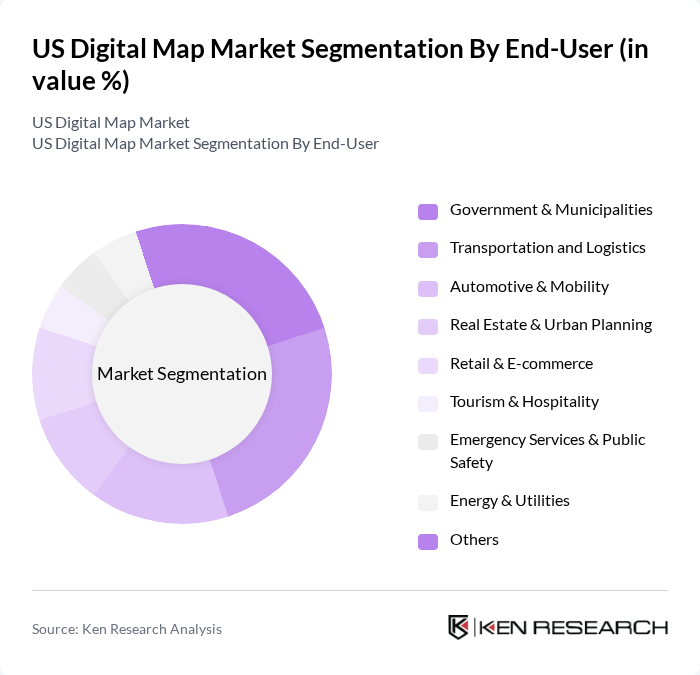

By End-User:The end-user segmentation includes Government & Municipalities, Transportation and Logistics, Automotive & Mobility, Real Estate & Urban Planning, Retail & E-commerce, Tourism & Hospitality, Emergency Services & Public Safety, Energy & Utilities, and Others. Government & Municipalities utilize digital maps for zoning, infrastructure management, and emergency response; Transportation and Logistics rely on mapping for route optimization and fleet management; Automotive & Mobility leverage high-definition maps for autonomous vehicles; Real Estate & Urban Planning use maps for site selection and development; Retail & E-commerce deploy location analytics for market targeting; Tourism & Hospitality enhance visitor experiences through interactive mapping; Emergency Services & Public Safety depend on real-time maps for disaster management; Energy & Utilities employ mapping for asset monitoring and grid management; and Others cover specialized industrial applications.

The US Digital Map Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google Maps (Google LLC), HERE Technologies, TomTom NV, Esri (Environmental Systems Research Institute), Mapbox, OpenStreetMap Foundation, Garmin Ltd., Apple Maps (Apple Inc.), Bing Maps (Microsoft Corporation), Trimble Inc., Maxar Technologies (formerly DigitalGlobe), Navteq (now part of HERE Technologies), MapQuest (Verizon Media), Waze (Google LLC), Foursquare Labs Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The US digital map market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As real-time mapping solutions gain traction, companies are increasingly leveraging artificial intelligence to enhance data analysis and improve user experiences. Furthermore, the integration of sustainable practices in mapping technologies is becoming a priority, aligning with broader environmental goals. These trends indicate a dynamic market landscape where innovation and sustainability will play pivotal roles in shaping future developments.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Maps Topographic Maps Thematic Maps Satellite Imagery D Maps Interactive Maps Indoor Maps Others |

| By End-User | Government & Municipalities Transportation and Logistics Automotive & Mobility Real Estate & Urban Planning Retail & E-commerce Tourism & Hospitality Emergency Services & Public Safety Energy & Utilities Others |

| By Application | Navigation & Routing Urban Planning & Land Use Disaster Management & Response Environmental Monitoring Infrastructure Development Asset Tracking & Fleet Management Location-Based Advertising Others |

| By Distribution Channel | Direct Sales Online Platforms & Marketplaces System Integrators & VARs Partnerships with Tech Firms Others |

| By Data Source | Satellite Data Aerial Surveys (Drones, Aircraft) Ground Surveys & Sensors User-Generated Content (Crowdsourced) Public & Government Data Others |

| By Technology | GIS Technology Cloud-Based Mapping Solutions Mobile Mapping Technology AI & Machine Learning Augmented Reality & 3D Visualization Others |

| By Geographic Coverage | Urban Areas Rural Areas National Coverage Regional Coverage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Planning Applications | 60 | City Planners, Urban Development Officials |

| Logistics and Supply Chain Mapping | 50 | Logistics Coordinators, Supply Chain Analysts |

| Real Estate Development | 40 | Real Estate Developers, Property Managers |

| Navigation and Fleet Management | 45 | Fleet Managers, Transportation Directors |

| Consumer Mapping Applications | 40 | Product Managers, Marketing Executives |

The US Digital Map Market is valued at approximately USD 4.8 billion, reflecting significant growth driven by the demand for location-based services, advancements in GPS technology, and the increasing use of mobile devices across various sectors.