Region:North America

Author(s):Shubham

Product Code:KRAD0883

Pages:92

Published On:November 2025

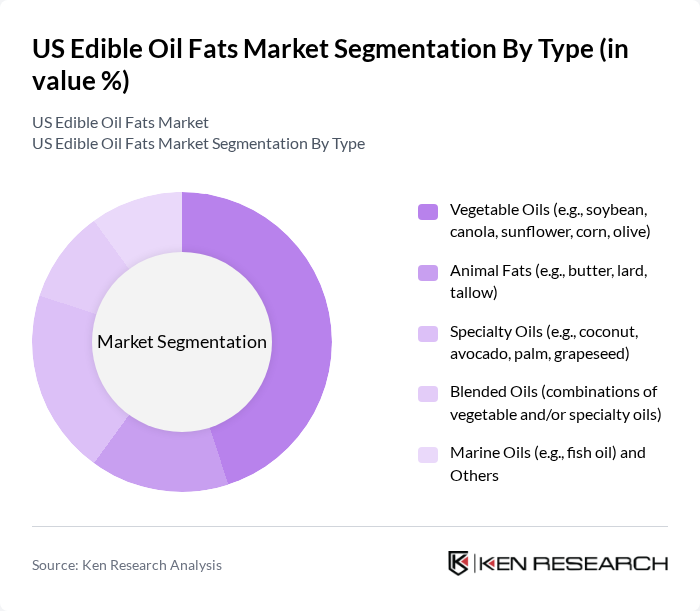

By Type:The edible oil fats market is segmented into vegetable oils, animal fats, specialty oils, blended oils, and marine oils. Vegetable oils, such as soybean, canola, sunflower, corn, and olive, dominate the market due to their widespread use in cooking and food processing. The increasing health consciousness among consumers has led to a growing preference for oils perceived as healthier, such as olive and avocado oils. Specialty oils are gaining traction, driven by trends in gourmet cooking, clean-label products, and health-focused diets. Blended oils are also being adopted for their tailored nutritional profiles and functional benefits .

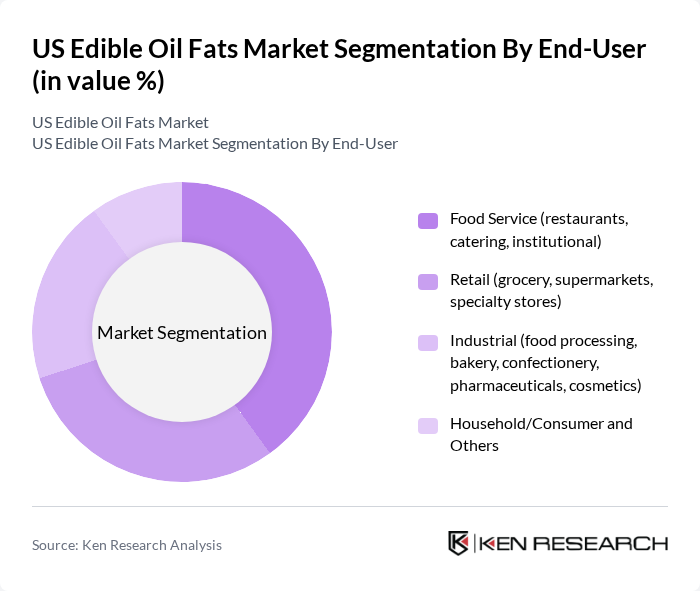

By End-User:The market is segmented by end-user into food service, retail, industrial, and household/consumer segments. The food service sector is the largest end-user, driven by the increasing number of restaurants and catering services that require large quantities of cooking oils. Retail sales are also significant, as consumers purchase oils for home cooking. The industrial segment, which includes food processing and bakery applications, is growing due to the rising demand for processed foods. The expansion of online retail and e-commerce channels is further supporting market growth across all end-user segments .

The US Edible Oil Fats Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Inc., Archer Daniels Midland Company (ADM), Bunge North America, Inc., Wilmar International Limited, Unilever PLC, Kraft Heinz Company, Associated British Foods plc, Louis Dreyfus Company B.V., CHS Inc., AAK AB, Bunge Limited, Catania Spagna Corporation, Spectrum Organic Products, LLC, Adams Group, Inc., California Olive Ranch, Inc., Upfield Holdings B.V., Conagra Brands, Inc., Ventura Foods, LLC, Richardson International Limited, Pompeian, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The US edible oil fats market is poised for transformative growth, driven by evolving consumer preferences and technological advancements. As health-conscious consumers increasingly seek oils with functional benefits, manufacturers are likely to innovate with fortified products. Additionally, the rise of e-commerce platforms is expected to enhance distribution channels, making a wider variety of oils accessible. Sustainability will also play a crucial role, with companies focusing on eco-friendly practices to meet consumer demand for responsible sourcing and packaging.

| Segment | Sub-Segments |

|---|---|

| By Type | Vegetable Oils (e.g., soybean, canola, sunflower, corn, olive) Animal Fats (e.g., butter, lard, tallow) Specialty Oils (e.g., coconut, avocado, palm, grapeseed) Blended Oils (combinations of vegetable and/or specialty oils) Marine Oils (e.g., fish oil) and Others |

| By End-User | Food Service (restaurants, catering, institutional) Retail (grocery, supermarkets, specialty stores) Industrial (food processing, bakery, confectionery, pharmaceuticals, cosmetics) Household/Consumer and Others |

| By Packaging Type | Bottles (PET, glass) Cans (metal, composite) Bulk Packaging (drums, totes, tankers) Sachets, Pouches, and Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Convenience Stores Foodservice Distributors and Others |

| By Region | Northeast Midwest South West |

| By Application | Cooking Baking Frying Confectionery, Pharmaceuticals, Cosmetics, and Others |

| By Product Form | Liquid Oils Solid Fats Semi-Solid Fats Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Edible Oil Manufacturers | 100 | Production Managers, Quality Control Officers |

| Retail Grocery Chains | 80 | Category Managers, Purchasing Agents |

| Food Service Providers | 70 | Executive Chefs, Procurement Managers |

| Health and Nutrition Experts | 60 | Dietitians, Food Scientists |

| Consumer Households | 100 | Home Cooks, Health-Conscious Consumers |

The US Edible Oil Fats Market is valued at approximately USD 139 billion, reflecting a significant growth trend driven by consumer demand for healthier cooking oils and the rise of plant-based diets.