Region:North America

Author(s):Geetanshi

Product Code:KRAC7937

Pages:90

Published On:November 2025

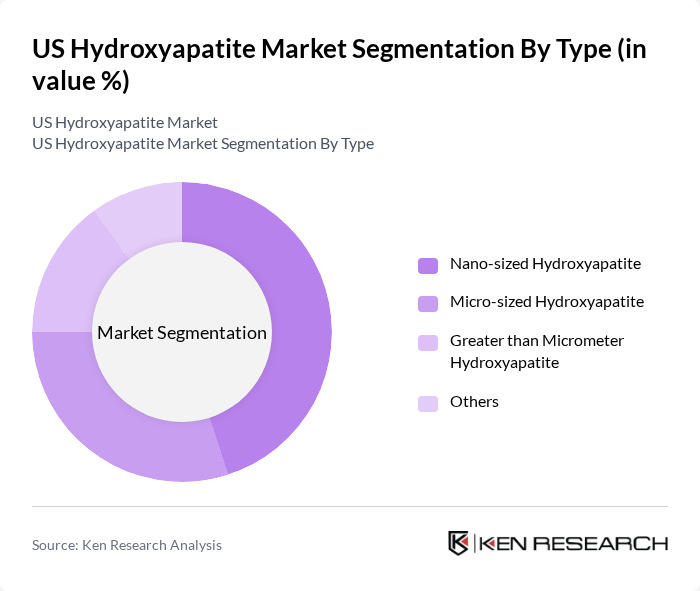

By Type:The hydroxyapatite market can be segmented into four main types: Nano-sized Hydroxyapatite, Micro-sized Hydroxyapatite, Greater than Micrometer Hydroxyapatite, and Others. Among these, Nano-sized Hydroxyapatite is gaining traction due to its superior properties, such as enhanced bioactivity and better integration with biological tissues. This subsegment is particularly favored in dental and orthopedic applications, where precision and effectiveness are paramount. Micro-sized hydroxyapatite currently holds the largest share, but nano-sized variants are experiencing the fastest growth due to their application in advanced dental and bone regeneration therapies .

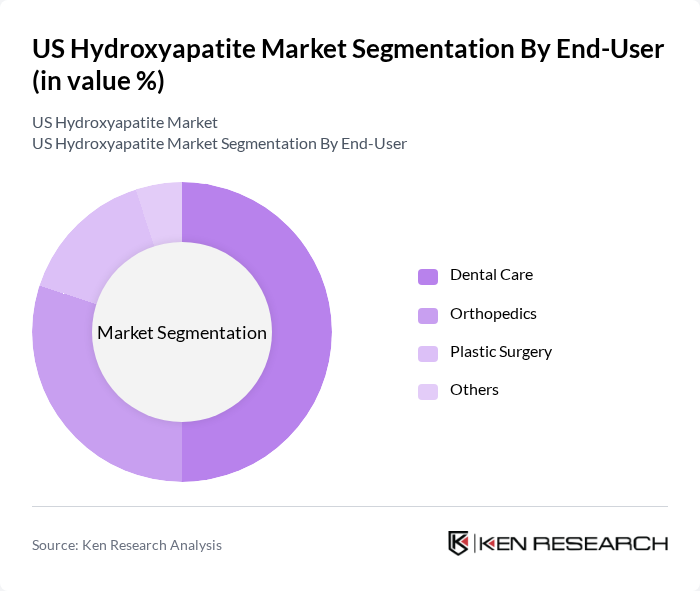

By End-User:The hydroxyapatite market is segmented by end-user into Dental Care, Orthopedics, Plastic Surgery, and Others. The Dental Care segment is the most significant, driven by the increasing demand for dental implants and restorative procedures. The rise in cosmetic dentistry, dental tourism, and growing awareness of oral health are also contributing to the expansion of this segment, making it a focal point for manufacturers and healthcare providers. Orthopedics remains a substantial segment due to the prevalence of musculoskeletal disorders and the need for bone graft substitutes .

The US Hydroxyapatite Market is characterized by a dynamic mix of regional and international players. Leading participants such as SigmaGraft, Berkeley Advanced Biomaterials, APS Materials, Inc., RevBio, Inc., InnoBio, OsteoMed, Medtronic, Zimmer Biomet, Stryker Corporation, AAP Implantate AG, BONESUPPORT AB, Collagen Solutions, HAPPE Spine, Xtant Medical Holdings, Inc., Bioventus Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The US hydroxyapatite market is poised for significant advancements driven by technological innovations and increasing healthcare investments. As the demand for personalized medicine grows, hydroxyapatite's role in tailored treatments will expand. Furthermore, the ongoing shift towards minimally invasive surgical techniques will enhance the material's application in various medical fields. Collaborations between industry and academia are expected to foster research, leading to novel hydroxyapatite formulations and applications, ultimately benefiting patient care and outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Nano-sized Hydroxyapatite Micro-sized Hydroxyapatite Greater than Micrometer Hydroxyapatite Others |

| By End-User | Dental Care Orthopedics Plastic Surgery Others |

| By Application | Bone Regeneration Dental Implants Joint Replacement Drug Delivery Others |

| By Formulation | Powder Granules Coatings Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Geography | Northeast Midwest South West |

| By Policy Support | Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Applications | 100 | Dentists, Oral Surgeons |

| Orthopedic Applications | 80 | Orthopedic Surgeons, Hospital Administrators |

| Cosmetic Applications | 60 | Plastic Surgeons, Dermatologists |

| Research & Development | 50 | Biomedical Researchers, University Professors |

| Manufacturing Insights | 40 | Production Managers, Quality Control Specialists |

The US Hydroxyapatite Market is valued at approximately USD 750 million, driven by increasing demand in dental and orthopedic applications, advancements in biomaterials technology, and a growing geriatric population.