Region:North America

Author(s):Shubham

Product Code:KRAD3679

Pages:85

Published On:November 2025

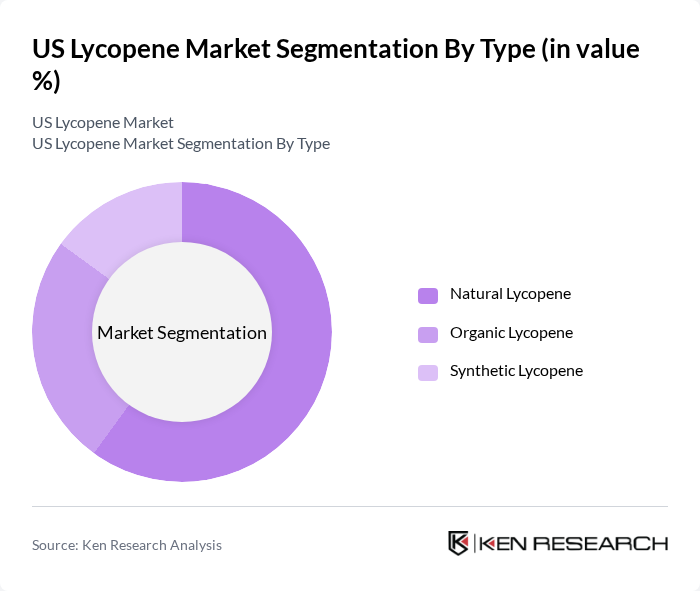

By Type:The market is segmented into three main types: Natural Lycopene, Organic Lycopene, and Synthetic Lycopene. Natural Lycopene, derived from tomatoes and other fruits, remains the most popular due to its recognized health benefits and consumer preference for natural ingredients. Organic Lycopene is gaining traction as consumers increasingly seek certified organic products, while Synthetic Lycopene, though less favored, is used in specific applications in food and pharmaceuticals where consistency and purity are prioritized .

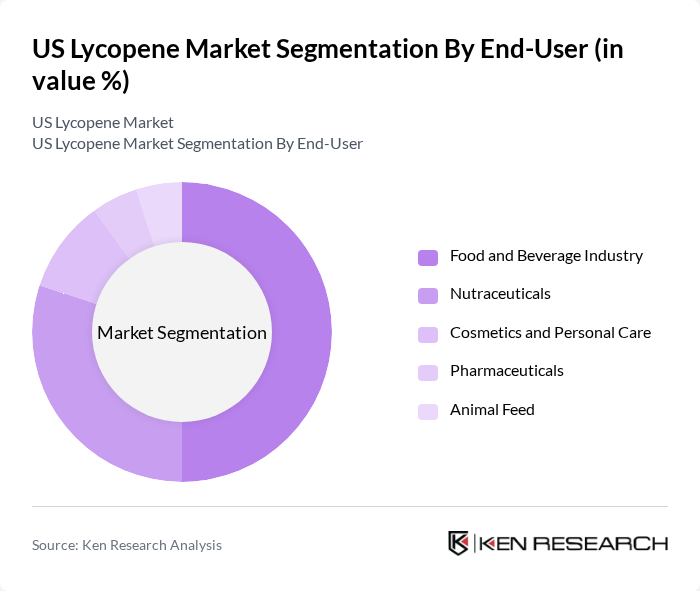

By End-User:The end-user segmentation includes the Food and Beverage Industry, Nutraceuticals, Cosmetics and Personal Care, Pharmaceuticals, and Animal Feed. The Food and Beverage Industry is the largest segment, driven by the demand for natural colorants and functional health supplements. Nutraceuticals are also significant, as consumers increasingly seek health benefits from their food. Cosmetics and Personal Care are growing segments, leveraging lycopene's antioxidant and skin-protective properties. The pharmaceutical and animal feed segments utilize lycopene for its functional and health-promoting attributes .

The US Lycopene Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lycored (a subsidiary of Adama Group), DSM-Firmenich, BASF SE, Naturex (a Givaudan company), Kemin Industries, Chr. Hansen Holding A/S, Archer Daniels Midland Company (ADM), DuPont de Nemours, Inc., Givaudan, Sabinsa Corporation, Axiom Foods, Inc., BioCare Copenhagen A/S, Frutarom (now part of IFF), Herbalife Nutrition Ltd., and Nutraceutical Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The US lycopene market is poised for significant growth, driven by increasing health awareness and a shift towards natural ingredients. As consumers continue to seek functional foods and beverages, the demand for lycopene is expected to rise. Innovations in extraction technologies will likely enhance production efficiency, making lycopene more accessible. Additionally, collaborations with food manufacturers will facilitate the integration of lycopene into a broader range of products, further expanding its market presence and consumer acceptance.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Lycopene Organic Lycopene Synthetic Lycopene |

| By End-User | Food and Beverage Industry Nutraceuticals Cosmetics and Personal Care Pharmaceuticals Animal Feed |

| By Application | Dietary Supplements Functional Foods & Beverages Personal Care Products Food Colorants Pharmaceuticals |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Health Stores |

| By Formulation | Powder Capsules Liquid Beadlets Oil Suspension |

| By Source | Tomato Extracts Watermelon Extracts Papaya Extracts Guava Extracts Others |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Product Development Managers, Quality Assurance Specialists |

| Health Supplement Producers | 80 | Marketing Directors, R&D Managers |

| Cosmetic Product Developers | 60 | Formulation Chemists, Brand Managers |

| Nutritionists and Dietitians | 50 | Clinical Nutritionists, Health Coaches |

| Retail Sector Buyers | 40 | Category Managers, Purchasing Agents |

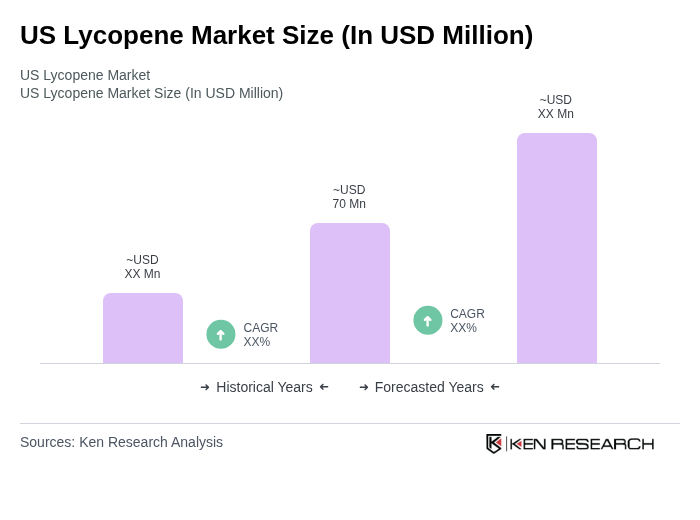

The US Lycopene Market is valued at approximately USD 70 million, reflecting a growing interest in the health benefits of lycopene, particularly its antioxidant properties and potential role in reducing chronic disease risks.