Region:North America

Author(s):Dev

Product Code:KRAC2053

Pages:92

Published On:October 2025

By Type:The market is segmented into various types, including Care Management Solutions, Data Analytics Tools, Patient Engagement Platforms, Risk Stratification Solutions, Population Health Data Management, Telehealth Solutions, Services (e.g., Consulting, Implementation, Post-Purchase Support), and Others. Among these, Care Management Solutions and Data Analytics Tools are particularly prominent due to their critical roles in enhancing patient care and optimizing healthcare operations. The increasing reliance on data-driven decision-making in healthcare is driving the demand for these solutions. Advanced analytics and integrated care platforms are being adopted to support value-based care, risk identification, and personalized interventions.

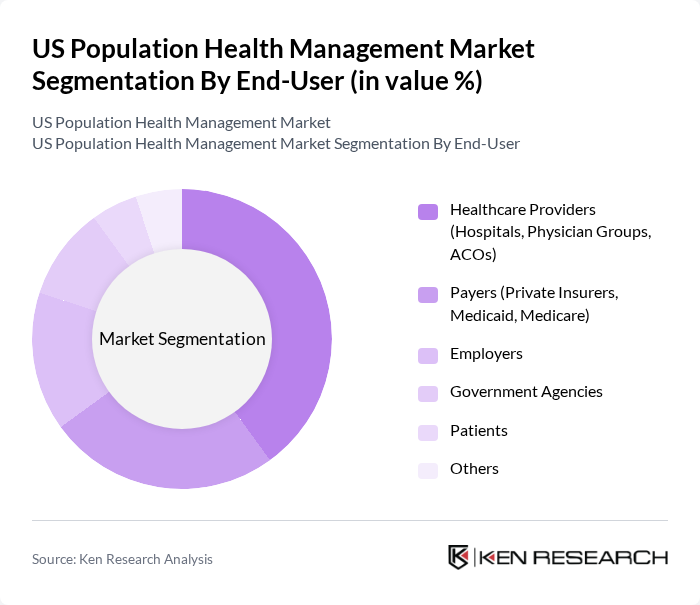

By End-User:The end-user segmentation includes Healthcare Providers (Hospitals, Physician Groups, ACOs), Payers (Private Insurers, Medicaid, Medicare), Employers, Government Agencies, Patients, and Others. Healthcare Providers are the leading end-users, driven by the need to improve care coordination and patient outcomes. The increasing focus on value-based care models is pushing providers to adopt population health management solutions to enhance their service delivery. Payers and employers are also expanding adoption to manage risk and improve population health metrics, while government agencies are investing in scalable solutions for public health initiatives.

The US Population Health Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Optum, Inc., Oracle Health (formerly Cerner Corporation), Veradigm LLC (formerly Allscripts Healthcare Solutions, Inc.), McKesson Corporation, Koninklijke Philips N.V. (Philips Healthcare), IBM Watson Health (now Merative), Epic Systems Corporation, Medecision, Inc., Health Catalyst, Inc., WellSky Corporation, Change Healthcare (now part of Optum), NextGen Healthcare, Inc., eClinicalWorks, athenahealth, Inc., Inovalon Holdings, Inc., Enli Health Intelligence, Medtronic plc, Advisory Board (part of Optum), RedBrick Health (now part of Virgin Pulse), Welltok, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The US Population Health Management Market is poised for significant transformation as healthcare providers increasingly adopt value-based care models. The integration of artificial intelligence and machine learning technologies is expected to enhance patient engagement and streamline care delivery. Additionally, the focus on social determinants of health will drive initiatives aimed at addressing health disparities, ultimately leading to improved health outcomes across diverse populations. The market is likely to witness continued growth as stakeholders prioritize innovative solutions to enhance population health management.

| Segment | Sub-Segments |

|---|---|

| By Type | Care Management Solutions Data Analytics Tools Patient Engagement Platforms Risk Stratification Solutions Population Health Data Management Telehealth Solutions Services (e.g., Consulting, Implementation, Post-Purchase Support) Others |

| By End-User | Healthcare Providers (Hospitals, Physician Groups, ACOs) Payers (Private Insurers, Medicaid, Medicare) Employers Government Agencies Patients Others |

| By Application | Chronic Disease Management Preventive Care & Wellness Behavioral & Mental Health Management Maternal and Child Health Medication Management Others |

| By Delivery Mode | On-Premise Solutions Cloud-Based Solutions Hybrid Solutions |

| By Region | Northeast Midwest South West |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| By Policy Support | Government Subsidies Tax Incentives Grants for Health IT |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Provider Organizations | 120 | Population Health Managers, Clinical Directors |

| Payer Organizations | 90 | Health Plan Executives, Policy Analysts |

| Technology Vendors in Population Health | 60 | Product Managers, Business Development Leads |

| Patient Advocacy Groups | 50 | Advocacy Directors, Community Outreach Coordinators |

| Public Health Agencies | 40 | Public Health Officials, Epidemiologists |

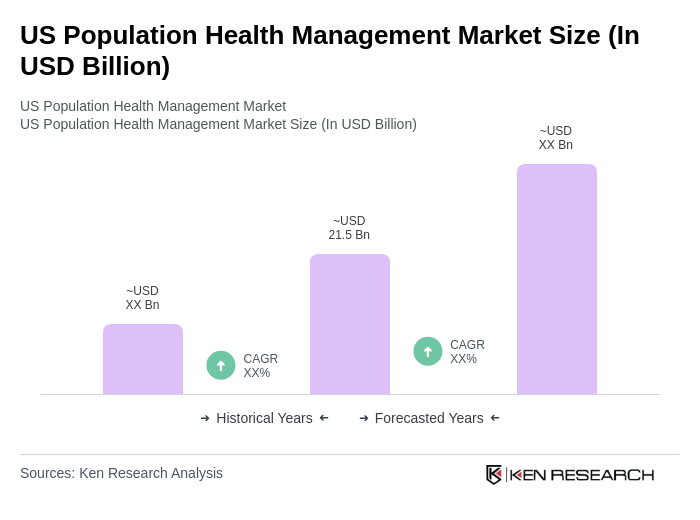

The US Population Health Management Market is valued at approximately USD 21.5 billion, reflecting a significant growth driven by the increasing prevalence of chronic diseases and the demand for value-based care solutions.