Region:North America

Author(s):Rebecca

Product Code:KRAA9396

Pages:85

Published On:November 2025

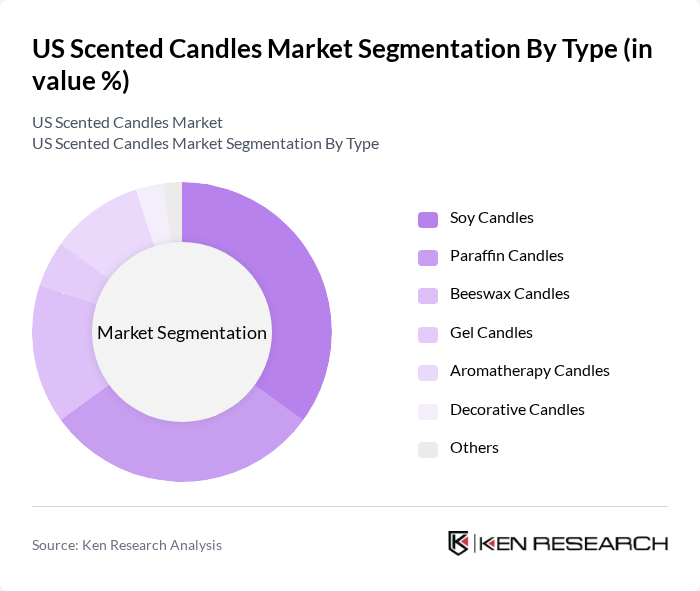

By Type:The scented candles market is segmented into soy candles, paraffin candles, beeswax candles, gel candles, aromatherapy candles, decorative candles, and others. Soy candles have gained significant popularity due to their eco-friendly nature and clean-burning properties. Consumers are increasingly opting for natural alternatives, leading to a rise in the demand for soy-based products. Paraffin candles, while still widely used, are facing competition from these greener options. Beeswax and aromatherapy candles are also experiencing growth, driven by wellness and therapeutic trends .

By Category:The market is also segmented by category into premium and mass market products. Premium candles are characterized by high-quality ingredients, unique scents, and attractive packaging, appealing to consumers seeking luxury items. The mass market segment caters to a broader audience with more affordable options. The premium category continues to experience robust growth, supported by consumer willingness to spend more on high-end products for enhanced home ambiance and wellness .

The US Scented Candles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yankee Candle Company, Bath & Body Works, WoodWick (Newell Brands), Village Candle, Chesapeake Bay Candle, Homesick Candles, Paddywax, Diptyque, Jo Malone London, Voluspa, Nest Fragrances, LAFCO New York, Aveda, Ecco Candle Company, Candle Warmers Etc., Boy Smells, Otherland, Capri Blue, Harlem Candle Co., Mrs. Meyer's Clean Day contribute to innovation, geographic expansion, and service delivery in this space.

The US scented candles market is poised for continued growth, driven by evolving consumer preferences and innovative product offerings. As the trend towards wellness and aromatherapy gains traction, manufacturers are likely to introduce more therapeutic scents. Additionally, the increasing focus on sustainability will push brands to develop eco-friendly products, aligning with consumer demand for environmentally responsible options. This dynamic environment presents opportunities for brands to differentiate themselves through unique offerings and enhanced customer experiences.

| Segment | Sub-Segments |

|---|---|

| By Type | Soy Candles Paraffin Candles Beeswax Candles Gel Candles Aromatherapy Candles Decorative Candles Others |

| By Category | Premium Mass Market |

| By End-User | Residential Commercial (Hotels, Restaurants, Spas) Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Convenience Stores Others |

| By Scent Type | Floral Fruity Spicy Fresh Blends Others |

| By Packaging Type | Glass Jars Tin Containers Votive Holders Pillar Candles Tea Light Candles Others |

| By Price Range | Premium Mid-range Budget Others |

| By Occasion | Seasonal Events Home Decor Gifting Wellness & Aromatherapy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Scented Candles | 120 | Homeowners, Apartment Dwellers |

| Retail Insights on Candle Sales | 60 | Store Managers, Merchandising Directors |

| Market Trends from Manufacturers | 50 | Product Managers, Marketing Executives |

| Distribution Channel Effectiveness | 40 | Logistics Coordinators, E-commerce Managers |

| Consumer Feedback on Fragrance Preferences | 80 | Fragrance Enthusiasts, Lifestyle Bloggers |

The US scented candles market is valued at approximately USD 2.4 billion, reflecting a growing consumer interest in home fragrances and wellness trends, alongside the rising popularity of scented candles as decorative items.