Region:Middle East

Author(s):Rebecca

Product Code:KRAE0948

Pages:93

Published On:December 2025

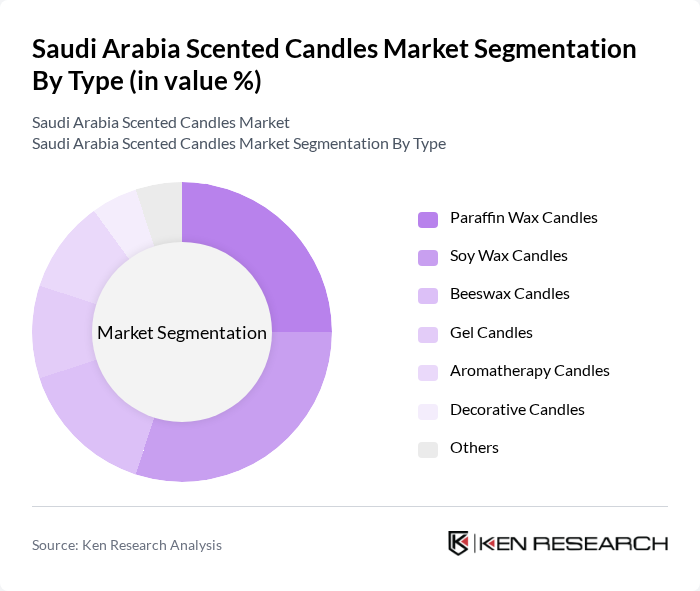

By Type:The scented candles market is segmented into various types, including paraffin wax candles, soy wax candles, beeswax candles, gel candles, aromatherapy candles, decorative candles, and others. Among these, soy wax candles are gaining popularity due to their eco-friendly nature and longer burn time, appealing to environmentally conscious consumers. Aromatherapy candles are also trending, driven by the growing interest in wellness and relaxation practices.

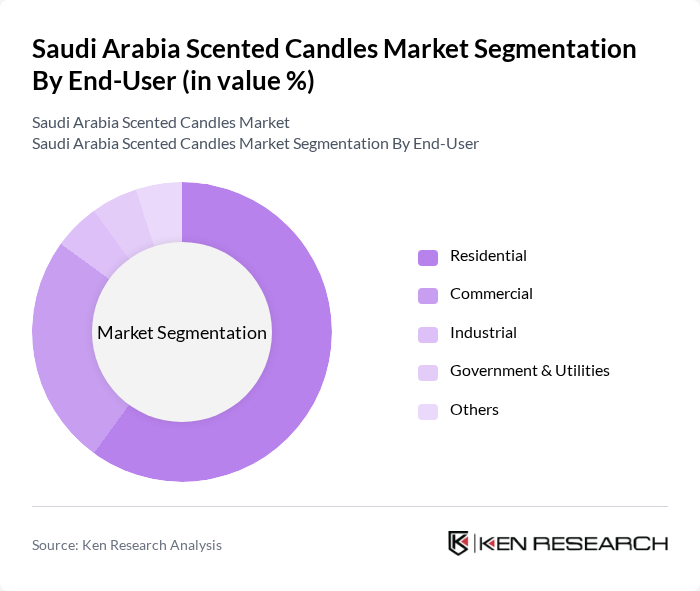

By End-User:The market is segmented by end-user into residential, commercial, industrial, government & utilities, and others. The residential segment dominates the market, driven by increasing consumer spending on home décor and personal wellness. The commercial segment is also significant, with hotels and restaurants using scented candles to enhance ambiance and customer experience.

The Saudi Arabia Scented Candles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Perfumes, Al Othaim Markets, Al Shaya Group, Home Centre, IKEA Saudi Arabia, Bath & Body Works, The Body Shop, L'Occitane en Provence, Diptyque, Jo Malone London, Yankee Candle, Woodwick Candles, Village Candle, Candle-Lite Company, and Scented Candle Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the scented candles market in Saudi Arabia appears promising, driven by evolving consumer preferences and a growing focus on wellness. As disposable incomes rise, consumers are likely to invest more in premium scented candles, enhancing their home environments. Additionally, the trend towards eco-friendly products will likely shape the market, with consumers increasingly seeking sustainable options. Innovations in product offerings and marketing strategies will be crucial for brands to capture the attention of a diverse consumer base in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Paraffin Wax Candles Soy Wax Candles Beeswax Candles Gel Candles Aromatherapy Candles Decorative Candles Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Convenience Stores Others |

| By Fragrance Type | Floral Fruity Spicy Fresh Others |

| By Packaging Type | Glass Containers Metal Containers Plastic Containers Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Occasion | Festivals Weddings Home Décor Gifting Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 150 | Store Managers, Retail Buyers |

| Consumer Preferences | 200 | General Consumers, Home Decor Enthusiasts |

| Distribution Channel Analysis | 100 | Wholesalers, Distributors |

| Market Trends and Innovations | 80 | Product Development Managers, Marketing Executives |

| Brand Perception Studies | 120 | Brand Managers, Advertising Professionals |

The Saudi Arabia Scented Candles Market is valued at approximately USD 125 million, driven by increasing consumer interest in home décor, wellness, and aromatherapy, alongside a growing preference for premium and eco-friendly products.