US Specialty Fuel Additives Industry Market Overview

- The US Specialty Fuel Additives Industry Market is valued at USD 2.5 billion, based on a five?year historical analysis. This growth is primarily driven by the increasing demand for high-performance fuels, stringent environmental regulations, and the need for improved fuel efficiency in vehicles. The market is also influenced by the rising adoption of biofuels and the growing automotive sector, which necessitates the use of specialized additives to enhance fuel properties. Advanced additive technologies are being developed to address challenges such as engine deposit formation, fuel degradation during storage, and cold weather operability, while also helping manufacturers meet evolving emissions standards.

- The United States, particularly states like Texas and California, dominates the market due to their extensive oil and gas industries, advanced technological capabilities, and significant investments in research and development. Additionally, the presence of major fuel additive manufacturers in these regions contributes to their market leadership, as they are able to innovate and meet the evolving demands of consumers and regulatory bodies. The robust transportation infrastructure and large-scale petroleum refining operations in these states further support the widespread adoption of specialty fuel additives across various fuel types including gasoline, diesel, and aviation fuel.

- The EPA Tier 3 Vehicle Emission and Fuel Standards, finalized in 2014 and implemented in phases through 2025, established stringent sulfur limits for gasoline (reducing from 30 ppm to 10 ppm) and tighter vehicle emissions standards. These regulations require fuel suppliers and refiners to utilize specialized fuel additives that enhance combustion efficiency, reduce harmful emissions including nitrogen oxides and particulate matter, and maintain fuel stability throughout the distribution chain. Compliance with these standards is essential for market participants, as it directly affects product formulation, refinery operations, and competitive positioning in the marketplace. The standards also drive innovation in additive technology to help achieve cleaner combustion while maintaining engine performance and fuel economy.

US Specialty Fuel Additives Industry Market Segmentation

By Additive Type:The market is segmented into various additive types, including Deposit Control Additives, Cetane Improvers, Antioxidants, Lubricity Improvers, Cold Flow Improvers, Corrosion Inhibitors, and Others. Among these, Deposit Control Additives are leading the market due to their essential role in maintaining engine cleanliness and performance. The increasing focus on fuel efficiency and engine longevity drives the demand for these additives, as they help prevent deposit formation in fuel systems. These additives work by preventing the accumulation of carbon deposits on fuel injectors, intake valves, and combustion chambers, which can impair engine performance, reduce fuel economy, and increase emissions over time.

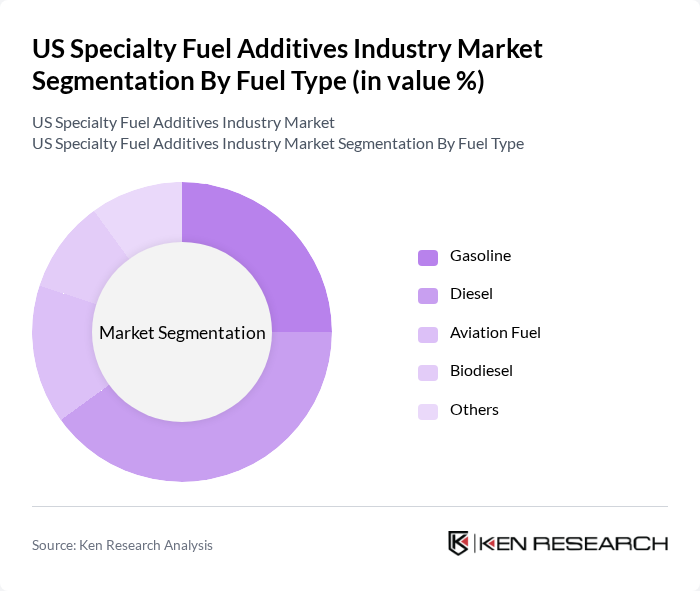

By Fuel Type:The market is categorized into Gasoline, Diesel, Aviation Fuel, Biodiesel, and Others. Diesel fuel is the dominant segment, primarily due to its widespread use in commercial transportation and heavy-duty vehicles. The increasing demand for diesel engines, which require specific additives to enhance performance and reduce emissions, further solidifies this segment's leadership in the market. Diesel fuel additives address multiple operational challenges including improving cetane number for better ignition quality, enhancing lubricity to protect fuel injection systems (especially critical with ultra-low sulfur diesel), preventing wax crystal formation in cold temperatures, and reducing particulate emissions to meet stringent environmental standards.

US Specialty Fuel Additives Industry Market Competitive Landscape

The US Specialty Fuel Additives Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as NewMarket Corporation, Innospec Inc., BASF SE, Infineum International Limited, The Lubrizol Corporation, Chevron Oronite Company LLC, Afton Chemical Corporation, Baker Hughes Company, Albemarle Corporation, TotalEnergies SE, Dow Inc., Evonik Industries AG, Clariant AG, Dorf Ketal Chemicals LLC, NALCO Champion (An Ecolab Company) contribute to innovation, geographic expansion, and service delivery in this space.

US Specialty Fuel Additives Industry Market Industry Analysis

Growth Drivers

- Increasing Demand for High-Performance Fuels:The US specialty fuel additives market is driven by a growing demand for high-performance fuels, which are projected to reach a consumption level of 210 billion gallons in future. This demand is fueled by the automotive sector's shift towards more efficient engines, with the average fuel economy of new vehicles expected to improve to 27 miles per gallon. Consequently, fuel additives that enhance performance and efficiency are increasingly sought after by manufacturers and consumers alike.

- Stringent Environmental Regulations:The implementation of stringent environmental regulations, such as the Clean Air Act, has led to a significant increase in the demand for specialty fuel additives. In future, compliance costs for fuel manufacturers are expected to exceed $6 billion, driving the need for additives that reduce emissions and improve fuel quality. This regulatory landscape compels manufacturers to innovate and adopt advanced formulations that meet these environmental standards, thereby boosting the specialty fuel additives market.

- Technological Advancements in Fuel Formulations:Technological advancements in fuel formulations are a key growth driver for the specialty fuel additives market. In future, R&D investments in this sector are projected to reach $1.5 billion, focusing on developing new additives that enhance fuel stability and performance. Innovations such as nano-additives and multifunctional formulations are gaining traction, enabling manufacturers to offer products that meet the evolving needs of consumers and regulatory requirements, thus propelling market growth.

Market Challenges

- Fluctuating Raw Material Prices:The specialty fuel additives market faces challenges due to fluctuating raw material prices, which can significantly impact production costs. In future, the price of key raw materials, such as ethanol and various hydrocarbons, is expected to vary by up to 20%, creating uncertainty for manufacturers. This volatility can lead to increased operational costs and affect pricing strategies, ultimately impacting profit margins and market competitiveness.

- Competition from Alternative Fuels:The rise of alternative fuels, such as electric and hydrogen-powered vehicles, poses a significant challenge to the specialty fuel additives market. In future, the market share of alternative fuels is projected to reach 12% of total fuel consumption in the US, driven by consumer preferences for sustainable options. This shift may reduce the demand for traditional fuels and, consequently, the additives that enhance their performance, creating a competitive landscape for manufacturers.

US Specialty Fuel Additives Industry Market Future Outlook

The future of the US specialty fuel additives market appears promising, driven by ongoing innovations and a shift towards sustainable solutions. As environmental regulations tighten, manufacturers are likely to invest more in R&D, focusing on bio-based and eco-friendly additives. Additionally, the growth of e-commerce platforms is expected to enhance product accessibility, allowing consumers to easily obtain high-performance fuel additives. These trends indicate a dynamic market landscape that will adapt to changing consumer preferences and regulatory demands in the coming years.

Market Opportunities

- Expansion into Emerging Markets:The specialty fuel additives market has significant opportunities for expansion into emerging markets, particularly in Asia-Pacific, where fuel consumption is projected to grow by 5% annually. This growth presents a lucrative avenue for manufacturers to introduce their products, catering to the increasing demand for high-quality fuels in developing economies.

- Development of Bio-Based Additives:The development of bio-based additives represents a substantial market opportunity, as consumer awareness of sustainability rises. In future, the bio-based additives segment is expected to grow by 25%, driven by demand for environmentally friendly products. Manufacturers can capitalize on this trend by investing in research to create innovative bio-based formulations that meet regulatory standards and consumer preferences.