US Superfood Market Overview

- The US Superfood Market is valued at USD 25 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness of health and wellness, along with a rising demand for nutrient-dense foods. The trend towards organic, plant-based, and clean-label products has significantly contributed to the market's expansion, as consumers seek alternatives to processed foods and prioritize functional health benefits. The US market is further propelled by the popularity of superfoods in applications such as smoothies, supplements, and ready-to-eat meals, reflecting a broader shift toward preventive health and wellness lifestyles .

- Key players in this market include California, New York, and Texas, which dominate due to their large populations and health-conscious consumer bases. These states have seen a surge in health food stores, organic markets, and wellness-focused restaurants, making them hotspots for superfood consumption and innovation. The presence of major metropolitan areas and a high concentration of millennials and Gen Z consumers further accelerates superfood adoption in these regions .

- The Food Safety Modernization Act (FSMA), enacted by the US Food and Drug Administration in 2011, remains the primary regulatory framework governing food safety in the US. The FSMA emphasizes preventive controls for food safety, requiring food producers, including those in the superfood sector, to implement hazard analysis and risk-based preventive controls (HARPC), maintain detailed records, and comply with supply chain program requirements. The regulation aims to ensure that all food products, including superfoods, meet stringent safety standards, thereby enhancing consumer trust and promoting healthier food options in the market. (Food Safety Modernization Act, US FDA, 2011) .

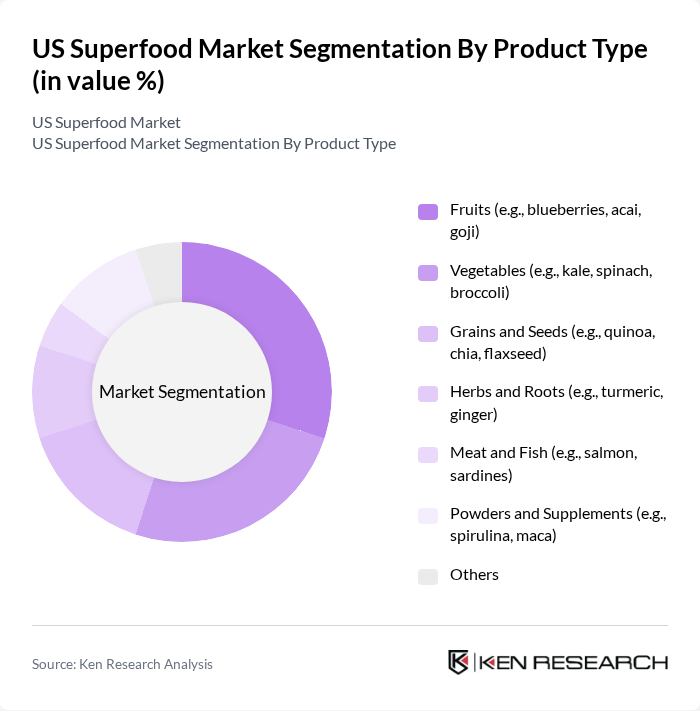

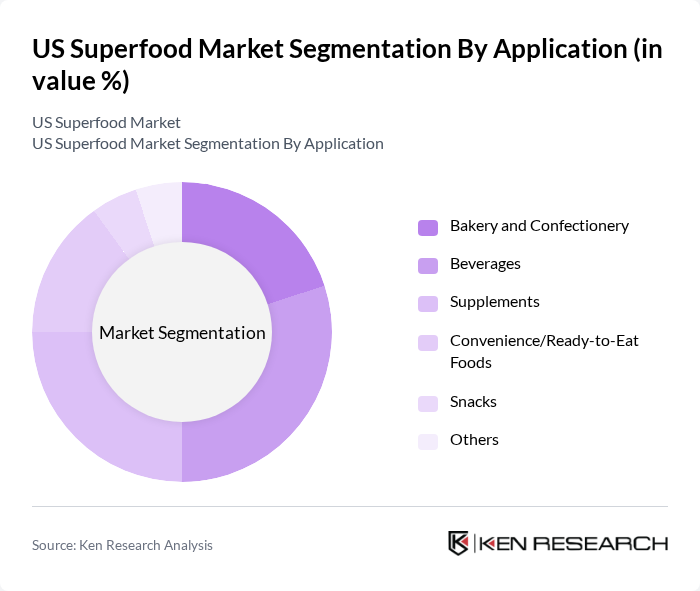

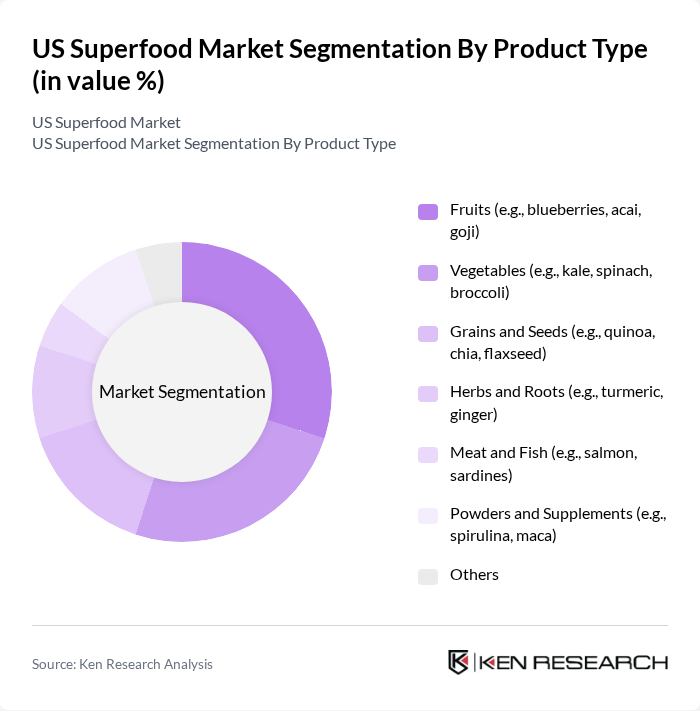

US Superfood Market Segmentation

By Product Type:The product type segmentation includes various categories such as fruits, vegetables, grains and seeds, herbs and roots, meat and fish, powders and supplements, and others. Each of these subsegments caters to different consumer preferences and dietary needs, with fruits and vegetables being particularly popular due to their perceived health benefits and high antioxidant content. The demand for grains and seeds, such as chia and quinoa, is also rising as consumers seek plant-based protein and fiber sources. Powders and supplements are gaining traction for their convenience and concentrated nutritional value .

By Application:The application segmentation includes bakery and confectionery, beverages, supplements, convenience/ready-to-eat foods, snacks, and others. Each application area reflects consumer trends towards healthier eating habits, with supplements and beverages gaining significant traction as consumers seek convenient ways to incorporate superfoods into their diets. The beverage segment, including smoothies and functional drinks, is particularly robust, while supplements are favored for targeted nutrition and wellness benefits .

US Superfood Market Competitive Landscape

The US Superfood Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., General Mills, Inc., The Kraft Heinz Company, Danone S.A., Unilever PLC, Chobani, LLC, Nature's Way Products, LLC, Garden of Life, LLC, Sunfood Superfoods, LLC, Navitas Organics, LLC, Superfoods Company, Inc., Amazing Grass, LLC, Health Warrior, Inc., Vital Proteins, LLC, Orgain, Inc., Nutiva, Inc., Manitoba Harvest Hemp Foods, Sambazon, Inc., Terrasoul Superfoods, Amazing Foods, LLC contribute to innovation, geographic expansion, and service delivery in this space.

US Superfood Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The US population is increasingly prioritizing health, with 75% of adults actively seeking healthier food options. This trend is supported by the CDC, which reported that 42.4% of adults were classified as obese in 2020, prompting a shift towards nutrient-dense superfoods. The demand for products rich in antioxidants, vitamins, and minerals is expected to rise, as consumers become more aware of the long-term benefits of a balanced diet, driving superfood sales significantly.

- Rising Demand for Organic Products:The organic food market in the US reached $61.7 billion in future, with superfoods being a significant contributor. According to the USDA, organic food sales have grown by 12% annually, reflecting a consumer preference for products free from synthetic pesticides and fertilizers. This trend is expected to continue, as 60% of consumers express a willingness to pay more for organic superfoods, further propelling market growth and innovation in this sector.

- Expansion of E-commerce Platforms:E-commerce sales of food and beverages in the US reached $109 billion in future, with superfoods accounting for a growing share. The convenience of online shopping has led to a 35% increase in superfood purchases through digital channels. As more consumers turn to online platforms for grocery shopping, companies are investing in digital marketing and distribution strategies, enhancing accessibility and driving sales growth in the superfood market.

Market Challenges

- High Competition:The US superfood market is characterized by intense competition, with over 1,200 brands vying for consumer attention. This saturation leads to price wars and reduced profit margins, as companies strive to differentiate their products. According to IBISWorld, the industry’s market share concentration is low, indicating a fragmented landscape where new entrants can disrupt established players, making it challenging for brands to maintain market share and profitability.

- Regulatory Compliance Costs:Compliance with FDA regulations and organic certification standards can impose significant costs on superfood companies. The FDA's guidelines on health claims require extensive scientific evidence, which can cost upwards of $100,000 per claim. Additionally, obtaining organic certification can take several years and cost between $7,500 to $12,500 annually. These financial burdens can hinder smaller companies from entering the market or expanding their product lines, limiting overall industry growth.

US Superfood Market Future Outlook

The US superfood market is poised for continued growth, driven by evolving consumer preferences towards health and wellness. As the trend of personalized nutrition gains traction, companies are likely to innovate by offering tailored superfood products that meet specific dietary needs. Furthermore, the increasing focus on sustainability will push brands to adopt eco-friendly practices, including sustainable sourcing and packaging, aligning with consumer values and enhancing brand loyalty in the competitive landscape.

Market Opportunities

- Growth in Plant-Based Diets:The plant-based food market is projected to reach $74 billion in future, creating significant opportunities for superfood brands. As more consumers adopt vegetarian and vegan diets, the demand for plant-based superfoods, such as spirulina and chia seeds, is expected to rise. This shift presents a lucrative avenue for companies to develop innovative products that cater to this growing demographic.

- Collaborations with Health Professionals:Partnerships with nutritionists and dietitians can enhance brand credibility and consumer trust. Research indicates that 65% of consumers are influenced by health professionals when making dietary choices. By collaborating with experts to promote superfood benefits, companies can effectively reach target audiences, driving sales and fostering long-term customer relationships in the health-conscious market.