Region:North America

Author(s):Dev

Product Code:KRAD5271

Pages:87

Published On:December 2025

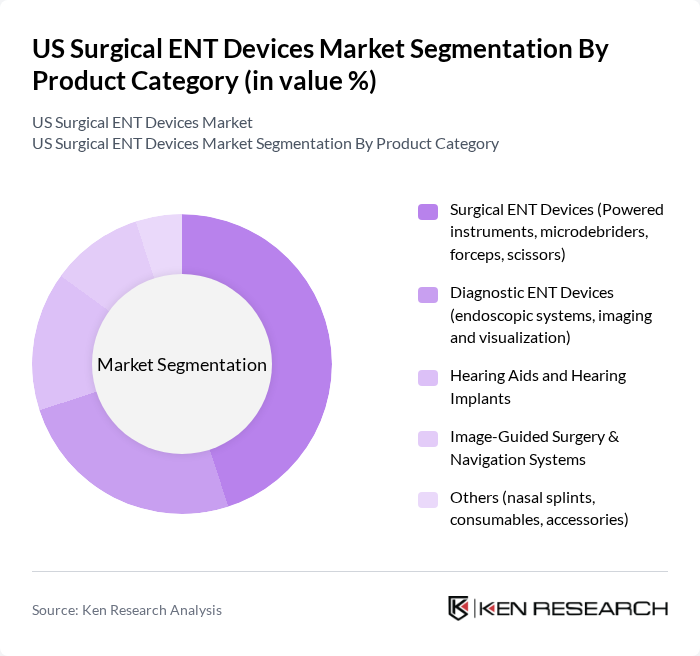

By Product Category:The product category segmentation includes various subsegments such as Surgical ENT Devices, Diagnostic ENT Devices, Hearing Aids and Hearing Implants, Image-Guided Surgery & Navigation Systems, and Others. Among these, Surgical ENT Devices, which encompass powered instruments, microdebriders, forceps, scissors, balloon sinus dilation systems, and radiofrequency/laser-based tools, dominate the market due to their essential role in performing complex procedures for sinus, skull base, otologic, and laryngologic indications. The increasing demand for minimally invasive endoscopic sinus and skull base surgeries, office-based procedures, and technologically advanced instrumentation (including ergonomic powered systems and disposable blades) contributes to the growth of this subsegment.

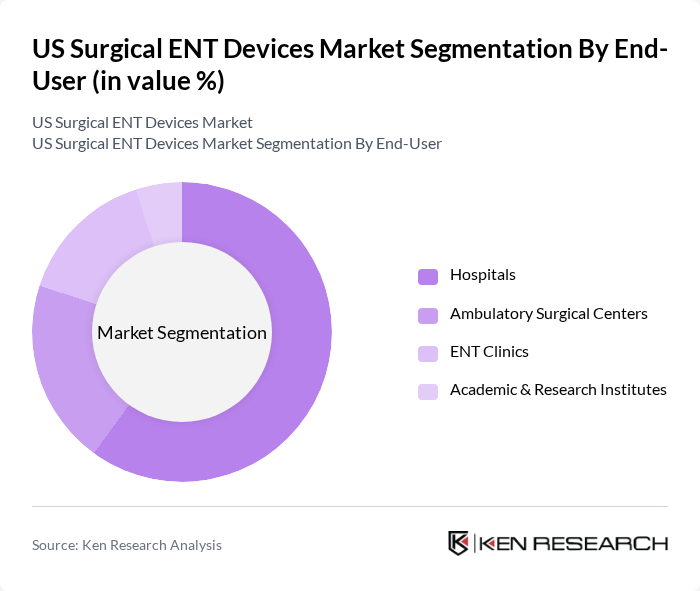

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, ENT Clinics, and Academic & Research Institutes. Hospitals are the leading end-user segment, accounting for a significant share of the market, supported by the high volume of complex ENT surgeries (such as functional endoscopic sinus surgery, head and neck oncology procedures, and cochlear implantation) and the availability of hybrid operating rooms, navigation platforms, and multidisciplinary teams. The trend towards outpatient and same-day surgery is contributing to the growth of Ambulatory Surgical Centers and specialized ENT clinics, particularly for less invasive sinus, tonsil, and office-based procedures, where efficiency, shorter recovery, and lower facility costs are key purchasing drivers.

The US Surgical ENT Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Johnson & Johnson (DePuy Synthes / Ethicon), Stryker Corporation, Olympus Corporation, Karl Storz SE & Co. KG, Smith & Nephew plc, Cochlear Limited, Hologic, Inc. (including ENT-related surgical solutions), CONMED Corporation, Richard Wolf GmbH, Acclarent, Inc. (a Johnson & Johnson company), Intersect ENT, Inc. (a Medtronic company), Xoran Technologies, LLC, Aesculap, Inc. (a B. Braun company), Ambu A/S contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. surgical ENT devices market appears promising, driven by ongoing technological advancements and an increasing focus on patient-centric care. The integration of digital technologies, such as artificial intelligence and telemedicine, is expected to enhance surgical precision and improve patient outcomes in future. Furthermore, the shift towards outpatient procedures is likely to streamline healthcare delivery, making surgeries more accessible. As these trends evolve, they will shape the landscape of surgical ENT devices, fostering innovation and improving patient care.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Surgical ENT Devices (Powered instruments, microdebriders, forceps, scissors) Diagnostic ENT Devices (endoscopic systems, imaging and visualization) Hearing Aids and Hearing Implants Image-Guided Surgery & Navigation Systems Others (nasal splints, consumables, accessories) |

| By End-User | Hospitals Ambulatory Surgical Centers ENT Clinics Academic & Research Institutes |

| By Surgical Application | Functional Endoscopic Sinus Surgery (FESS) & Rhinology Otologic & Neurotologic Surgery (middle ear, cochlear, stapes, skull base) Laryngology & Head and Neck Surgery Sleep & Airway Surgery (OSA, snoring, airway reconstruction) Pediatric ENT Surgery |

| By Technology | Endoscopic & Microscopic Surgical Systems Robotic-Assisted & Powered Surgical Systems Laser & Radiofrequency Ablation Systems Image-Guided & Navigation Systems Others |

| By Distribution Channel | Direct Sales to Hospitals and IDNs Medical Device Distributors Group Purchasing Organizations (GPOs) Online and E-procurement Platforms |

| By Region | Northeast Midwest South West |

| By Patient Demographics | Pediatric Adult Geriatric Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| ENT Surgeons | 120 | Otolaryngologists, Surgical Specialists |

| Hospital Procurement Managers | 100 | Purchasing Directors, Supply Chain Managers |

| Medical Device Sales Representatives | 80 | Sales Managers, Territory Representatives |

| Healthcare Administrators | 70 | Hospital Administrators, Policy Makers |

| Clinical Researchers | 60 | Research Scientists, Clinical Trial Coordinators |

The US Surgical ENT Devices Market is valued at approximately USD 8.6 billion, reflecting a significant share of the broader ENT devices market, driven by the increasing prevalence of ENT disorders and advancements in surgical technologies.