Region:North America

Author(s):Geetanshi

Product Code:KRAB5170

Pages:95

Published On:October 2025

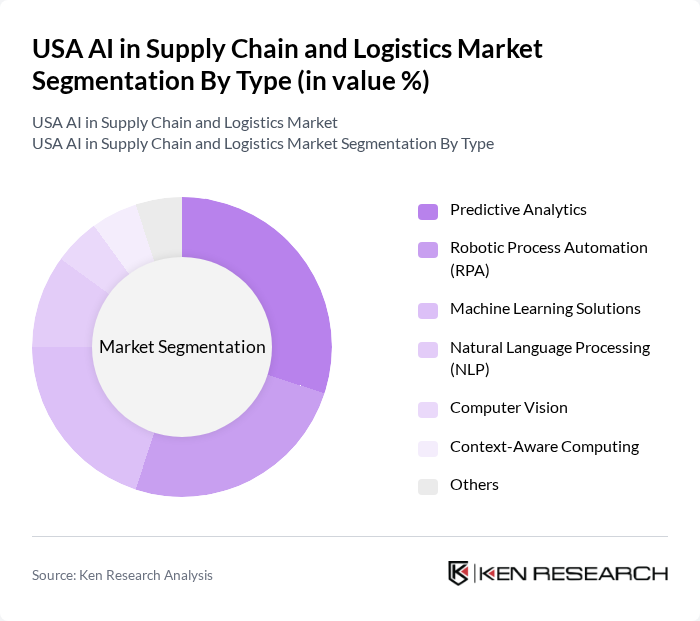

By Type:The market is segmented into various types, including Predictive Analytics, Robotic Process Automation (RPA), Machine Learning Solutions, Natural Language Processing (NLP), Computer Vision, Context-Aware Computing, and Others. Among these,Predictive Analyticsleads due to its ability to forecast demand, optimize inventory levels, and enable proactive decision-making. The growing reliance on data-driven insights is accelerating the adoption of predictive analytics, while RPA and machine learning are also gaining traction for automating repetitive tasks and enhancing supply chain agility .

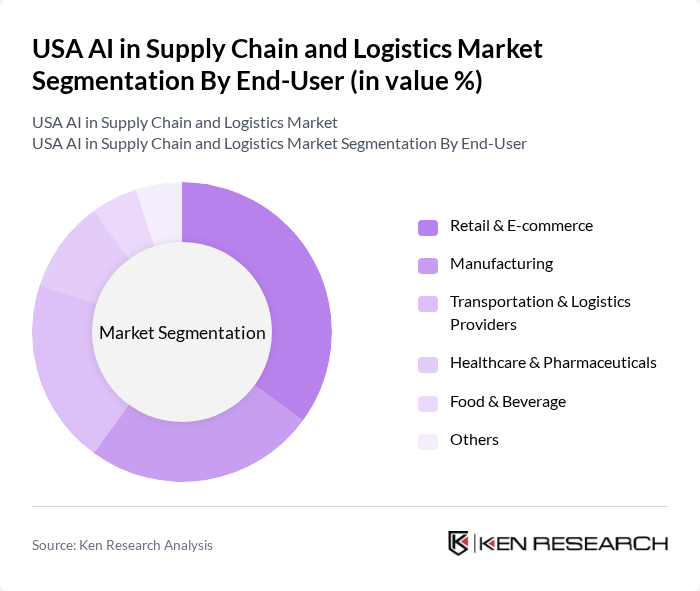

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Transportation & Logistics Providers, Healthcare & Pharmaceuticals, Food & Beverage, and Others. TheRetail & E-commercesector is the dominant segment, driven by the need for efficient inventory management, real-time order tracking, and enhanced customer experiences. The surge in online shopping and omnichannel fulfillment has accelerated AI adoption in this segment, while manufacturing and logistics providers are also investing in AI for process optimization and risk mitigation .

The USA AI in Supply Chain and Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Oracle Corporation, SAP SE, Microsoft Corporation, Blue Yonder (formerly JDA Software), Kinaxis Inc., Llamasoft (an IBM Company), ClearMetal (a Project44 Company), Project44, FourKites, C3.ai, Zebra Technologies, Honeywell International Inc., Amazon Web Services (AWS), Google Cloud, Manhattan Associates, Descartes Systems Group, FedEx Corporation (AI Logistics Solutions), UPS Supply Chain Solutions, and Flexport contribute to innovation, geographic expansion, and service delivery in this space .

The future of AI in the USA supply chain and logistics market appears promising, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt AI solutions, the focus will shift towards enhancing operational efficiency and sustainability. Innovations in autonomous delivery systems and real-time data analytics are expected to reshape logistics strategies. Furthermore, the integration of AI with IoT technologies will facilitate smarter supply chain management, enabling businesses to respond swiftly to market changes and consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Robotic Process Automation (RPA) Machine Learning Solutions Natural Language Processing (NLP) Computer Vision Context-Aware Computing Others |

| By End-User | Retail & E-commerce Manufacturing Transportation & Logistics Providers Healthcare & Pharmaceuticals Food & Beverage Others |

| By Application | Inventory & Warehouse Management Demand Forecasting Route & Fleet Optimization Supply Chain Planning Order Fulfillment & Last-Mile Delivery Risk Management & Anomaly Detection Customer Service (Chatbots, Virtual Assistants) Others |

| By Component | Software Hardware Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | B2B B2C |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Optimization | 120 | Supply Chain Managers, IT Directors |

| Manufacturing AI Integration | 90 | Operations Managers, Production Supervisors |

| Healthcare Logistics Innovations | 60 | Logistics Coordinators, Compliance Officers |

| Transportation Management Systems | 50 | Fleet Managers, Data Analysts |

| Warehouse Automation Solutions | 70 | Warehouse Managers, Technology Officers |

The USA AI in Supply Chain and Logistics Market is valued at approximately USD 6 billion, driven by the increasing adoption of AI technologies aimed at enhancing operational efficiency, reducing costs, and improving customer service across various sectors.