Region:North America

Author(s):Rebecca

Product Code:KRAB4160

Pages:98

Published On:October 2025

Market.png)

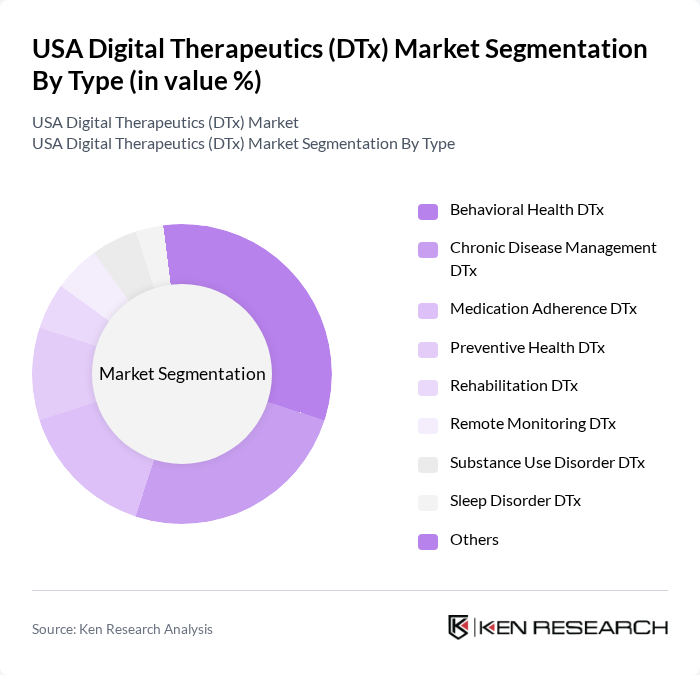

By Type:The Digital Therapeutics market is segmented into various types, including Behavioral Health DTx, Chronic Disease Management DTx, Medication Adherence DTx, Preventive Health DTx, Rehabilitation DTx, Remote Monitoring DTx, Substance Use Disorder DTx, Sleep Disorder DTx, and Others. Among these, Behavioral Health DTx is currently the leading sub-segment, driven by the increasing awareness of mental health issues and the growing demand for accessible mental health solutions. The rise in anxiety and depression cases, particularly post-pandemic, has led to a surge in the adoption of digital solutions that provide therapy and support for mental health conditions.

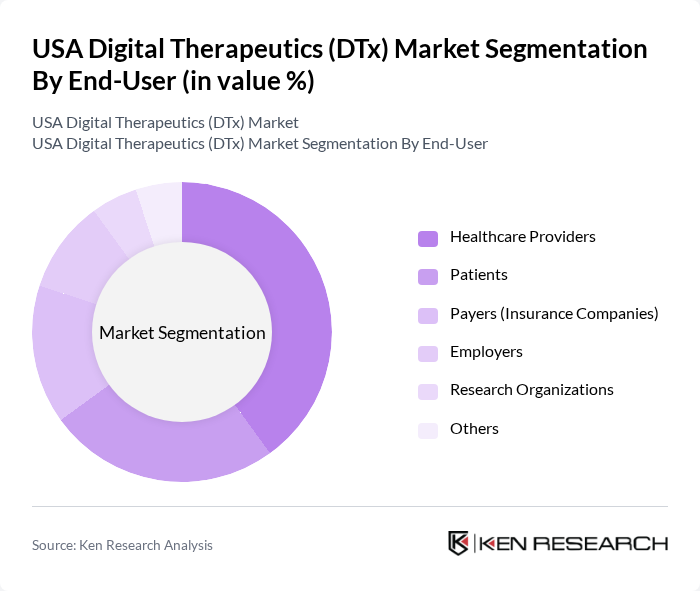

By End-User:The market is also segmented by end-users, which include Healthcare Providers, Patients, Payers (Insurance Companies), Employers, Research Organizations, and Others. Healthcare Providers are the dominant end-user segment, as they are increasingly adopting digital therapeutics to enhance patient care and improve treatment outcomes. The integration of DTx into clinical workflows allows providers to offer personalized treatment plans and monitor patient progress effectively, leading to better health management.

The USA Digital Therapeutics (DTx) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omada Health, Pear Therapeutics, Welldoc, Akili Interactive, DarioHealth, Happify Health, SilverCloud Health, mySugr, Livongo Health (Teladoc Health), Click Therapeutics, Biofourmis, Headspace Health, Woebot Health, BetterHelp, Big Health, Propeller Health (ResMed), Noom, 2Morrow, Limbix Health, and Canary Health contribute to innovation, geographic expansion, and service delivery in this space.

The USA Digital Therapeutics market is poised for significant evolution, driven by technological advancements and changing healthcare paradigms. As the focus shifts towards preventive healthcare, digital therapeutics will play a crucial role in early intervention strategies. Additionally, the integration of artificial intelligence and machine learning will enhance the personalization of treatment plans, improving patient engagement. The collaboration between tech companies and healthcare providers will further streamline the adoption of DTx solutions, ensuring they become integral to patient care in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Behavioral Health DTx Chronic Disease Management DTx Medication Adherence DTx Preventive Health DTx Rehabilitation DTx Remote Monitoring DTx Substance Use Disorder DTx Sleep Disorder DTx Others |

| By End-User | Healthcare Providers Patients Payers (Insurance Companies) Employers Research Organizations Others |

| By Application | Diabetes Management Mental Health (Depression, Anxiety, PTSD) Cardiovascular Health (Hypertension, Heart Failure) Respiratory Health (Asthma, COPD) Obesity & Weight Management Substance Use Disorder Sleep Disorders Others |

| By Distribution Channel | Direct Sales (B2B) Online Platforms (B2C) Partnerships with Healthcare Institutions Pharmacies Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Bundled with Employer/Insurer Plans Others |

| By Technology | Mobile Applications Wearable Devices Cloud-Based Solutions AI-Driven Platforms Others |

| By Regulatory Approval Status | FDA Approved Prescription Digital Therapeutics (PDTx) CE Marked Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers Using DTx | 100 | Physicians, Nurse Practitioners, Therapists |

| Patients Engaged with Digital Therapeutics | 90 | Chronic Disease Patients, Mental Health Patients |

| Payers and Insurers | 50 | Health Insurance Executives, Policy Analysts |

| Technology Developers in DTx | 40 | Product Managers, R&D Directors |

| Regulatory Experts in Digital Health | 40 | Compliance Officers, Regulatory Affairs Specialists |

The USA Digital Therapeutics (DTx) Market is valued at approximately USD 3.0 billion, reflecting significant growth driven by the rising prevalence of chronic diseases, increasing healthcare costs, and the acceptance of digital health solutions among patients and providers.