Region:North America

Author(s):Geetanshi

Product Code:KRAB5188

Pages:89

Published On:October 2025

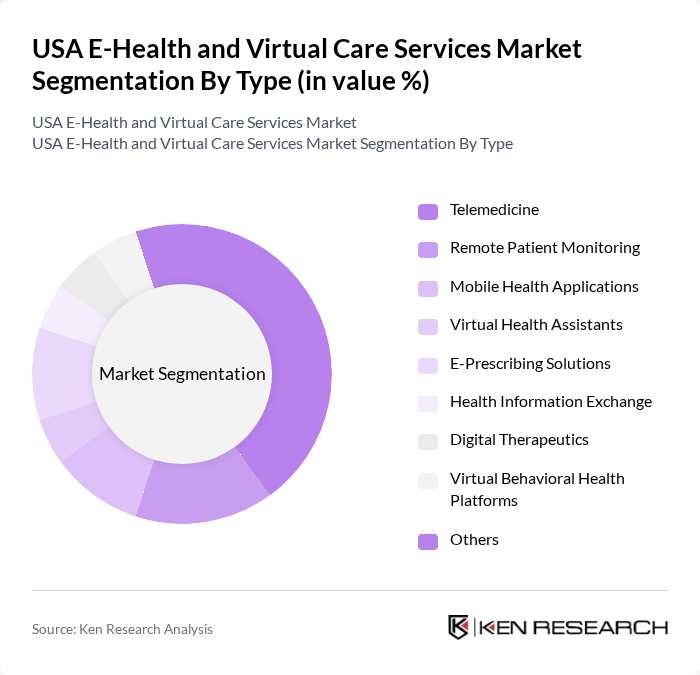

By Type:The market is segmented into various types of e-health and virtual care services, including Telemedicine, Remote Patient Monitoring, Mobile Health Applications, Virtual Health Assistants, E-Prescribing Solutions, Health Information Exchange, Digital Therapeutics, Virtual Behavioral Health Platforms, and Others. Among these,Telemedicineis the leading sub-segment, driven by its ability to provide immediate access to healthcare professionals and reduce the need for in-person visits. The increasing acceptance of telehealth services by both patients and providers, as well as the integration of AI-powered platforms and digital therapeutics, has significantly contributed to its dominance .

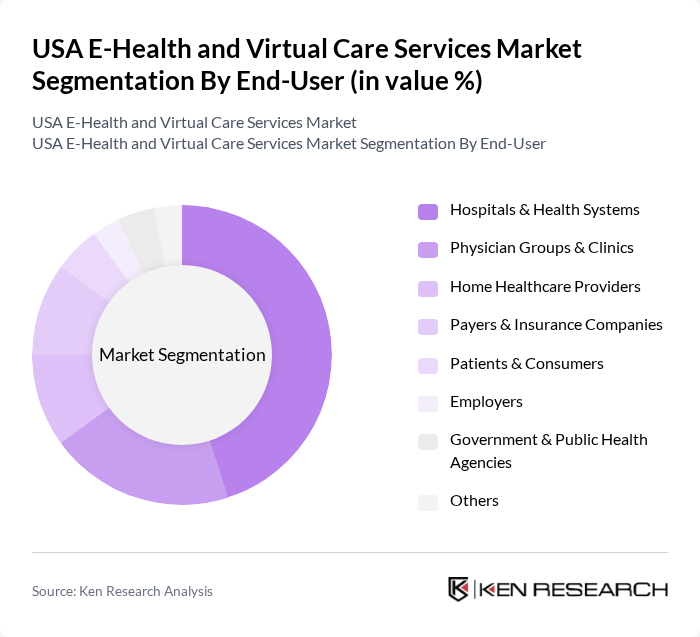

By End-User:The end-user segmentation includes Hospitals & Health Systems, Physician Groups & Clinics, Home Healthcare Providers, Payers & Insurance Companies, Patients & Consumers, Employers, Government & Public Health Agencies, and Others.Hospitals & Health Systemsare the dominant end-users, as they are increasingly integrating e-health solutions to enhance patient care, streamline operations, and improve health outcomes. The growing trend of value-based care, combined with the need for operational efficiency and improved patient engagement, is driving hospitals to adopt these technologies .

The USA E-Health and Virtual Care Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teladoc Health, Inc., Amwell (American Well Corporation), MDLIVE, Inc., Doxy.me, Doctor On Demand (now Included Health), Zocdoc, Inc., HealthTap, Inc., PlushCare, Inc., eVisit, Inc., SimplePractice, LLC, Luma Health, Inc., MyTelemedicine, Inc., Talkspace, Inc., BetterHelp (a subsidiary of Teladoc Health), Medici Technologies, LLC, CVS Health (MinuteClinic Virtual Care), Walgreens Boots Alliance (Walgreens Virtual Care), Walmart Health Virtual Care, One Medical (an Amazon company), Optum (a UnitedHealth Group company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA e-health and virtual care services market appears promising, driven by technological advancements and changing consumer preferences. As the healthcare landscape shifts towards value-based care, providers are increasingly adopting integrated solutions that enhance patient outcomes. Furthermore, the expansion of telehealth services is expected to continue, supported by favorable reimbursement policies and increased investment in health IT infrastructure, fostering innovation and accessibility in healthcare delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Telemedicine Remote Patient Monitoring Mobile Health Applications Virtual Health Assistants E-Prescribing Solutions Health Information Exchange Digital Therapeutics Virtual Behavioral Health Platforms Others |

| By End-User | Hospitals & Health Systems Physician Groups & Clinics Home Healthcare Providers Payers & Insurance Companies Patients & Consumers Employers Government & Public Health Agencies Others |

| By Application | Chronic Disease Management Mental & Behavioral Health Services Preventive & Wellness Care Emergency & Urgent Care Rehabilitation & Post-Acute Care Women’s Health Pediatrics Others |

| By Distribution Channel | Direct Sales (B2B) Online Platforms (B2C) Third-Party Distributors Partnerships with Healthcare Providers Employer Benefit Programs Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Bundled Services Freemium Models Value-Based Pricing Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions Mobile Technologies AI & Machine Learning Platforms Wearable & IoT Devices Others |

| By User Demographics | Age Groups Gender Socioeconomic Status Geographic Location Digital Literacy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telehealth Service Providers | 100 | Healthcare Administrators, Telehealth Coordinators |

| Patients Using Virtual Care | 120 | Patients aged 18-65, Recent users of telehealth services |

| Healthcare Technology Developers | 60 | Product Managers, Software Engineers in e-health |

| Insurance Providers Offering Telehealth Coverage | 40 | Policy Analysts, Claims Managers |

| Regulatory Bodies and Health Policy Experts | 40 | Health Policy Advisors, Regulatory Affairs Specialists |

The USA E-Health and Virtual Care Services Market is valued at approximately USD 79 billion, reflecting significant growth driven by the adoption of telehealth services and digital health platforms, particularly accelerated by the COVID-19 pandemic.