Region:North America

Author(s):Geetanshi

Product Code:KRAA0250

Pages:98

Published On:August 2025

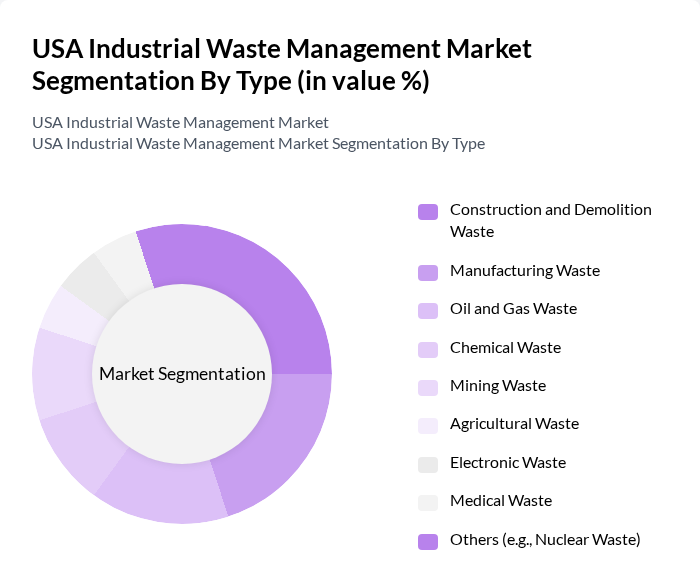

By Type:The market is segmented into various types of industrial waste, including Construction and Demolition Waste, Manufacturing Waste, Oil and Gas Waste, Chemical Waste, Mining Waste, Agricultural Waste, Electronic Waste, Medical Waste, and Others (e.g., Nuclear Waste). Each sub-segment plays a crucial role in the overall waste management landscape, with specific characteristics and disposal requirements. Construction and demolition waste and manufacturing waste are the largest contributors, with significant volumes also arising from oil and gas, chemical, and mining activities. Electronic and medical waste, while smaller in volume, require specialized handling due to their hazardous nature .

The Construction and Demolition Waste segment is currently dominating the market due to the rapid growth in the construction industry and urban development projects. This segment is characterized by a high volume of waste generated from building activities, which necessitates efficient waste management solutions. The increasing focus on sustainable construction practices and recycling of materials is further driving the demand for effective management of construction and demolition waste. As cities expand and infrastructure projects proliferate, this segment is expected to maintain its leadership position .

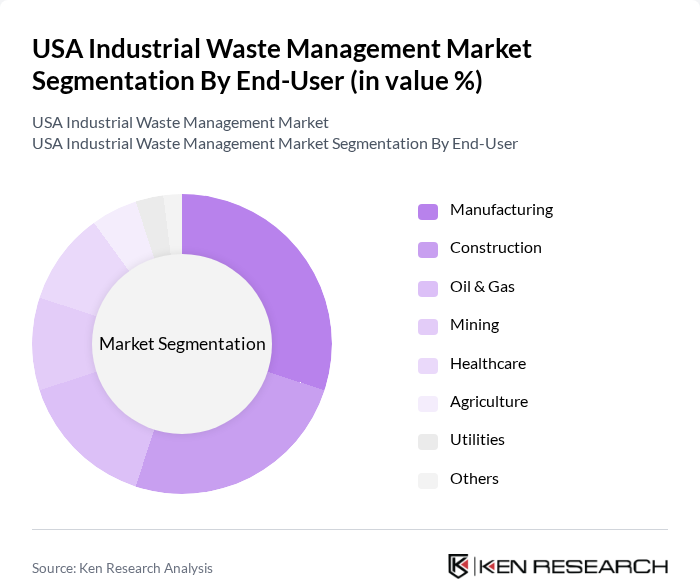

By End-User:The market is segmented by end-users, including Manufacturing, Construction, Oil & Gas, Mining, Healthcare, Agriculture, Utilities, and Others. Each end-user category has distinct waste management needs and regulatory requirements, influencing the overall market dynamics. The manufacturing and construction sectors are the largest end-users, reflecting the scale of waste generated and the complexity of compliance requirements .

The Manufacturing sector is the leading end-user in the industrial waste management market, driven by the high volume of waste generated from production processes. This sector encompasses a wide range of industries, including automotive, electronics, and consumer goods, all of which produce significant amounts of waste that require effective management. The increasing emphasis on sustainability, resource recovery, and regulatory compliance in manufacturing processes is pushing companies to adopt advanced waste management solutions, thereby solidifying the manufacturing sector's dominance in the market .

The USA Industrial Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Waste Management, Inc., Republic Services, Inc., Veolia North America, Clean Harbors, Inc., Stericycle, Inc., Covanta Holding Corporation (now Reworld), Waste Connections, Inc., GFL Environmental Inc., Casella Waste Systems, Inc., Recology, Inc., Recycle Track Systems, Inc., Rumpke Waste & Recycling, Suez North America, Advanced Disposal Services, Inc. (acquired by Waste Management, Inc.), Waste Industries, LLC (acquired by GFL Environmental Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA industrial waste management market is poised for transformation, driven by a growing emphasis on sustainability and technological innovation. As industries increasingly adopt circular economy principles, waste reduction and resource recovery will become central to waste management strategies. Additionally, the integration of smart technologies, such as IoT and data analytics, will enhance operational efficiency and compliance monitoring. These trends indicate a shift towards more sustainable practices, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Construction and Demolition Waste Manufacturing Waste Oil and Gas Waste Chemical Waste Mining Waste Agricultural Waste Electronic Waste Medical Waste Others (e.g., Nuclear Waste) |

| By End-User | Manufacturing Construction Oil & Gas Mining Healthcare Agriculture Utilities Others |

| By Waste Management Method | Landfilling Incineration Recycling Composting Waste-to-Energy Other Advanced Treatment Methods |

| By Service Type | Collection Services Transportation Services Treatment Services Disposal Services Consulting & Compliance Services Others |

| By Region | Northeast Midwest South West |

| By Industry Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| By Policy Support | Federal Support State Support Local Support Private Sector Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Waste Management | 100 | Plant Managers, Environmental Compliance Officers |

| Construction Industry Waste Disposal | 60 | Project Managers, Site Supervisors |

| Hazardous Waste Treatment Facilities | 50 | Facility Managers, Safety Officers |

| Recycling Initiatives in Manufacturing | 40 | Sustainability Managers, Operations Directors |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

The USA Industrial Waste Management Market is valued at approximately USD 30 billion, reflecting a significant growth driven by increasing industrial activities, stringent environmental regulations, and the demand for sustainable waste disposal solutions.