Region:North America

Author(s):Rebecca

Product Code:KRAB4142

Pages:89

Published On:October 2025

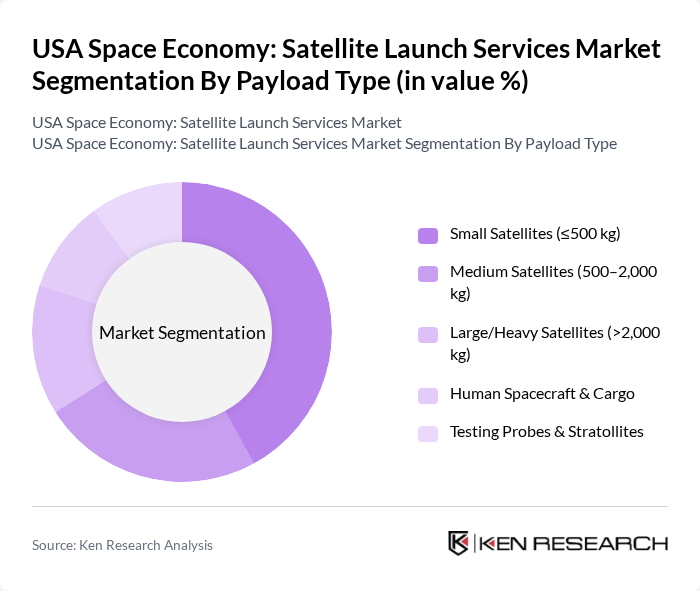

By Payload Type:The payload type segmentation includes various categories such as small satellites, medium satellites, large/heavy satellites, human spacecraft & cargo, and testing probes & stratollites. Among these, small satellites (?500 kg) are currently dominating the market due to their cost-effectiveness and increasing applications in communication, Earth observation, and scientific research. The trend towards miniaturization and the growing number of startups focusing on small satellite technology have significantly contributed to this segment's growth .

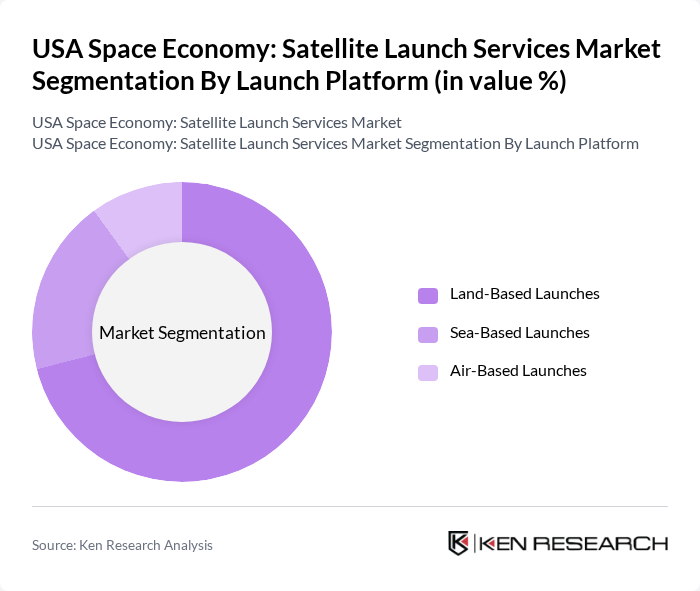

By Launch Platform:The launch platform segmentation includes land-based launches, sea-based launches, and air-based launches. Land-based launches dominate the market due to the established infrastructure and logistical advantages they offer. The majority of satellite launches occur from well-equipped launch sites in the U.S., such as Cape Canaveral and Vandenberg Space Force Base, which provide reliable access to various orbits .

The USA Space Economy: Satellite Launch Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as SpaceX, Blue Origin, United Launch Alliance (ULA), Northrop Grumman, Rocket Lab USA, Firefly Aerospace, Relativity Space, Virgin Orbit, Sierra Space, Astra Space, Planet Labs, Maxar Technologies, Boeing, Lockheed Martin, L3Harris Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the satellite launch services market is poised for transformative growth, driven by increasing privatization and technological advancements. As more private companies enter the market, competition will intensify, leading to innovative solutions and cost-effective launch options. Additionally, the integration of artificial intelligence and automation in launch operations is expected to enhance efficiency and safety. These trends will likely reshape the landscape, making satellite launches more accessible and sustainable in the future.

| Segment | Sub-Segments |

|---|---|

| By Payload Type | Small Satellites (?500 kg) Medium Satellites (500–2,000 kg) Large/Heavy Satellites (>2,000 kg) Human Spacecraft & Cargo Testing Probes & Stratollites |

| By Launch Platform | Land-Based Launches Sea-Based Launches Air-Based Launches |

| By Service Type | Full Mission Launch Services Rideshare Launch Services Dedicated Launch Services In-Orbit Servicing |

| By Orbit | Low Earth Orbit (LEO) Medium Earth Orbit (MEO) Geostationary Orbit (GEO) Beyond GEO (Cislunar, Interplanetary) |

| By End-User | Government Agencies (NASA, DoD, NOAA, etc.) Commercial Enterprises Research & Academic Institutions Non-Profit Organizations |

| By Application | Earth Observation Communication Scientific Research Navigation & Positioning Space Tourism Others |

| By Launch Frequency | Monthly Launches Quarterly Launches Annual Launches |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Satellite Launch Services | 120 | Business Development Managers, Operations Directors |

| Government Satellite Programs | 90 | Policy Makers, Program Managers |

| Emerging Space Startups | 60 | Founders, Technical Leads |

| International Launch Partnerships | 50 | International Relations Officers, Strategic Planners |

| Satellite Manufacturing Firms | 70 | Product Managers, R&D Engineers |

The USA Space Economy: Satellite Launch Services Market is valued at approximately USD 5 billion, driven by increasing demand for satellite-based services, advancements in launch technologies, and the rise of private space companies.