Region:Asia

Author(s):Shubham

Product Code:KRAD5435

Pages:84

Published On:December 2025

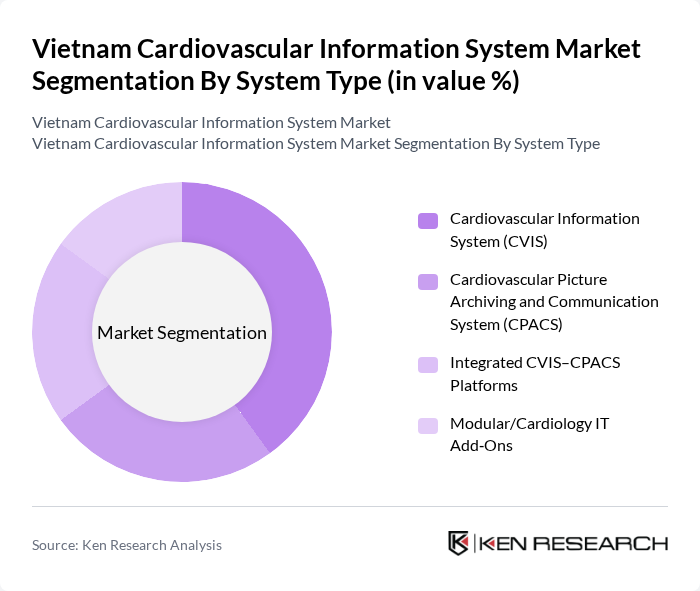

By System Type:

The market for cardiovascular information systems is primarily dominated by the Cardiovascular Information System (CVIS) segment, which is favored for its comprehensive data management capabilities and its ability to support structured reporting, registry submission, and integration with interventional suites. Hospitals and clinics are increasingly adopting CVIS due to its ability to integrate patient data from diagnostic modalities, streamline workflows across imaging, catheterization, and outpatient follow-up, and enhance clinical decision-making through standardized data. The growing emphasis on patient-centered care, value-based cardiology services, and the need for efficient data handling in cardiac departments further bolster the demand for CVIS, making it the leading subsegment in the market.

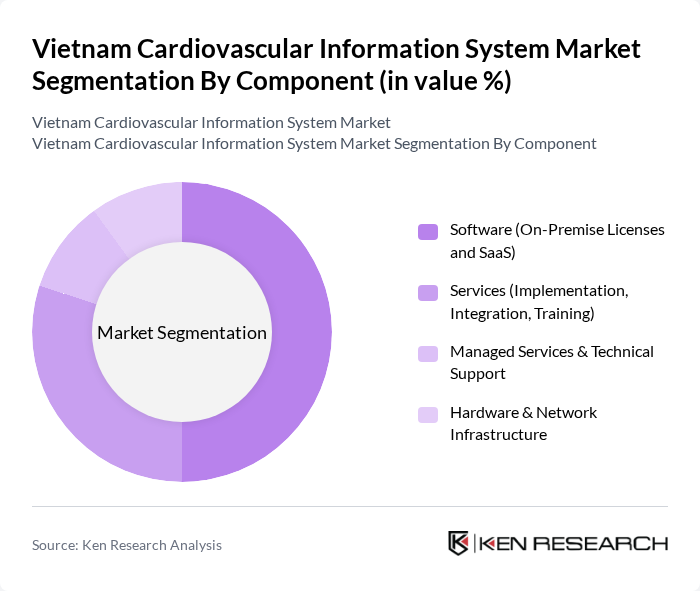

By Component:

The Software segment, particularly On-Premise Licenses and SaaS, leads the market due to the increasing demand for flexible and scalable solutions that can be tailored to the specific needs of healthcare providers and integrated with existing hospital information systems and electronic medical records. The shift towards cloud-based solutions and software-as-a-service models in medical imaging and cardiology IT has also contributed to the growth of this segment, as it allows for easier access to data, remote reading, and improved collaboration among healthcare professionals across facilities. As hospitals seek to enhance their operational efficiency, comply with digital health regulations, and improve patient care, the software component remains the most significant contributor to the market.

The Vietnam Cardiovascular Information System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viettel Solutions (Viettel Group), FPT Information System (FPT IS), VNPT IT (Vietnam Posts and Telecommunications Group), VIMEDIMEX Medico Technology Joint Stock Company, IBM Vietnam Company Limited, Oracle Health (Cerner) – Vietnam Operations, Philips Healthcare Vietnam (Royal Philips), GE HealthCare Vietnam, Siemens Healthineers Vietnam, Fujifilm Healthcare Vietnam, Canon Medical Systems Vietnam, Infinitt Healthcare – Vietnam, Medtronic Vietnam Co., Ltd., Abbott Laboratories S.A. – Vietnam, Boston Scientific Vietnam contribute to innovation, geographic expansion, and service delivery in this space, particularly through cardiology imaging systems, enterprise imaging platforms, and localized deployments tailored to Vietnamese hospitals.

The future of the Vietnam cardiovascular information system market appears promising, driven by ongoing government support and technological advancements. As healthcare digitization initiatives gain momentum, the integration of artificial intelligence and machine learning into cardiovascular care is expected to enhance diagnostic accuracy and treatment personalization. Furthermore, the growing emphasis on preventive healthcare will likely lead to increased investments in data analytics, enabling healthcare providers to make informed decisions and improve patient outcomes significantly.

| Segment | Sub-Segments |

|---|---|

| By System Type | Cardiovascular Information System (CVIS) Cardiovascular Picture Archiving and Communication System (CPACS) Integrated CVIS–CPACS Platforms Modular/Cardiology IT Add?Ons |

| By Component | Software (On-Premise Licenses and SaaS) Services (Implementation, Integration, Training) Managed Services & Technical Support Hardware & Network Infrastructure |

| By Application | Cardiac & Peripheral Catheterization Labs Echocardiography & Cardiac Imaging Management Electrophysiology & Rhythm Management Hemodynamic Monitoring & Reporting ECG/Stress/Holter Data Management Nuclear Cardiology & Advanced Cardiac Imaging Analytics, Registries & Quality Reporting |

| By Deployment Model | On-Premise Private Cloud Public Cloud Hybrid Deployment |

| By End-User | Tertiary Care & Cardiac Specialty Hospitals General Hospitals with Cardiology Departments Standalone Cath Labs & Cardiology Clinics Academic & Research Institutions |

| By Procurement Channel | Direct Tender / Public Procurement Direct Sales to Private Providers Local Distributors & Value?Added Resellers Regional System Integrators |

| By Region | Northern Vietnam (including Hanoi) Southern Vietnam (including Ho Chi Minh City) Central Vietnam Mekong Delta & Other Provinces |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiologists in Major Hospitals | 120 | Cardiologists, Department Heads |

| Healthcare IT Managers | 100 | IT Managers, System Administrators |

| Patients with Cardiovascular Conditions | 150 | Patients, Caregivers |

| Healthcare Policy Makers | 80 | Health Officials, Policy Analysts |

| Medical Device Suppliers | 90 | Sales Representatives, Product Managers |

The Vietnam Cardiovascular Information System Market is valued at approximately USD 12 million, reflecting a significant growth driven by the increasing prevalence of cardiovascular diseases and advancements in healthcare technology.