Region:Middle East

Author(s):Dev

Product Code:KRAC3364

Pages:98

Published On:October 2025

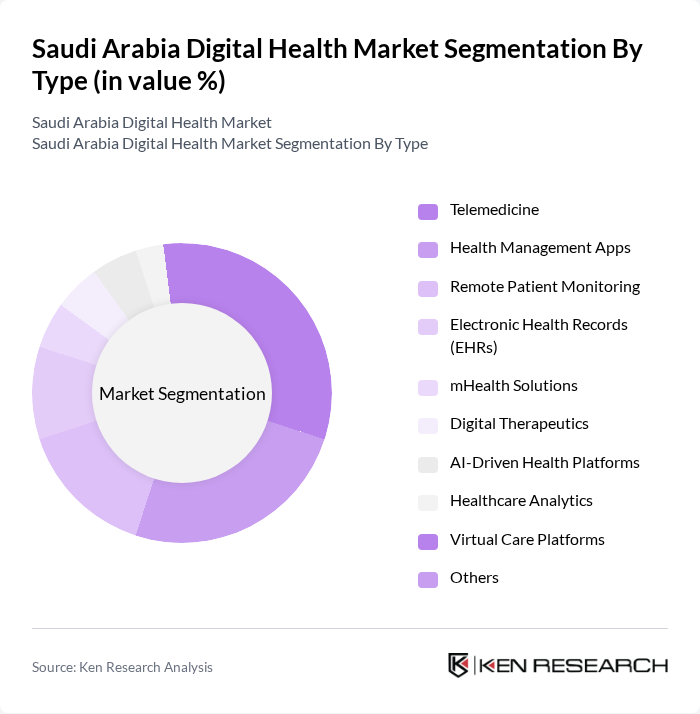

By Type:The digital health market can be segmented into various types, including telemedicine, health management apps, remote patient monitoring, electronic health records (EHRs), mHealth solutions, digital therapeutics, AI-driven health platforms, healthcare analytics, virtual care platforms, and others. Among these,telemedicineandhealth management appsare particularly prominent due to their increasing adoption by healthcare providers and patients alike. Telemedicine has gained traction as a convenient solution for remote consultations, especially in response to the need for accessible care in both urban and remote areas. Health management apps empower users to monitor their health proactively, manage chronic conditions, and access personalized health insights, reflecting the growing consumer demand for digital health engagement .

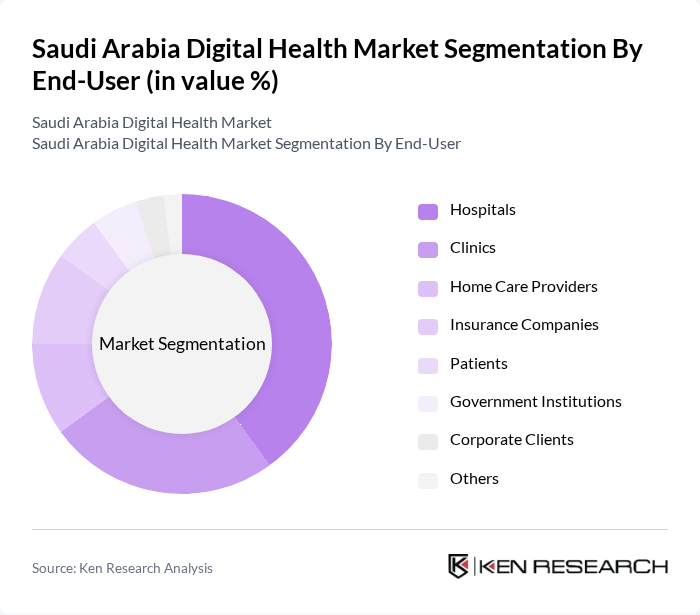

By End-User:The end-user segmentation includes hospitals, clinics, home care providers, insurance companies, patients, government institutions, corporate clients, and others.Hospitalsandclinicsare the primary users of digital health solutions, driven by the need for efficient patient management, improved healthcare delivery, and compliance with national digital health mandates. The increasing focus on patient-centric care and the integration of technology in clinical settings are propelling the adoption of digital health solutions among these end-users. Additionally, home care providers and insurance companies are leveraging digital platforms for remote monitoring and claims processing, while patients are increasingly engaging with digital tools for self-care and chronic disease management .

The Saudi Arabia Digital Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Seha Virtual Hospital, Mawid (Ministry of Health), Sehhaty, Wasfaty, Altibbi, Vezeeta, Philips Healthcare Saudi Arabia, Siemens Healthineers Saudi Arabia, GE HealthCare Saudi Arabia, Cerner Middle East Ltd., Epic Systems Corporation, Oracle Health Sciences, Medtronic Saudi Arabia, DarioHealth Corp., Kilow, Babylon Health, Teladoc Health, HealthTap, IBM Watson Health, Health Catalyst, Zocdoc contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia digital health market appears promising, driven by ongoing technological advancements and increasing consumer acceptance of digital health solutions. The integration of artificial intelligence and machine learning into healthcare services is expected to enhance diagnostic accuracy and patient engagement. Additionally, the government's commitment to improving healthcare infrastructure will likely facilitate the growth of telehealth services, making healthcare more accessible and efficient for the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Telemedicine Health Management Apps Remote Patient Monitoring Electronic Health Records (EHRs) mHealth Solutions Digital Therapeutics AI-Driven Health Platforms Healthcare Analytics Virtual Care Platforms Others |

| By End-User | Hospitals Clinics Home Care Providers Insurance Companies Patients Government Institutions Corporate Clients Others |

| By Application | Chronic Disease Management (e.g., Diabetes, Cardiovascular, Obesity) Mental Health Services Preventive Healthcare Rehabilitation Services Women's Health Pediatric Care Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Healthcare Providers Pharmacies Others |

| By Region | Central Region Western Region Eastern Region Southern Region Northern Region Others |

| By Customer Segment | Individual Consumers Corporate Clients Government Institutions Non-Governmental Organizations Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Services | 120 | Healthcare Providers, Telehealth Coordinators |

| Mobile Health Applications | 60 | App Developers, UX Designers |

| Electronic Health Records | 50 | IT Managers, Health Information Officers |

| Wearable Health Technology | 40 | Product Managers, Health Tech Innovators |

| Patient Engagement Platforms | 70 | Patient Experience Managers, Digital Health Strategists |

The Saudi Arabia Digital Health Market is valued at approximately USD 2.5 billion, driven by the increasing adoption of telemedicine, health management applications, and remote patient monitoring solutions, alongside government initiatives aimed at enhancing healthcare accessibility.