Region:Asia

Author(s):Rebecca

Product Code:KRAE2847

Pages:80

Published On:February 2026

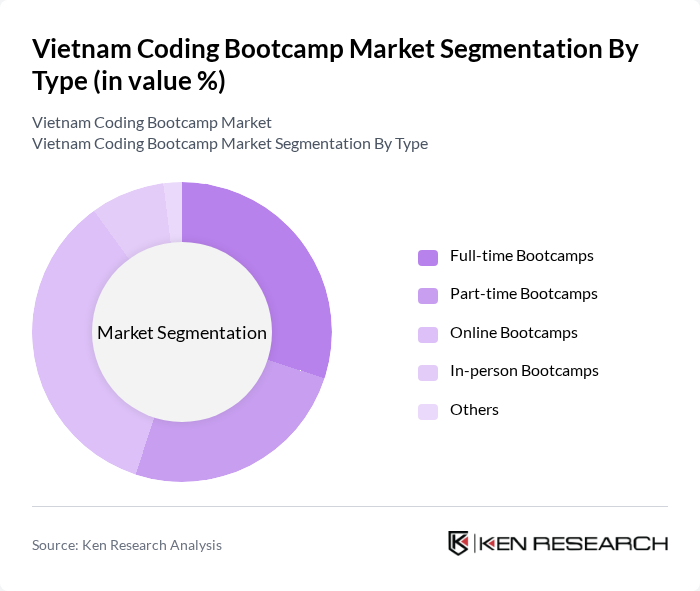

By Type:The coding bootcamp market can be segmented into various types, including Full-time Bootcamps, Part-time Bootcamps, Online Bootcamps, In-person Bootcamps, and Others. Each of these sub-segments caters to different learner needs and preferences, with online and part-time options gaining popularity due to their flexibility. Full-time bootcamps are favored by those seeking immersive learning experiences, while in-person bootcamps provide hands-on training and networking opportunities.

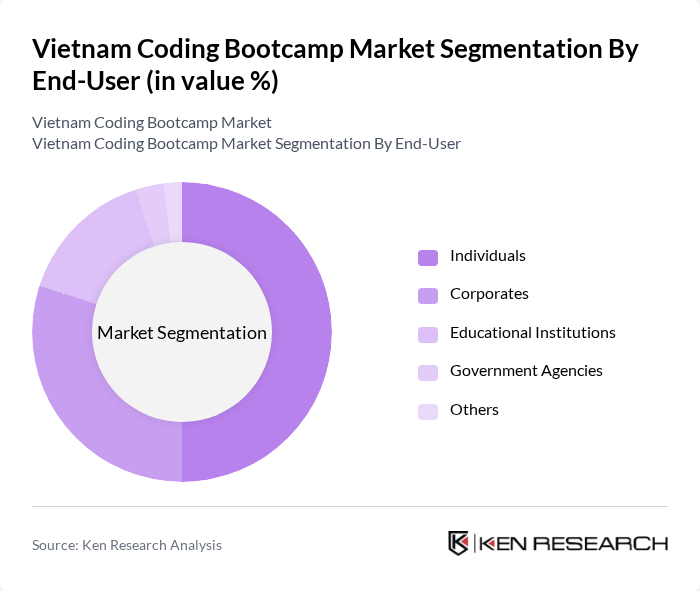

By End-User:The end-user segmentation includes Individuals, Corporates, Educational Institutions, Government Agencies, and Others. Individuals represent the largest segment, driven by the increasing number of people looking to switch careers or enhance their skills in technology. Corporates are also investing in bootcamps to upskill their employees, while educational institutions are integrating coding bootcamps into their curricula to meet the demand for tech-savvy graduates.

The Vietnam Coding Bootcamp Market is characterized by a dynamic mix of regional and international players. Leading participants such as CodeGym, MindX, Khoa Pham Academy, Học viện Công nghệ Bưu chính Viễn thông, TechKids, Coderschool, VTC Academy, Green Academy, FPT University, Aptech Vietnam, TopDev, ITPlus Academy, CoderSchool, TechMaster, VietnamNet Media contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam coding bootcamp market appears promising, driven by the increasing integration of technology in various sectors and the government's commitment to digital education. As the demand for tech skills continues to rise, bootcamps are likely to adapt by offering more specialized programs. Additionally, the trend towards hybrid learning models will enhance accessibility, allowing more students to participate. The focus on soft skills and mentorship will further prepare graduates for the evolving job market, ensuring their competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-time Bootcamps Part-time Bootcamps Online Bootcamps In-person Bootcamps Others |

| By End-User | Individuals Corporates Educational Institutions Government Agencies Others |

| By Course Duration | Short-term Courses Long-term Courses Bootcamps with Flexible Duration Others |

| By Subject Focus | Web Development Data Science Mobile Development Cybersecurity Others |

| By Delivery Mode | Online Learning In-person Learning Hybrid Learning Others |

| By Certification Type | Industry-recognized Certifications Bootcamp-specific Certifications No Certification Others |

| By Target Audience | Beginners Intermediate Learners Advanced Learners Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coding Bootcamp Graduates | 150 | Recent graduates from various coding bootcamps |

| Bootcamp Instructors | 100 | Instructors and course designers from coding bootcamps |

| Industry Employers | 80 | HR managers and tech leads from companies hiring tech talent |

| Education Policy Makers | 50 | Government officials and education administrators |

| Tech Industry Analysts | 60 | Market analysts and researchers focused on tech education |

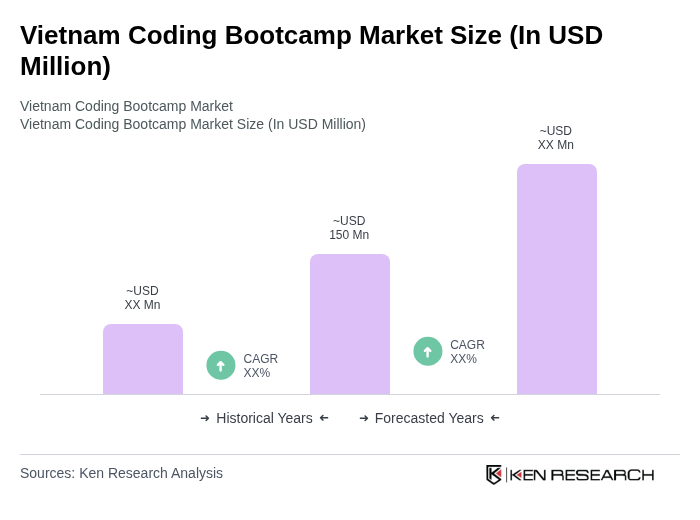

The Vietnam Coding Bootcamp Market is valued at approximately USD 150 million, driven by the increasing demand for skilled software developers and the rapid digital transformation across various sectors in the country.