Region:Asia

Author(s):Rebecca

Product Code:KRAE2855

Pages:85

Published On:February 2026

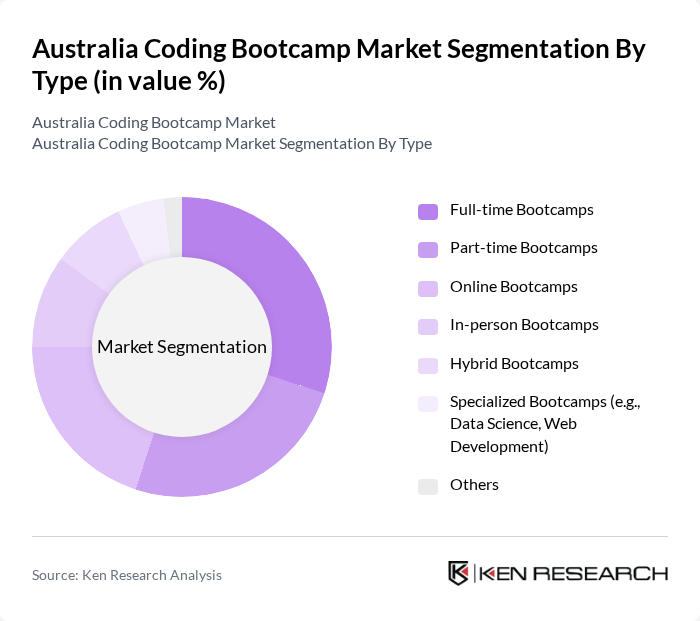

By Type:The market is segmented into various types of bootcamps, including Full-time Bootcamps, Part-time Bootcamps, Online Bootcamps, In-person Bootcamps, Hybrid Bootcamps, Specialized Bootcamps (e.g., Data Science, Web Development), and Others. Each type caters to different learning preferences and schedules, allowing a diverse range of participants to engage in coding education.

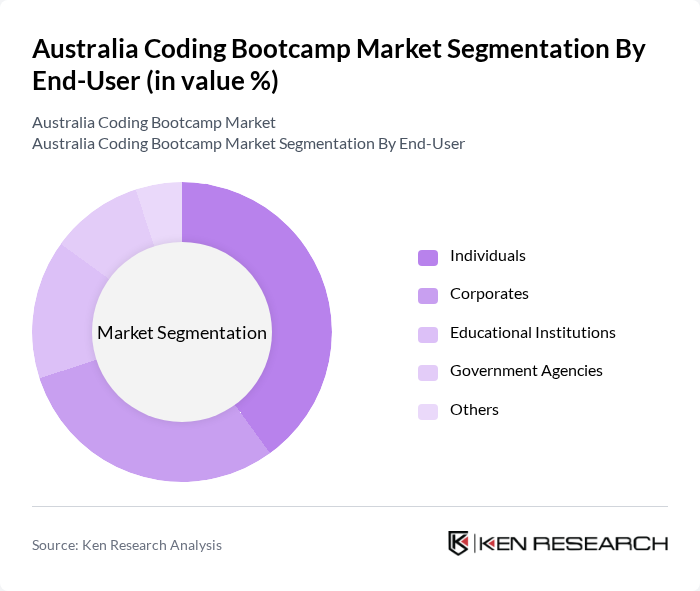

By End-User:The end-user segmentation includes Individuals, Corporates, Educational Institutions, Government Agencies, and Others. Each segment has unique needs and motivations for engaging in coding bootcamps, from personal career advancement to corporate training initiatives.

The Australia Coding Bootcamp Market is characterized by a dynamic mix of regional and international players. Leading participants such as General Assembly, Le Wagon, Academy Xi, Coder Academy, The Software Guild, Thinkful, Ironhack, The Tech Academy, JMC Academy, RMIT Online, UNSW Sydney, TAFE Queensland, CoderDojo, DataCamp, and Udacity contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia coding bootcamp market appears promising, driven by the increasing integration of technology in various sectors and the ongoing demand for skilled professionals. As companies continue to invest in digital transformation, bootcamps are likely to adapt their curricula to include emerging technologies such as artificial intelligence and data analytics. Additionally, the rise of hybrid learning models will enhance accessibility, allowing more individuals to participate in coding education, thus fostering a more skilled workforce.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-time Bootcamps Part-time Bootcamps Online Bootcamps In-person Bootcamps Hybrid Bootcamps Specialized Bootcamps (e.g., Data Science, Web Development) Others |

| By End-User | Individuals Corporates Educational Institutions Government Agencies Others |

| By Demographics | Age Group (18-24, 25-34, 35+) Gender Employment Status (Employed, Unemployed, Students) Others |

| By Learning Format | Online Learning In-Person Learning Blended Learning Others |

| By Duration | Short-term (Less than 3 months) Medium-term (3-6 months) Long-term (6 months and above) Others |

| By Certification Type | Industry-recognized Certifications Non-certified Courses Others |

| By Geographic Reach | National Bootcamps Regional Bootcamps International Bootcamps operating in Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bootcamp Graduate Feedback | 150 | Recent graduates from various coding bootcamps |

| Employer Insights | 100 | HR Managers and Technical Leads from tech companies |

| Bootcamp Instructor Perspectives | 80 | Instructors and curriculum developers from coding bootcamps |

| Industry Expert Opinions | 50 | Education policy analysts and workforce development experts |

| Market Trend Analysts | 60 | Market researchers and analysts specializing in education technology |

The Australia Coding Bootcamp Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for skilled tech professionals and the need for rapid reskilling in the workforce.