Region:Asia

Author(s):Rebecca

Product Code:KRAE2850

Pages:84

Published On:February 2026

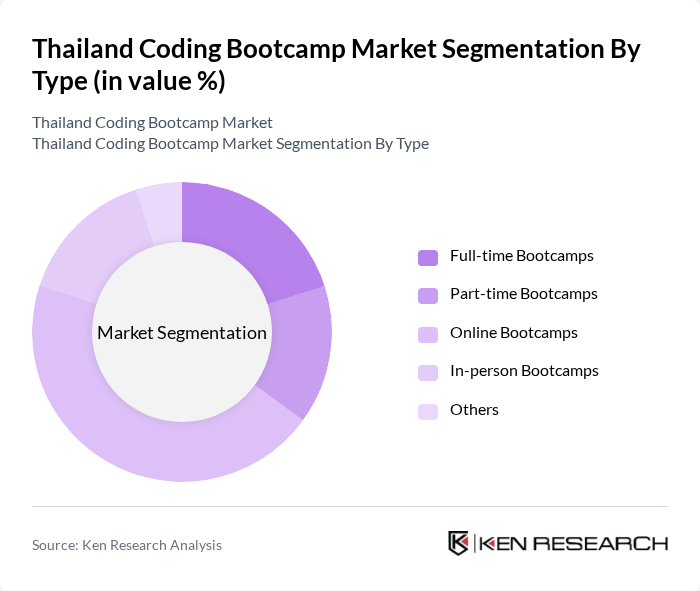

By Type:The market is segmented into Full-time Bootcamps, Part-time Bootcamps, Online Bootcamps, In-person Bootcamps, and Others. Among these, Online Bootcamps are currently dominating the market due to their flexibility and accessibility, allowing learners to participate from anywhere. The trend towards remote learning has significantly increased the popularity of online formats, especially among working professionals seeking to upskill without disrupting their careers.

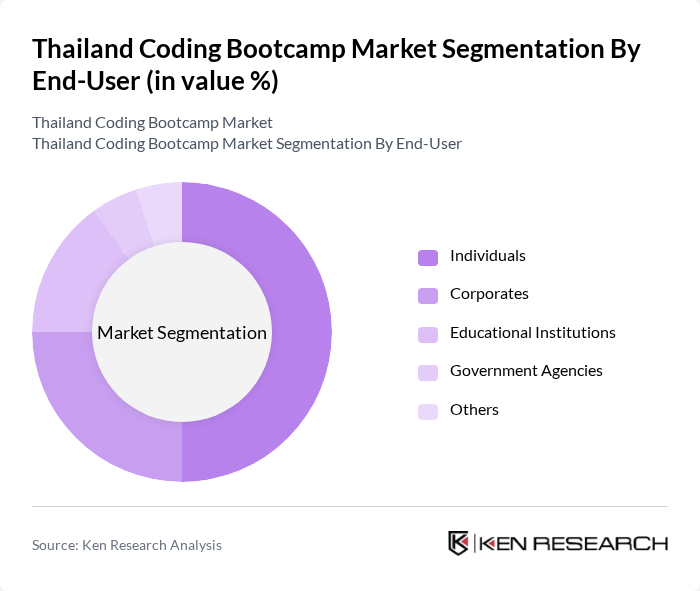

By End-User:The market is segmented into Individuals, Corporates, Educational Institutions, Government Agencies, and Others. The Individuals segment is leading the market, driven by the increasing number of people seeking to enhance their skills for better job opportunities. The rise in self-directed learning and the need for digital skills in the job market have made coding bootcamps an attractive option for personal development.

The Thailand Coding Bootcamp Market is characterized by a dynamic mix of regional and international players. Leading participants such as CodeCamp Thailand, Techsauce Academy, Digital Academy Thailand, The Coding Bootcamp Thailand, Droids On Roids, Learn to Code Thailand, Coding Dojo Thailand, SkillLane, KMITL Coding Bootcamp, Chula Coding Bootcamp, Bangkok Coding Bootcamp, Code Academy Thailand, TechUp Thailand, Code Factory Thailand, Code Ninja Thailand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand coding bootcamp market appears promising, driven by ongoing digital transformation and government initiatives. As the demand for tech skills continues to rise, bootcamps are likely to adapt their curricula to include emerging technologies such as AI and data science. Furthermore, the integration of hybrid learning models will enhance accessibility, allowing more students to participate. With a focus on quality and partnerships, bootcamps can position themselves as credible alternatives to traditional education, fostering a skilled workforce for the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-time Bootcamps Part-time Bootcamps Online Bootcamps In-person Bootcamps Others |

| By End-User | Individuals Corporates Educational Institutions Government Agencies Others |

| By Course Duration | Short-term Courses Long-term Courses Bootcamps with Flexible Duration Others |

| By Skill Level | Beginner Level Intermediate Level Advanced Level Others |

| By Subject Focus | Web Development Data Science Mobile Development Cybersecurity Others |

| By Delivery Method | Online Learning In-person Learning Hybrid Learning Others |

| By Certification Type | Industry-recognized Certifications Bootcamp-specific Certifications No Certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coding Bootcamp Graduates | 150 | Recent graduates from various bootcamps |

| Bootcamp Instructors | 100 | Instructors from leading coding bootcamps |

| Tech Industry Employers | 80 | HR Managers and Technical Recruiters |

| Education Policy Makers | 50 | Government officials and educational administrators |

| Potential Bootcamp Students | 120 | Individuals considering enrollment in coding bootcamps |

The Thailand Coding Bootcamp Market is valued at approximately USD 150 million, driven by the increasing demand for tech talent and the rapid digital transformation across various sectors in the country.