Vietnam Digital Remittance and Wallet Services Market Overview

- The Vietnam Digital Remittance and Wallet Services Market is valued at approximately USD 18 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital payment solutions, the rising number of Vietnamese expatriates sending money home, and the rapid expansion of e-commerce in the country. The convenience, speed, and enhanced accessibility of digital transactions have significantly contributed to market expansion, with mobile-based remittance and wallet services now accounting for a substantial share of total transactions in Vietnam .

- Key cities such as Ho Chi Minh City and Hanoi continue to dominate the market due to their high population density, robust economic activity, and advanced technological infrastructure. These urban centers serve as financial service hubs and have the highest concentration of digital wallet users, making them critical drivers of growth for digital remittance and wallet services in Vietnam .

- In 2023, the Vietnamese government strengthened regulations to enhance digital transaction security, requiring all digital wallet providers to comply with strict Know Your Customer (KYC) guidelines. This regulatory framework is defined under Circular No. 39/2014/TT-NHNN issued by the State Bank of Vietnam, which mandates comprehensive KYC procedures, transaction monitoring, and reporting obligations for licensed payment intermediaries. These measures aim to prevent fraud and money laundering, ensuring a safer environment for users and fostering trust in digital financial services .

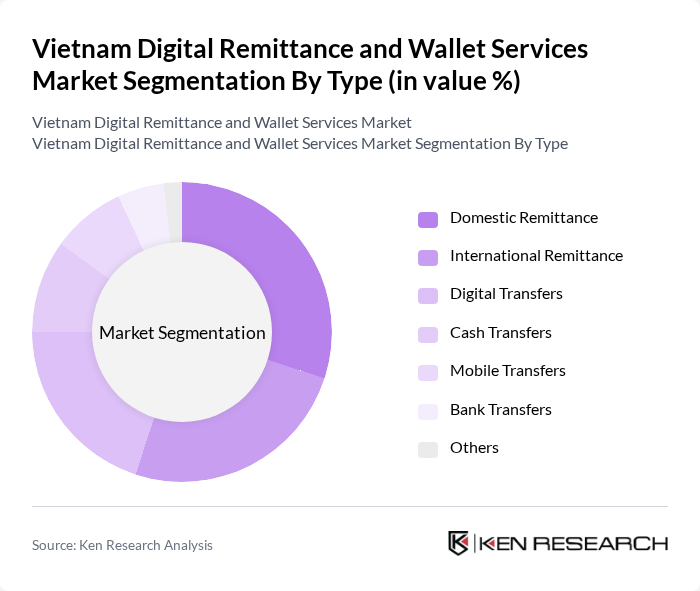

Vietnam Digital Remittance and Wallet Services Market Segmentation

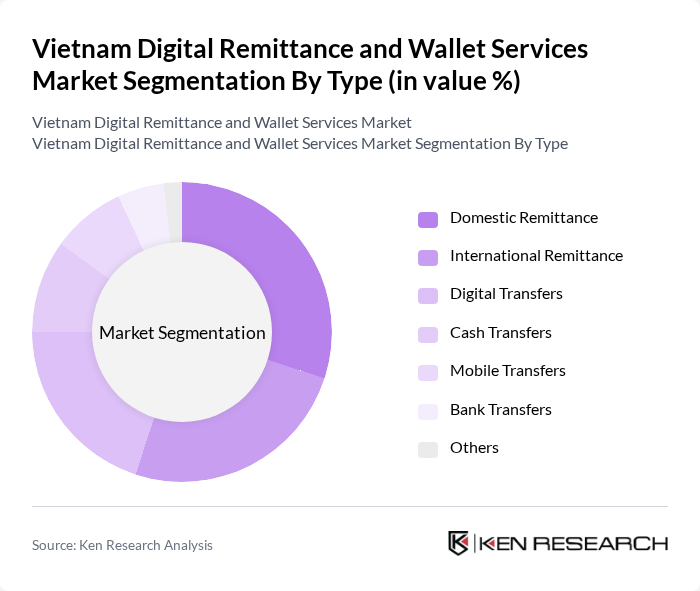

By Type:The market is segmented into Domestic Remittances, International Remittances, Digital Transfers, Cash Transfers, Mobile Transfers, Bank Transfers, and Others. Domestic Remittances remain the leading sub-segment, driven by the high volume of intra-country transactions supporting family and personal financial needs. The increasing penetration of smartphones and internet access has accelerated the adoption of Digital Transfers, which are gaining popularity due to their convenience, speed, and integration with e-wallet platforms. Mobile Transfers and Bank Transfers also show robust growth, reflecting the shift from cash-based to digital payment ecosystems .

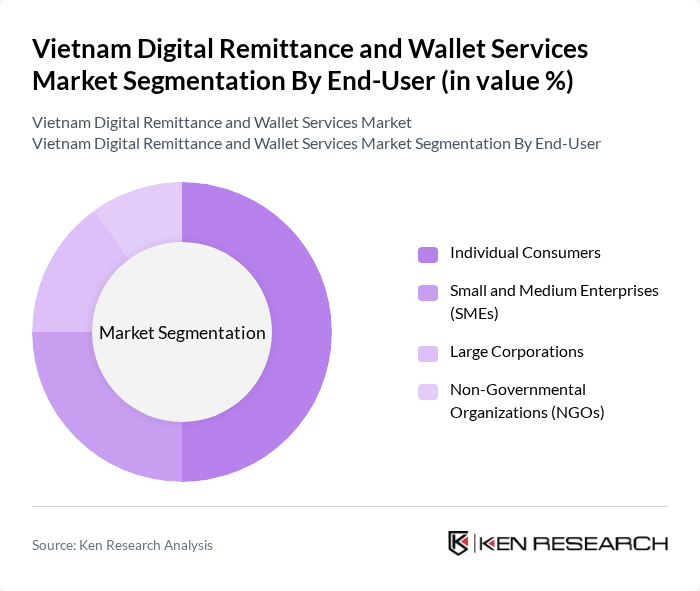

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Individual Consumers dominate this segment, frequently utilizing digital remittance and wallet services for personal transactions, such as sending money to family members or paying for services. The rise of SMEs in Vietnam is also contributing to the growth of digital wallet services, as these businesses increasingly adopt digital payment solutions to streamline operations and facilitate business-to-business transactions. Large Corporations and NGOs are gradually increasing their adoption of digital remittance solutions, particularly for payroll and cross-border payments .

Vietnam Digital Remittance and Wallet Services Market Competitive Landscape

The Vietnam Digital Remittance and Wallet Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as MoMo (M_Service), ZaloPay (VNG Corporation), Viettel Money (Viettel Group), VNPay, Payoo (VietUnion), ShopeePay (Sea Limited), GrabPay (Grab Holdings), Western Union, MoneyGram International, Wise (formerly TransferWise), Remitly, PayPal, Sacombank, Agribank (Vietnam Bank for Agriculture and Rural Development), Vietcombank (Bank for Foreign Trade of Vietnam) contribute to innovation, geographic expansion, and service delivery in this space.

Vietnam Digital Remittance and Wallet Services Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, Vietnam's smartphone penetration rate is projected to reach73%, with approximately72 million smartphone users. This surge facilitates access to digital remittance and wallet services, enabling users to conduct transactions conveniently. The World Bank reports that mobile money transactions in Vietnam increased by150%in future, highlighting the growing reliance on smartphones for financial services. This trend is expected to continue, driving the digital remittance market forward.

- Rising Remittance Inflows from Overseas Vietnamese:In future, remittance inflows to Vietnam are anticipated to exceedUSD 16 billion, reflecting a5%increase from the previous year. This growth is primarily driven by the Vietnamese diaspora, which is estimated at5.3 million individualsglobally. The World Bank indicates that these remittances significantly contribute to household incomes, enhancing the demand for efficient digital remittance services. This trend underscores the importance of digital wallets in facilitating these transactions.

- Growing E-commerce Adoption:Vietnam's e-commerce market is projected to reachUSD 20.5 billionin future, driven by a25%annual growth rate. This rapid expansion is fostering a culture of online transactions, increasing the demand for digital payment solutions. According to the Vietnam E-commerce Association,60%of online shoppers prefer using digital wallets for payments. This shift towards e-commerce is a significant growth driver for digital remittance and wallet services, as consumers seek seamless payment options.

Market Challenges

- Regulatory Compliance Complexities:The regulatory landscape for digital remittance and wallet services in Vietnam is evolving, with new laws being implemented. In future, compliance costs for service providers are expected to rise by20%due to stricter regulations, including anti-money laundering (AML) and consumer protection laws. This complexity can hinder market entry for new players and increase operational costs for existing providers, impacting overall market growth.

- High Competition Among Service Providers:The digital remittance and wallet services market in Vietnam is highly competitive, with over40 active playersas of future. This saturation leads to price wars and reduced profit margins, making it challenging for companies to differentiate their offerings. According to industry reports, the average market share of the top five providers is only50%, indicating a fragmented market. This intense competition can stifle innovation and limit growth opportunities for smaller players.

Vietnam Digital Remittance and Wallet Services Market Future Outlook

The future of Vietnam's digital remittance and wallet services market appears promising, driven by technological advancements and increasing consumer adoption. As digital payment infrastructure expands, more users will engage with these services, enhancing financial inclusion. Additionally, the integration of artificial intelligence and blockchain technology is expected to streamline operations and improve security. These trends will likely foster a more robust ecosystem, enabling service providers to innovate and meet the evolving needs of consumers in the digital finance landscape.

Market Opportunities

- Expansion of Digital Payment Infrastructure:The Vietnamese government plans to investUSD 1 billionin enhancing digital payment infrastructure by future. This investment will facilitate faster and more secure transactions, creating opportunities for digital wallet providers to capture a larger market share. Improved infrastructure will also support rural areas, increasing access to financial services for underserved populations.

- Partnerships with Local Banks:Collaborations between digital wallet providers and local banks are expected to grow, with over50 partnershipsanticipated by future. These alliances will enhance service offerings, improve customer trust, and expand user bases. By leveraging existing banking networks, digital wallets can offer more comprehensive services, including credit and savings options, thereby attracting a wider audience.