Region:Europe

Author(s):Geetanshi

Product Code:KRAA7942

Pages:97

Published On:September 2025

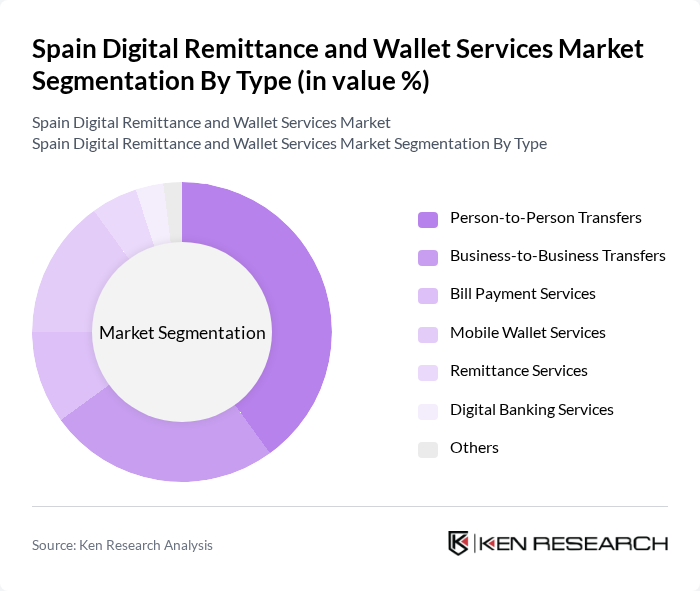

By Type:The market is segmented into various types, including Person-to-Person Transfers, Business-to-Business Transfers, Bill Payment Services, Mobile Wallet Services, Remittance Services, Digital Banking Services, and Others. Among these, Person-to-Person Transfers have emerged as the leading segment, driven by the increasing need for quick and convenient money transfers among individuals, especially expatriates and students. The growing acceptance of mobile wallets and digital banking solutions has also contributed to the rise of this segment.

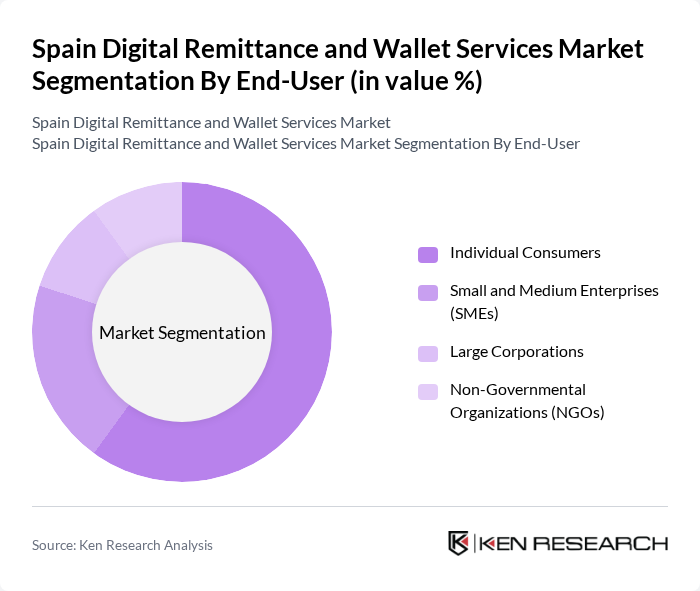

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Individual Consumers represent the largest segment, primarily due to the increasing number of people utilizing digital remittance services for personal transactions, such as sending money to family and friends. The rise of e-commerce and online services has also led to a growing demand from SMEs, but the individual consumer segment remains dominant.

The Spain Digital Remittance and Wallet Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as TransferWise, PayPal, Western Union, Revolut, N26, Remitly, Skrill, WorldRemit, MoneyGram, CaixaBank, Banco Sabadell, BBVA, Santander, Orange Money, and Fintonic contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital remittance and wallet services market in Spain appears promising, driven by technological advancements and evolving consumer preferences. The integration of blockchain technology is expected to enhance transaction security and efficiency, while the growth of mobile wallet applications will cater to the increasing demand for cashless solutions. As financial literacy improves, more users will embrace digital services, further propelling market growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Person-to-Person Transfers Business-to-Business Transfers Bill Payment Services Mobile Wallet Services Remittance Services Digital Banking Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments Cash Payments |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Use | Daily Users Weekly Users Monthly Users |

| By Geographic Reach | Domestic Transfers International Transfers |

| By Customer Segment | Students Expatriates Tourists Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Wallet Users | 150 | Individuals aged 18-45 using digital wallets for remittances |

| Small Business Owners | 100 | Owners of businesses utilizing digital remittance services |

| Financial Technology Experts | 80 | Industry analysts and consultants specializing in fintech |

| Regulatory Authorities | 50 | Officials from financial regulatory bodies in Spain |

| Remittance Service Providers | 70 | Executives from companies offering remittance and wallet services |

The Spain Digital Remittance and Wallet Services Market is valued at approximately USD 7 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions and the rise of e-commerce, particularly among expatriates sending money back home.