Germany Digital Remittance and Wallet Services Market Overview

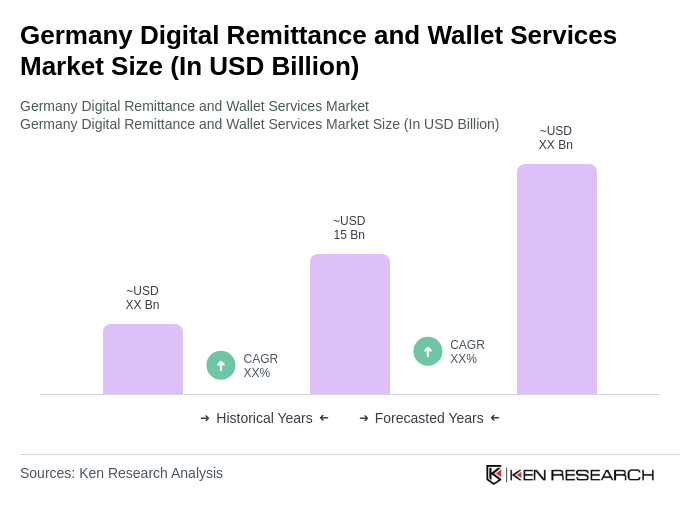

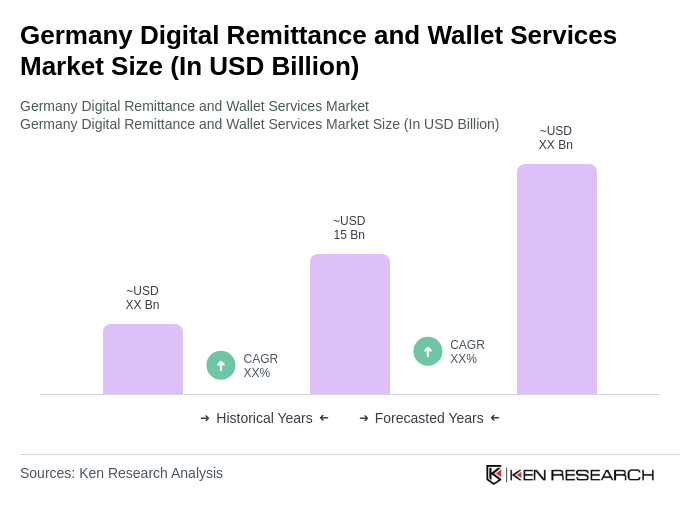

- The Germany Digital Remittance and Wallet Services Market is valued at USD 15 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital payment solutions, the rise of e-commerce, and the growing demand for cross-border transactions. The convenience and speed of digital remittance services have significantly contributed to the market's expansion, as consumers and businesses alike seek efficient ways to manage their financial transactions.

- Key cities such as Berlin, Frankfurt, and Munich dominate the market due to their robust financial infrastructure, high population density, and a strong presence of tech-savvy consumers. These urban centers are also home to numerous fintech startups and established financial institutions, fostering innovation and competition in the digital remittance and wallet services sector.

- In 2023, the German government implemented the Payment Services Supervision Act (ZAG), which regulates payment services and electronic money institutions. This regulation aims to enhance consumer protection, ensure the security of payment transactions, and promote competition among service providers. By establishing a clear legal framework, the ZAG supports the growth of digital remittance and wallet services while safeguarding users' interests.

Germany Digital Remittance and Wallet Services Market Segmentation

By Type:The market is segmented into various types, including Peer-to-Peer Transfers, Business Payments, Remittance Services, Digital Wallets, Cryptocurrency Transactions, Mobile Payment Solutions, and Others. Among these, Digital Wallets have emerged as a leading segment due to their convenience and widespread acceptance among consumers and businesses. The increasing reliance on mobile devices for financial transactions has further propelled the growth of this segment, making it a preferred choice for users seeking seamless payment experiences.

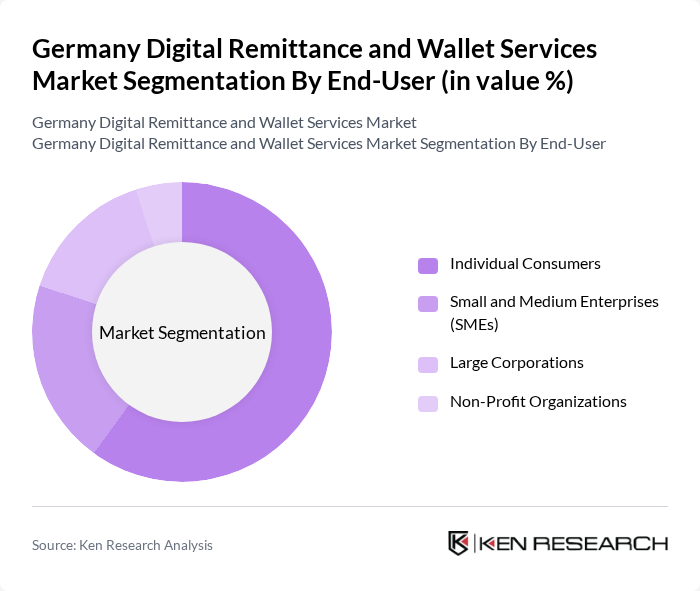

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Profit Organizations. Individual Consumers dominate this segment, driven by the increasing adoption of digital payment methods for everyday transactions. The convenience of using digital wallets and remittance services for personal finance management has led to a significant rise in the number of users, making this segment a key driver of market growth.

Germany Digital Remittance and Wallet Services Market Competitive Landscape

The Germany Digital Remittance and Wallet Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc., TransferWise Ltd., Revolut Ltd., N26 GmbH, Skrill Limited, Western Union Company, MoneyGram International, Inc., WorldRemit Ltd., Remitly, Inc., Venmo, LLC, Zelle, Cash App, Curve, BitPanda, PPRO Financial Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Germany Digital Remittance and Wallet Services Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, Germany's smartphone penetration rate is projected to reach 83%, with approximately 70 million users. This widespread adoption facilitates access to digital remittance and wallet services, enabling users to conduct transactions seamlessly. The rise in smartphone usage is also linked to increased internet connectivity, with over 90% of the population having access to mobile internet, further driving the demand for digital financial solutions.

- Rise in Cross-Border Transactions:In future, cross-border remittances in Germany are expected to exceed €25 billion, reflecting a growing trend among expatriates and international workers. This increase is driven by the influx of foreign workers, with over 1.5 million non-EU nationals residing in Germany. The demand for efficient and cost-effective remittance solutions is rising, as these individuals seek to send money back home quickly and securely.

- Growing Demand for Instant Payment Solutions:The instant payment market in Germany is projected to reach €100 billion in transaction volume by future. This surge is fueled by consumer preferences for immediate transactions, with 60% of users indicating a preference for instant payment options. The increasing adoption of real-time payment systems, such as SEPA Instant Credit Transfer, is reshaping the landscape, making digital wallets and remittance services more appealing to consumers.

Market Challenges

- Regulatory Compliance Complexities:The digital remittance sector in Germany faces stringent regulatory requirements, including compliance with the EU's PSD2 and AML directives. In future, the cost of compliance for payment service providers is estimated to reach €1 billion, significantly impacting operational budgets. These complexities can hinder the entry of new players and stifle innovation, as established firms navigate the regulatory landscape to maintain compliance.

- High Competition Among Service Providers:The German digital remittance market is characterized by intense competition, with over 200 active service providers. This saturation leads to price wars and reduced profit margins, making it challenging for new entrants to gain market share. In future, the average transaction fee for digital remittances is expected to drop to 1.5%, pressuring companies to differentiate their offerings through enhanced services and customer experience.

Germany Digital Remittance and Wallet Services Market Future Outlook

The future of the digital remittance and wallet services market in Germany appears promising, driven by technological advancements and evolving consumer preferences. As the adoption of AI and machine learning for fraud detection becomes more prevalent, service providers will enhance security measures, fostering consumer trust. Additionally, the shift towards cashless transactions will continue, with an increasing number of users opting for digital wallets for everyday purchases, further solidifying the market's growth trajectory.

Market Opportunities

- Adoption of Blockchain Technology:The integration of blockchain technology in remittance services presents a significant opportunity, potentially reducing transaction costs by up to 30%. This technology enhances transparency and security, appealing to consumers seeking reliable and efficient solutions. As blockchain adoption increases, service providers can leverage this innovation to differentiate themselves in a competitive market.

- Partnerships with Fintech Startups:Collaborating with fintech startups can provide established companies access to innovative technologies and agile business models. In future, partnerships are expected to drive a 20% increase in service offerings, enabling providers to enhance customer experiences and expand their market reach. This strategy can help traditional players remain competitive in a rapidly evolving landscape.