Region:Asia

Author(s):Geetanshi

Product Code:KRAA7930

Pages:100

Published On:September 2025

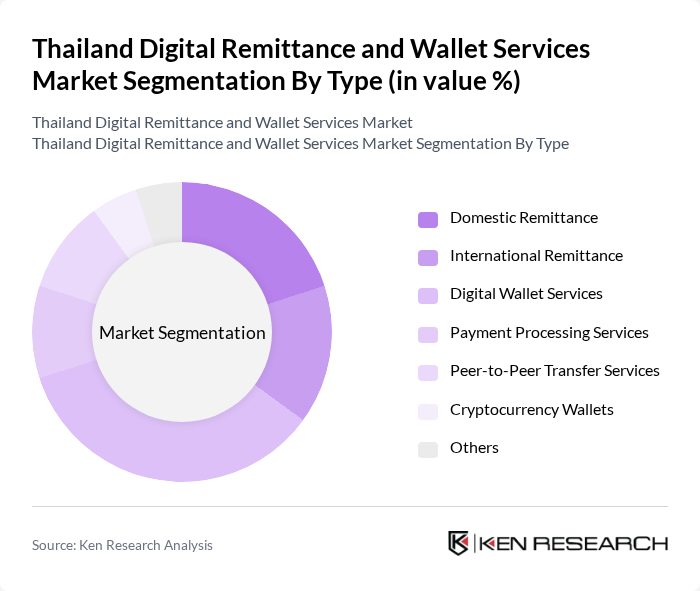

By Type:The market is segmented into various types, including Domestic Remittance, International Remittance, Digital Wallet Services, Payment Processing Services, Peer-to-Peer Transfer Services, Cryptocurrency Wallets, and Others. Among these, Digital Wallet Services have emerged as the leading segment due to the increasing preference for cashless transactions and the convenience they offer. The rise of e-commerce and mobile payments has further fueled the demand for digital wallets, making them a vital component of the market.

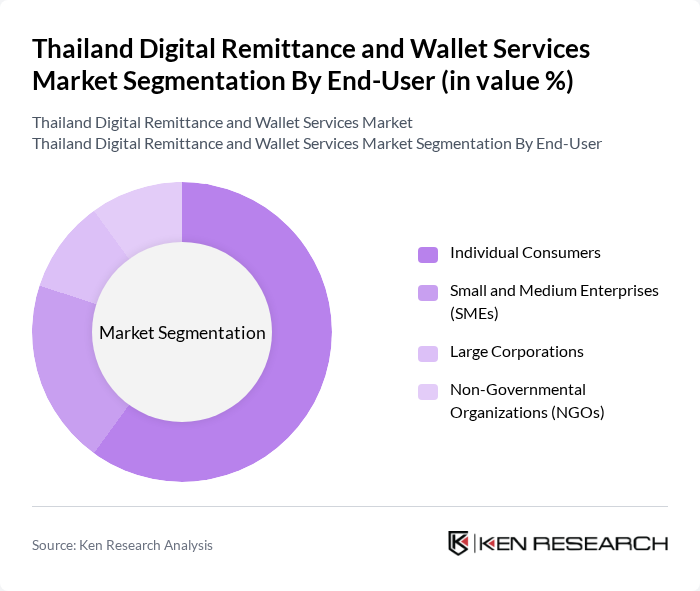

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Individual Consumers dominate this segment, driven by the increasing use of mobile applications for personal transactions and the growing trend of online shopping. The convenience and accessibility of digital remittance services have made them particularly appealing to individual users, leading to a significant share in the market.

The Thailand Digital Remittance and Wallet Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bangkok Bank, Kasikornbank, Siam Commercial Bank, Krung Thai Bank, TrueMoney, Line Pay, PayPal, Western Union, MoneyGram, Alipay, WeChat Pay, GrabPay, ShopeePay, Payoneer, and Revolut contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's digital remittance and wallet services market appears promising, driven by technological advancements and evolving consumer preferences. With the continued rise of smartphone usage and government support for digital payments, the market is likely to see increased adoption of cashless solutions. Additionally, the integration of innovative technologies such as blockchain and artificial intelligence will enhance service efficiency and security. As these trends unfold, the market is poised for significant growth, catering to a diverse range of consumers and businesses.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Remittance International Remittance Digital Wallet Services Payment Processing Services Peer-to-Peer Transfer Services Cryptocurrency Wallets Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Mobile Payments Credit/Debit Cards Cash Payments |

| By User Demographics | Age Groups Income Levels Geographic Distribution |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Use | Daily Users Weekly Users Monthly Users |

| By Customer Loyalty Programs | Reward Points Cashback Offers Referral Bonuses |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Wallet Users | 150 | Regular Users, Occasional Users |

| Remittance Service Providers | 100 | Product Managers, Business Development Executives |

| Expatriate Community Insights | 80 | Community Leaders, Frequent Senders |

| Financial Institutions | 70 | Banking Executives, Compliance Officers |

| Regulatory Bodies | 50 | Policy Makers, Financial Regulators |

The Thailand Digital Remittance and Wallet Services Market is valued at approximately USD 15 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions and a rise in smartphone usage.