Region:Asia

Author(s):Geetanshi

Product Code:KRAE6772

Pages:108

Published On:December 2025

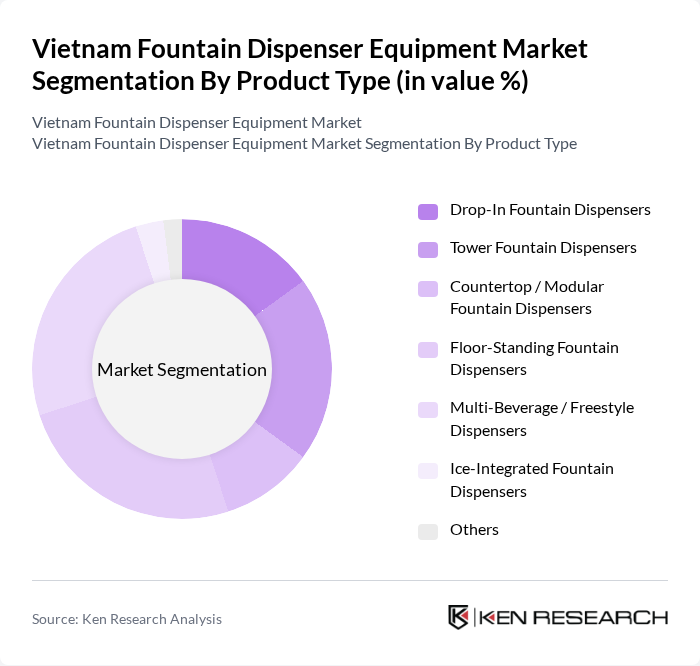

By Product Type:The product type segmentation includes various types of fountain dispensers that cater to different consumer needs and preferences. The market is characterized by a diverse range of products, including Drop-In Fountain Dispensers, Tower Fountain Dispensers, Countertop / Modular Fountain Dispensers, Floor-Standing Fountain Dispensers, Multi-Beverage / Freestyle Dispensers, Ice-Integrated Fountain Dispensers, and Others. Among these, the Multi-Beverage / Freestyle Dispensers are gaining significant traction due to their versatility and ability to offer a wide variety of beverage options, appealing to the modern consumer's desire for customization.

By Beverage Type:The beverage type segmentation encompasses a variety of drink options available through fountain dispensers. This includes Carbonated Soft Drinks, Juices & Juice Drinks, Packaged / Purified Water, Functional & Energy Drinks, Coffee, Tea & Hot Beverages, Frozen & Slush Beverages, and Others. Carbonated Soft Drinks dominate this segment due to their popularity in quick-service restaurants and fast-food chains, where consumers often seek refreshing and fizzy beverage options.

The Vietnam Fountain Dispenser Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Coca-Cola Company (Coca-Cola Beverages Vietnam), PepsiCo, Inc. (Suntory PepsiCo Vietnam Beverage), Lancer Corporation, Cornelius, Inc., Manitowoc Beverage Systems (Welbilt), Hoshizaki Vietnam, Vinamilk (Vietnam Dairy Products JSC), TH Group (TH True Milk), Masan Consumer Holdings, Trung Nguyen Group, Mondelez Kinh Do Vietnam, Local Foodservice Equipment Integrators and Distributors, Key Regional Fountain Dispenser OEMs Serving Vietnam, International Beverage Chains Operating in Vietnam (e.g., KFC, Lotteria, McDonald’s), Other Notable Emerging Players contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam fountain dispenser equipment market is poised for significant growth, driven by technological advancements and changing consumer preferences. As automation and smart technologies become more prevalent, businesses are likely to invest in innovative dispensing solutions that enhance efficiency and customer experience. Furthermore, the increasing focus on sustainability will push manufacturers to develop eco-friendly dispensers, aligning with the growing consumer demand for environmentally responsible products. This evolving landscape presents a dynamic environment for market participants to explore new opportunities.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Drop-In Fountain Dispensers Tower Fountain Dispensers Countertop / Modular Fountain Dispensers Floor-Standing Fountain Dispensers Multi-Beverage / Freestyle Dispensers Ice-Integrated Fountain Dispensers Others |

| By Beverage Type | Carbonated Soft Drinks Juices & Juice Drinks Packaged / Purified Water Functional & Energy Drinks Coffee, Tea & Hot Beverages Frozen & Slush Beverages Others |

| By End-User | Quick Service Restaurants (QSRs) & Fast Food Chains Full-Service Restaurants Cafés & Coffee Chains Hotels, Resorts & Bars Cinemas & Entertainment Venues Convenience Stores & Supermarkets Institutional & Corporate Facilities Others |

| By Technology | Gravity-Fed Systems Pump-Driven Systems Pressurized / Post-Mix Systems Smart / IoT-Enabled Dispensers Others |

| By Distribution Channel | Direct OEM Sales Distributors & Dealers Foodservice Equipment Integrators Online / E-commerce Others |

| By Capacity | Up to 4 Valves –8 Valves Above 8 Valves Customized High-Capacity Systems |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Restaurant Fountain Dispenser Usage | 120 | Restaurant Owners, Beverage Managers |

| Café Equipment Preferences | 90 | Café Managers, Procurement Officers |

| Event Venue Equipment Insights | 60 | Event Coordinators, Venue Managers |

| Retail Outlet Dispensing Trends | 70 | Store Managers, Merchandising Directors |

| Consumer Feedback on Fountain Beverages | 100 | Regular Consumers, Focus Group Participants |

The Vietnam Fountain Dispenser Equipment market is valued at approximately USD 140 million, reflecting a significant growth trend driven by increasing demand for convenient beverage dispensing solutions in the foodservice sector.