Region:Middle East

Author(s):Geetanshi

Product Code:KRAE6771

Pages:90

Published On:December 2025

By Type:The market is segmented into various types of dispensers, including Carbonated Beverage Dispensers, Non-Carbonated Beverage Dispensers, Juice Dispensers, Water Dispensers, Coffee and Tea Dispensers, Frozen Beverage Dispensers, and Others. Each type caters to different consumer preferences and operational needs.

The Carbonated Beverage Dispensers segment leads the market, driven by the popularity of soft drinks and carbonated beverages in restaurants and cafes. This segment benefits from consumer preferences for fizzy drinks, especially in social settings. Non-Carbonated Beverage Dispensers follow closely, catering to health-conscious consumers seeking alternatives like juices and flavored waters. The growing trend of customization in beverage offerings also supports the demand for these dispensers, as establishments aim to provide unique experiences to their customers.

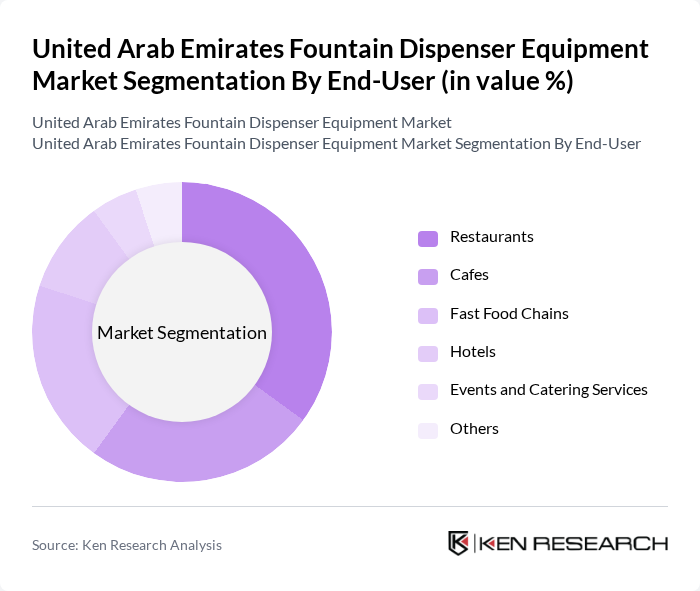

By End-User:The market is segmented by end-users, including Restaurants, Cafes, Fast Food Chains, Hotels, Events and Catering Services, and Others. Each segment reflects the diverse applications of fountain dispensers across various service sectors.

Restaurants dominate the end-user segment, driven by the high volume of beverage sales and the need for efficient service. The café segment is also significant, reflecting the growing coffee culture in the UAE. Fast food chains contribute to the market with their demand for quick-service beverage solutions. Hotels and catering services are increasingly adopting fountain dispensers to enhance guest experiences, particularly during events and banquets.

The United Arab Emirates Fountain Dispenser Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coca-Cola Company, PepsiCo, Inc., Nestlé S.A., Keurig Dr Pepper Inc., Brita GmbH, Waterlogic Ltd., Manitowoc Ice, Inc., Cornelius Inc., Follett LLC, SODEXO, Hoshizaki Corporation, Tetra Pak International S.A., Lancer Corporation, Reddy Ice Holdings, Inc., Ecolab Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE fountain dispenser equipment market appears promising, driven by ongoing technological innovations and a growing emphasis on sustainability. As businesses increasingly adopt smart and connected devices, the integration of AI and machine learning will enhance operational efficiency. Additionally, the rising health consciousness among consumers will likely lead to a demand for eco-friendly and customizable beverage solutions, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbonated Beverage Dispensers Non-Carbonated Beverage Dispensers Juice Dispensers Water Dispensers Coffee and Tea Dispensers Frozen Beverage Dispensers Others |

| By End-User | Restaurants Cafes Fast Food Chains Hotels Events and Catering Services Others |

| By Application | Indoor Installations Outdoor Installations Mobile Dispensers Others |

| By Distribution Channel | Direct Sales Online Sales Retail Sales Distributors Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Brand | Local Brands International Brands Premium Brands Budget Brands Others |

| By Technology | Manual Dispensers Automatic Dispensers Smart Dispensers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospitality Sector Fountain Dispensers | 100 | Hotel Managers, Restaurant Owners |

| Event Management Equipment Usage | 75 | Event Coordinators, Venue Managers |

| Retail Beverage Dispensing Solutions | 80 | Store Managers, Beverage Buyers |

| Corporate Office Beverage Solutions | 60 | Office Administrators, Facility Managers |

| Public Space Fountain Installations | 50 | City Planners, Facility Maintenance Supervisors |

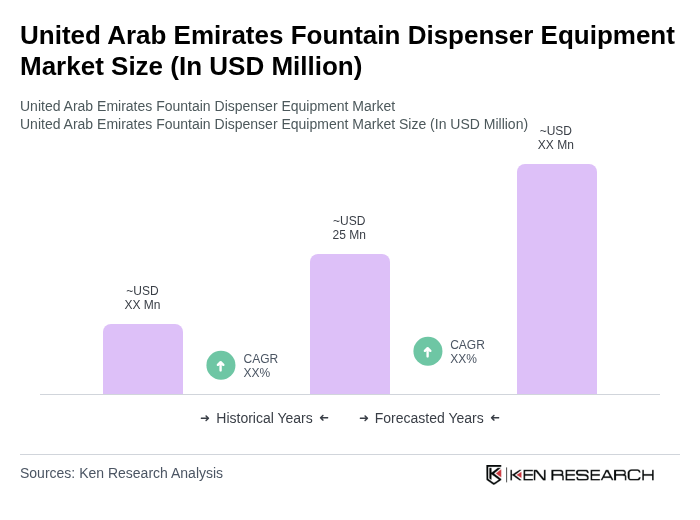

The United Arab Emirates Fountain Dispenser Equipment Market is valued at approximately USD 25 million, reflecting a five-year historical analysis that highlights the growing demand for beverage dispensing solutions in the hospitality and food service sectors.