Saudi Arabia Fountain Dispenser Equipment Market Overview

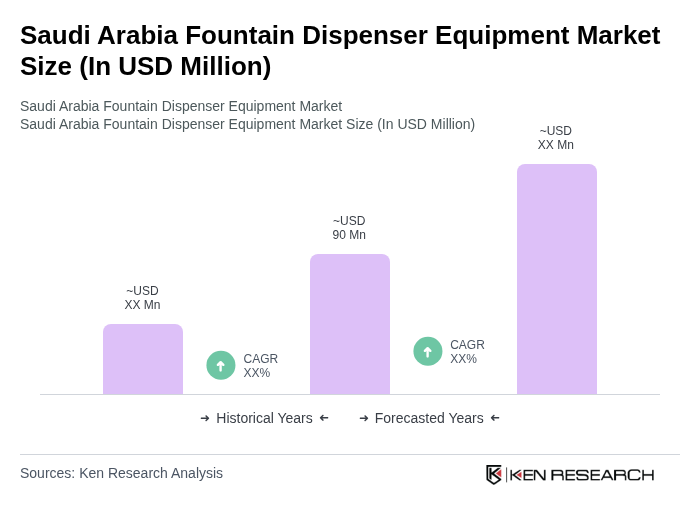

- The Saudi Arabia Fountain Dispenser Equipment Market is valued at USD 90 million, based on a five-year historical analysis and benchmarking against the global fountain dispenser and regional vending and dispenser equipment markets. This growth is primarily driven by the increasing demand for beverage dispensing solutions in the food service industry, coupled with the rising trend of convenience and on-the-go consumption among consumers. The market is also supported by advancements in technology, including energy-efficient, touchless, and smart-connected dispensing systems that enhance hygiene, operational efficiency, and user experience.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their high population density, higher disposable incomes, and concentration of commercial establishments in foodservice, retail, corporate, and institutional settings. These urban centers are experiencing rapid growth in the hospitality sector, including restaurants, cafes, quick-service restaurants, hotels, malls, and event venues, which significantly boosts the demand for fountain dispenser equipment. The presence of major international beverage brands, global foodservice chains, and strong local franchise operators further enhances market dynamics in these regions through standardized beverage programs and large-scale equipment rollouts.

- In 2023, the Saudi Arabian government strengthened policy measures aimed at promoting sustainability and energy efficiency in commercial equipment used in the food service industry, including beverage dispensing and cooling systems. Key instruments include the Saudi Energy Efficiency Center’s mandatory energy efficiency standards for commercial refrigeration and dispensing appliances and the Technical Regulation for Energy Efficiency, Labeling and Minimum Energy Performance Requirements for Electrical Appliances issued by the Saudi Standards, Metrology and Quality Organization in 2018, which cover parameters such as energy labeling, minimum performance thresholds, and compliance testing. These frameworks, along with incentives and procurement preferences for high-efficiency equipment under Vision 2030 sustainability initiatives, are expected to drive innovation in eco-friendly materials, reduced water and power consumption, and lower life-cycle operating costs for fountain dispenser systems.

Saudi Arabia Fountain Dispenser Equipment Market Segmentation

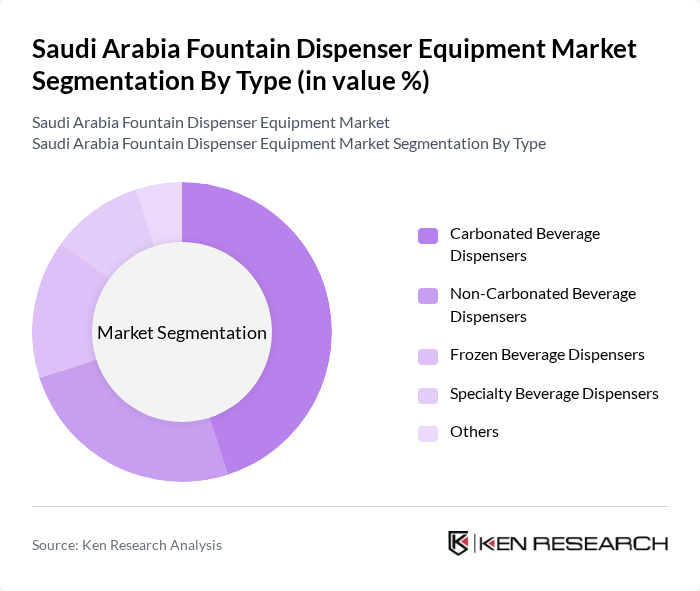

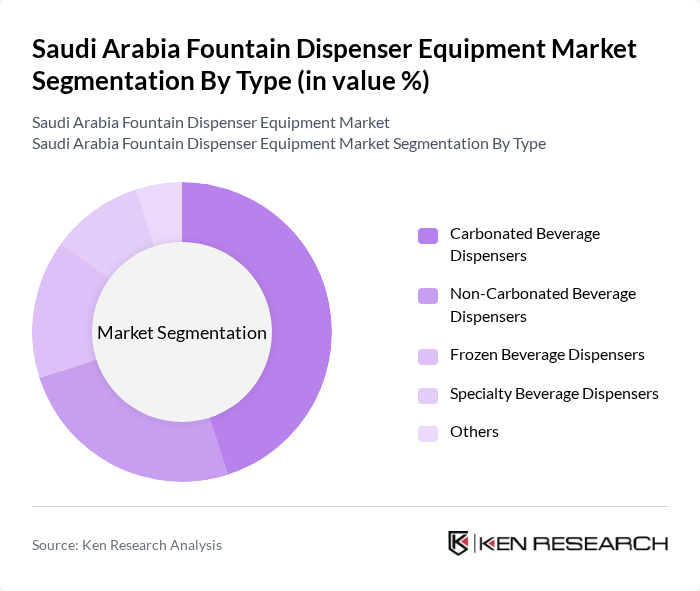

By Type:The market is segmented into various types of dispensers, including carbonated beverage dispensers, non-carbonated beverage dispensers, frozen beverage dispensers, specialty beverage dispensers, and others, in line with global fountain equipment classifications covering cold, hot, and juice-based systems. Among these, carbonated beverage dispensers are leading the market due to their widespread use in quick-service restaurants, cinemas, convenience stores, and fast-food chains, driven by strong consumer preference for soft drinks and value-driven refills. Non-carbonated beverage dispensers, including juice, flavored water, iced tea, and functional beverages, are also gaining traction as health-conscious consumers increasingly seek lower-sugar, hydration-focused, and better-for-you alternatives within foodservice outlets.

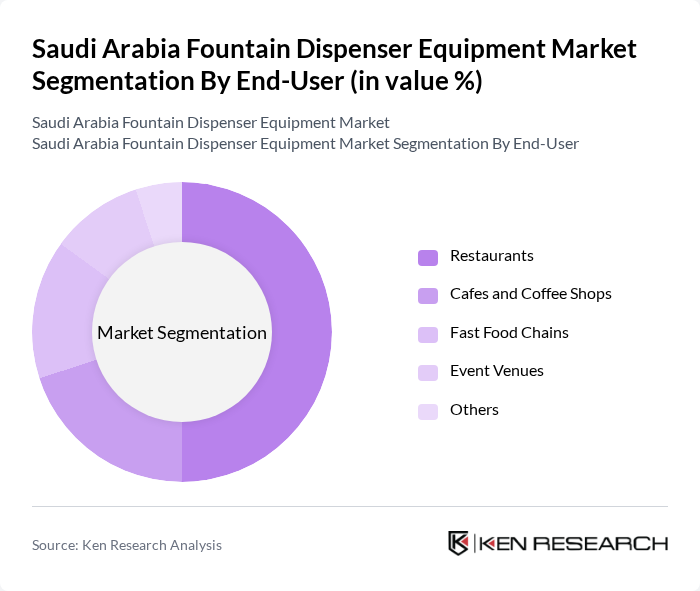

By End-User:The end-user segmentation includes restaurants, cafes and coffee shops, fast food chains, event venues, and others, closely mirroring the application breakdown used in global fountain dispenser and beverage dispensing equipment studies. Restaurants are the dominant segment, supported by the increasing number of casual and full-service dining establishments under Saudi Arabia’s tourism and hospitality expansion and the need for efficient, high-throughput beverage service. Fast food chains and quick-service restaurants also significantly contribute to the market, as they require standardized, high-capacity fountain systems to cater to high customer volumes, offer combo meals, and support self-service beverage formats.

Saudi Arabia Fountain Dispenser Equipment Market Competitive Landscape

The Saudi Arabia Fountain Dispenser Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coca-Cola Company, PepsiCo, Inc., Nestlé S.A., Keurig Dr Pepper Inc., The Kraft Heinz Company, Dr Pepper Snapple Group, Red Bull GmbH, Monster Beverage Corporation, Suntory Beverage & Food Limited, Unilever PLC, Diageo PLC, Constellation Brands, Inc., Cott Corporation, A.G. Barr PLC, National Beverage Corp. contribute to innovation, geographic expansion, and service delivery in this space through branded fountain programs, equipment leasing models, and integrated beverage solutions for foodservice operators.

Saudi Arabia Fountain Dispenser Equipment Market Industry Analysis

Growth Drivers

- Increasing Demand for Beverage Dispensing Solutions:The Saudi Arabian beverage market is projected to reach approximately SAR 20 billion in future, driven by a growing population and urbanization. This surge in demand for beverage dispensing solutions is fueled by the increasing number of food and beverage outlets, which are expected to grow by 10% annually. As consumers seek convenience and variety, the need for efficient dispensing systems becomes critical, propelling market growth significantly.

- Expansion of Food and Beverage Outlets:The number of food and beverage outlets in Saudi Arabia is anticipated to increase from 50,000 in future to over 60,000 in future. This expansion is driven by rising disposable incomes and changing consumer lifestyles. As more establishments open, the demand for fountain dispenser equipment will rise, as these outlets require efficient and reliable systems to meet customer expectations for quick service and diverse beverage options.

- Technological Advancements in Dispensing Equipment:The fountain dispenser equipment market is witnessing rapid technological advancements, with innovations such as touchless dispensing and IoT integration. In future, the adoption of smart technology in food service equipment is expected to increase by 15%. These advancements enhance operational efficiency and customer experience, making modern dispensing solutions more appealing to businesses looking to optimize their service delivery and reduce waste.

Market Challenges

- High Initial Investment Costs:The initial investment for fountain dispenser equipment can range from SAR 50,000 to SAR 200,000, depending on the technology and capacity. This high upfront cost poses a significant barrier for small and medium-sized enterprises (SMEs) in the food and beverage sector. Many potential buyers may delay purchasing decisions, impacting overall market growth and limiting the adoption of advanced dispensing solutions in the region.

- Regulatory Compliance and Standards:The Saudi Arabian market is subject to stringent health and safety regulations, which require compliance with local and international standards. Businesses must navigate complex regulatory frameworks, which can lead to delays in equipment procurement and increased operational costs. Non-compliance can result in fines or shutdowns, creating a challenging environment for companies looking to invest in fountain dispenser equipment.

Saudi Arabia Fountain Dispenser Equipment Market Future Outlook

The future of the Saudi Arabia fountain dispenser equipment market appears promising, driven by ongoing technological innovations and a growing hospitality sector. As consumer preferences shift towards personalized beverage experiences, businesses are likely to invest in advanced dispensing solutions. Additionally, the increasing focus on sustainability will encourage the development of eco-friendly equipment, aligning with global trends. Overall, the market is poised for growth, supported by favorable economic conditions and evolving consumer demands.

Market Opportunities

- Growth in the Hospitality Sector:The hospitality sector in Saudi Arabia is projected to grow by 12% annually, driven by increased tourism and investment in infrastructure. This growth presents significant opportunities for fountain dispenser equipment suppliers to cater to hotels, restaurants, and cafes, enhancing their beverage offerings and service efficiency.

- Innovations in Eco-Friendly Dispensing Solutions:With rising environmental awareness, there is a growing demand for eco-friendly dispensing solutions. Companies that innovate in sustainable materials and energy-efficient technologies can capture a significant market share, appealing to environmentally conscious consumers and businesses looking to reduce their carbon footprint.